Updated: Citi's FX trading desks will be making use of the bank's in-house chat function that is part of the banks FX news wire, in a step which will be replacing Bloomberg's chat tool, according to a report in The Financial Times. Citi's in-house news wire service provides news; a range of reports from short-term intra-day commentary to longer-term macro research; G10 coverage and onshore and offshore emerging markets. It has been established since 2010 and is provided to the bank's institutional client base.

The move comes in when premier news provider, Bloomberg, was caught in the act of 'snooping' around client data. The news and information company that supplies data to the world's leading banks, hedge funds and government offices, found journalists had access to sensitive client data, however they are not linked together. In a statement given to Forex Magnates, Citi confirms that the migration from CitiFX Wire to Bloomberg is not linked to concerns over sensitivity: “This has been in the works for some time and is unrelated to recent issues."

Banks provide packaged services to clients including trading terminals (Single Dealer Platform), research and Analytics . The CitiFX Wire news service was launched in September 2010. "Being at the centre of the global FX market, Citi generates an enormous amount of information every day that our clients find valuable. Our intention is to make CitiFX Wire the one-stop shop for the information needs of our clients", said Anil Prasad, Global Head of Foreign Exchange and Local Markets at Citi about the launch in a statement to the press.

The service has been growing as volatility and key events keep markets upbeat and traders are on the look out for important & useful information. In March 2013, the news service hit a record number of viewings on its portal on the 25th of March the service recorded a 95% YoY growth rate.

Matthew Winkler, Editor in Chief at Bloomberg

It makes sense for Citi's trading team to utilise content from their in-house researchers. A Bloomberg terminal costs around $2000 per month. CitiFX Wire is an ideal replacement, apart from CitiFX's analysts providing content, CitiFX Wire also receives content from Dow Jones's DJ FX Trader.

Since the journalistic breach of confidentiality & privacy was unveiled last week by Bloomberg, the news provider has changed access rights for reporters. It was revealed that Bloomberg's journalists had access to high level customer data, including;

- Login Creation Date – this provides information on when a client initiated usage of a Bloomberg terminal.

- Login History – this provides information on when a user logged into the terminal.

- High Level Usage Data – this provides information on functions used — aggregated over time — with no ability to look into specific security information.

- Help Desk Inquiries – this contains information about customer inquiries and requests. This was typically used to answer client inquiries to reporters about news stories.

Bloomberg acted immediately after the news broke out and now journalists have the same rights as clients. In a statement by editor in chief Matthew Winkler on the firm's website, the editor explains the new measures taken: "we immediately changed our policy so that reporters now have no greater access to information than our customers have. Removing this access will have no effect on Bloomberg news-gathering.”

Mr Matthew further stated that the “error is inexcusable and the firm is sorry about what happened". Reporters had access to certain amount of discrete data including a clients history of logging in and out, as well as the number of times the help desk was inquired.

Wall Street has raised its concerns over the information leakage, JP Morgan made a statement on Wednesday (according to Reuters), the bank has requested for Bloomberg to provide details of the logs of all staff members since 2008 who used the company's data terminals to search activities of J.P. Morgan subscribers.

Mitch Eaglstein, Managing Director at Boston Prime, a Liquidity and technology solutions provider to financial services firms, told Forex Magnates: "Bloomberg's recent misuse of information was quite a blunder and should not be underestimated. It would not be surprising to see other banks' compliance departments question the use of continued use of its terminals. This will surely become a boon for Bloomberg's competitors, notably Reuters and potentially an opportunity for some new entrants to the market place, maybe even other specialist news publications will develop their own competing product and enter the space."

Mr Eaglstein, adds, that "garnering trust and protecting credibility are the most important qualities of any successful financial information service”.

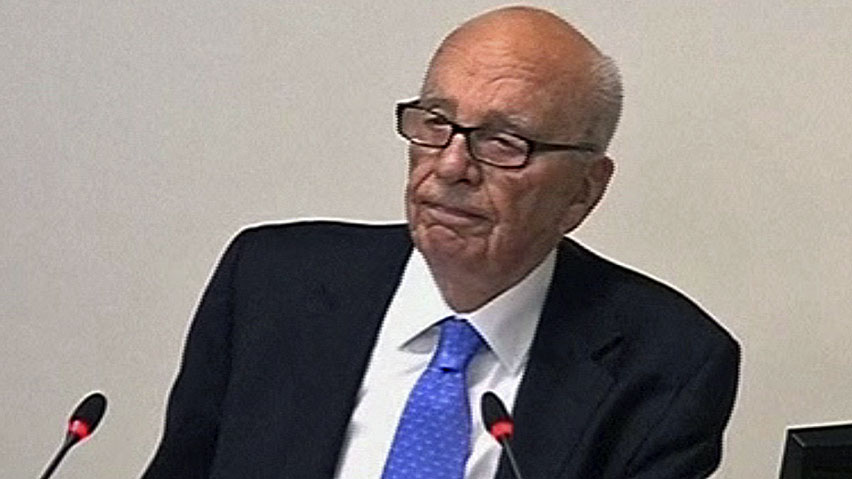

Rupert Murdoch was questioned by the High Court

Journalists have to remain credible and follow the rules and regulations applied by industry bodies, especially in financial markets where sensitive data can be used and misused for a monetary benefit and potentially impact the markets. In the UK, the Press Complaints Commission (PCC) identifies key areas a news business needs to adhere to remain transparent and compliant, the PCC states on its website in regards to the Editors Code; “All members of the press have a duty to maintain the highest professional standards. The Code, which includes this preamble and the public interest exceptions below, sets the benchmark for those ethical standards, protecting both the rights of the individual and the public's right to know. It is the cornerstone of the system of self-regulation to which the industry has made a binding commitment.”

In the UK, a major news related scandal was unfolded where journalists of the News of the World (a UK based tabloid which is part of News International owned by Rupert Murdoch) were using ill-tactics to gain sensitive information. Employees of the newspaper were accused of engaging in; phone hacking, police bribery, and exercising improper influence in the pursuit of publishing stories. Investigations conducted from 2005 to 2007 concluded that the paper's phone hacking activities were limited to celebrities, politicians and members of the British Royal Family.

The scandal had detrimental effects for the news publication; senior people had to resign, were dismissed and even legally cautioned.

This article has been updated since it was first published on Friday the 17th of May 2013.