Few industry insiders have remained unfamiliar with the story of IronFX. The Cyprus headquartered brokerage has been making headlines as its operations were impacted by complaints from Chinese IBs. The firm's Chinese offices were stormed by angry clients demanding their withdrawals back in the beginning of 2015.

Subsequent reports from additional clients with pending withdrawal requests have also been circulating around the web. The company, however, claims that it has been conducting business in line with its terms and conditions, maintaining that the clients are responsible for any misconduct by themselves not adhering to these terms and conditions.

IronFX has repeatedly stated that the company is experiencing ongoing issues with a group of traders who have been abusing its promotions system. Regarding clients with pending withdrawals, they claim to be innocent of any wrongdoing, even reporting instances where some customers claim unsettled withdrawal requests immediately after depositing their funds.

Since the escalation of reports, the company has been investigated by the Cyprus Securities and Exchange Commission (CySEC), a matter that was resolved with one of the biggest settlements in the history of the Cypriot regulator.

It would be most enlightening to discover what really happened to this company, whose reputation has suffered greatly as a consequence of critical web reviews and the complaints launched by CySEC and the Cypriot Financial Ombudsman.

Some internal IPO documents which were obtained by Finance Magnates have shed some light on the situation.

The IronFX Business Model

Back in 2010, when the company started its operations, the firm chose a different approach than most market players at the time. With an extensive team of “account managers”, the brokerage relied upon developing a strong relationship with its clients, which in theory should have resulted in higher deposit rates.

At the same time, the firm picked a market maker model of operation allowing it to capture a bigger part of the revenue than any agency broker would be able to book. With the trades starting to flow into the retail foreign exchange market, the approach initially worked quite well for the company.

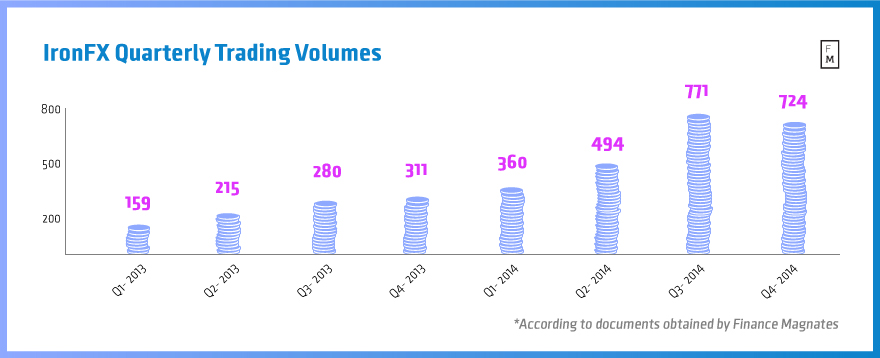

Aided by the opening of multiple company offices across the globe, IronFX managed to achieve enviable growth figures. Internal IPO documents which were obtained by Finance Magnates showed that at its peak in the third-quarter of 2014, the company’s turnover totaled over $770 billion.

Note that the trading volumes shown below were generated with 1:500 leverage and with bonuses of up to 100 percent on top of the original deposit of the client. With the considerable marketing costs attached to maintaining so many employees, competitions, sponsorship and advertisement, the trading volumes at IronFX would have had to continue perpetually growing, a trend that was reversed in the last quarter of 2014.

IronFX Quarterly Trading Volumes

Bonus, Bonus, Bonus

Bearing in mind the volumes which were registered by the brokerage, it is interesting to observe the evolution of the business model. While in the beginning, the bonus promotions worked just fine and new depositors were incoming, at some point clients stopped depositing.

The tactic that IronFX used to prevent this from happening was to increase the amount of bonuses. Despite the conditions attached to bonus withdrawals, the clients who had opened multiple accounts with the same conditions effectively managed to hedge their risks in the big trend environment in which major pairs had been trading last year.

Clients Labeled as Bonus Abusers

Consider this: you and your spouse open two accounts in June of 2014, both of you get a bonus and you take different directions on the market. One is long the EUR/USD, the other is short the EUR/USD. Both of the accounts utilize substantial margin levels.

In the case of the EUR/USD move last year, a person who opened a 1,000,000 position which is warranted with a 2,000 EUR (assuming the leverage is 1:500) in the account could face two outcomes - losing those 2,000 EUR and the remaining principle on the account if the trader was long EUR/USD, or gaining $1,500,000 by December (assuming you entered at 1.35 and closed at 1.20).

With IronFX being a market making broker, its Risk Management team could not have foreseen what the effects of a big trend and the trading practice described above would have on such accounts. Aside from the trading volumes being greatly inflated by the up to 1:500 leverage and the bonus promotions, new risks started growing for the company.

Reputation Damage & Downsizing

With the company identifying the trickery the Chinese clients had become particularly partial to, it chose to label them as bonus abusers and deny the repayment of their funds. The damage to the reputation of the brokerage was a surprise for the company, as the news spread quickly and more withdrawal requests started to flow in. The reputation of IronFX started to precede it and trickled down to the day to day operations of the company. Client after client, complaint after complaint, the efforts of the marketing department and the account managers started to lose their influence.

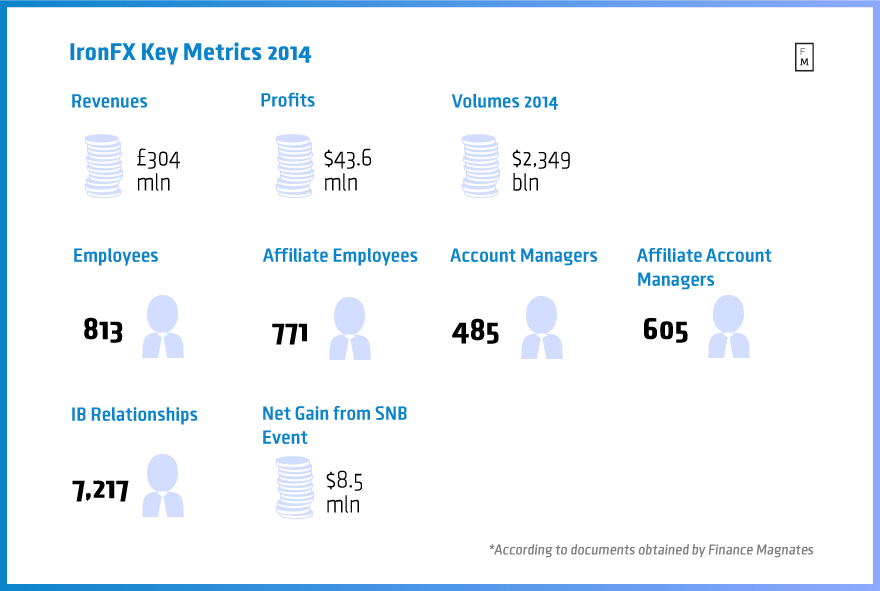

Key 2014 data facts found in the IPO documents that are the source of this article

IPO documents seen by Finance Magnates reveal that IronFX actually made $8.5 million from the Swiss franc event, but that didn’t help much. Multiple reports about the downsizing of its personnel and multiple office closures serve as a testament to the unsustainable business model. This contradicts the author’s suspicions that the STP operation of IronFX in the UK might have been hit by the Swiss franc Black Swan . In reality, only 3 percent of the CHF volumes of the company were put out into the market outside of IronFX.

The company has openly claimed that it is generally internalizing about 90 percent of its flow.

According to the data obtained by Finance Magnates, the company boasts 813 employees, 771 affiliate employees, 485 account managers, 605 affiliate account managers, 7217 introducing broker relationships, and its revenues for 2014 totaled $304 million with profits exceeding $43 million. These figures are taken from its operational peak in 2014, before the big downsizing of its business and office closures in 2015.

How will the company tackle the difficult situation in which it has found itself ? Only time will tell - hopefully there will be a fair resolution for all clients of the company who haven’t abused its promotions, and for the broker itself.