Gold prices experienced their steepest single-day drop in five years today (Tuesday), as investors booked profits following a record-setting rally.

Spot gold fell 6.8% to $4,082.35 per ounce, after reaching an all-time high of $4,381.21 the previous day. US gold futures for December delivery declined to $4,129.20 per ounce.

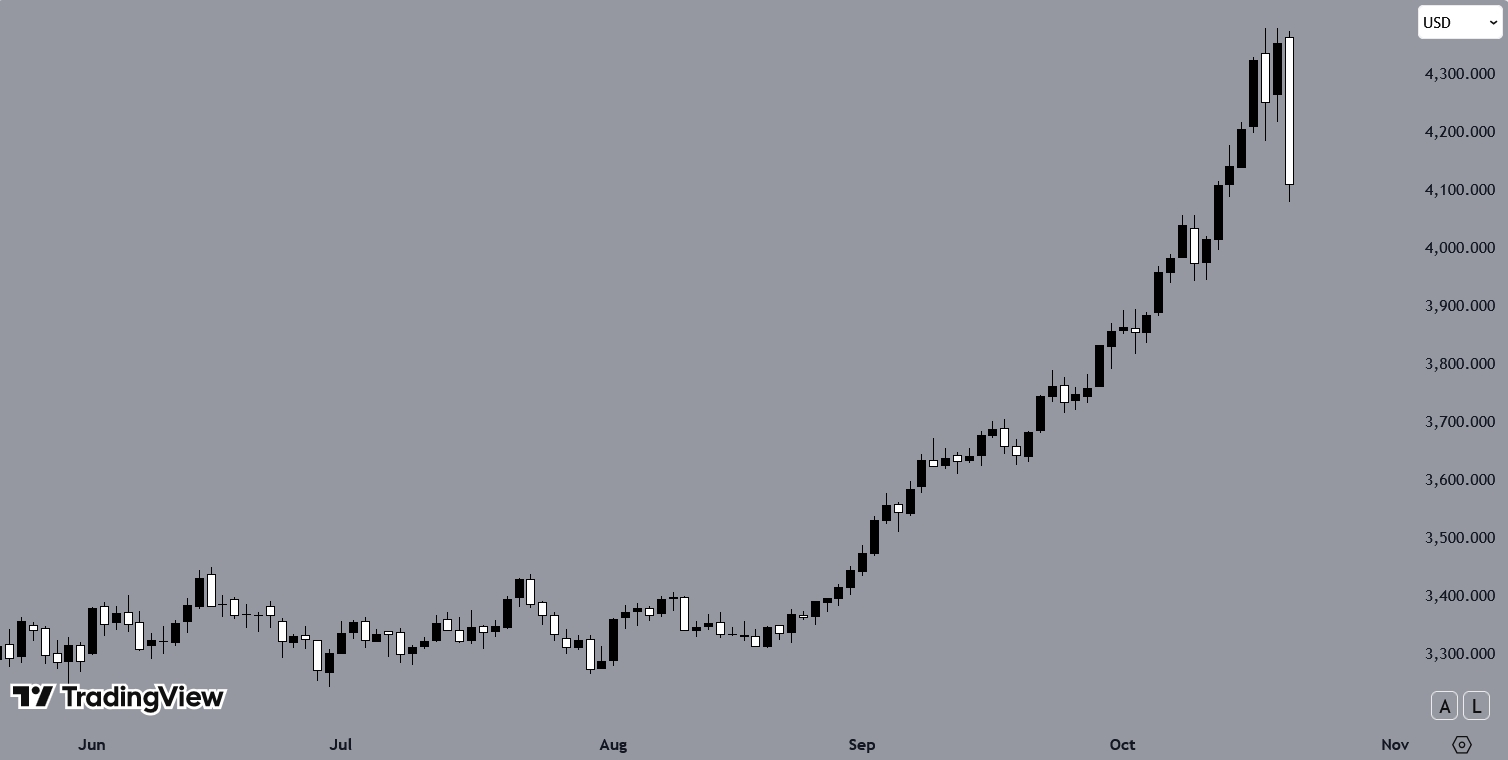

Spot Gold Hits Biggest Daily Loss

The recent surge in gold prices, which have risen about 60% this year, was driven by factors including geopolitical tensions, expectations of U.S. interest rate cuts, and increased central bank purchases. However, the strengthening US dollar and improved market risk appetite contributed to the sell-off.

Join IG, CMC, and Robinhood at London’s leading trading industry event!

The metal is on track for its biggest single-day drop since April 2013, when prices fell sharply after peaking near $1,670 per ounce amid concerns about reduced central bank stimulus in the U.S. “Spot gold prices extend their decline to over -6% on the day, now on track for the biggest daily decline since April 2013,” The Kobeissi Letter shard at X.

- NBA Star Kevin Durant Can’t Dig Up His Bitcoin While a Man Digs Through a Dump

- The Trader's Easter Break(?)

- Crypto.com’s Coin Cronos Climbs 27.8% After Trump Media ETF Plans

Gold Fails Form New Higher High

The gold daily chart shows that the precious metal had been consolidating near its recent highs. Yesterday, it formed a bullish daily candle but failed to produce a new higher high. As of writing, today’s candle has appeared as a bearish engulfing pattern. If it closes below yesterday’s low, intraday selling pressure could dominate in the near term.

Silver, Platinum, Palladium Drop Significantly Today

Other precious metals also saw significant declines, with silver dropping 8.4% to $48.06 per ounce, platinum falling 7% to $1,523.30, and palladium decreasing 6.6% to $1,398.

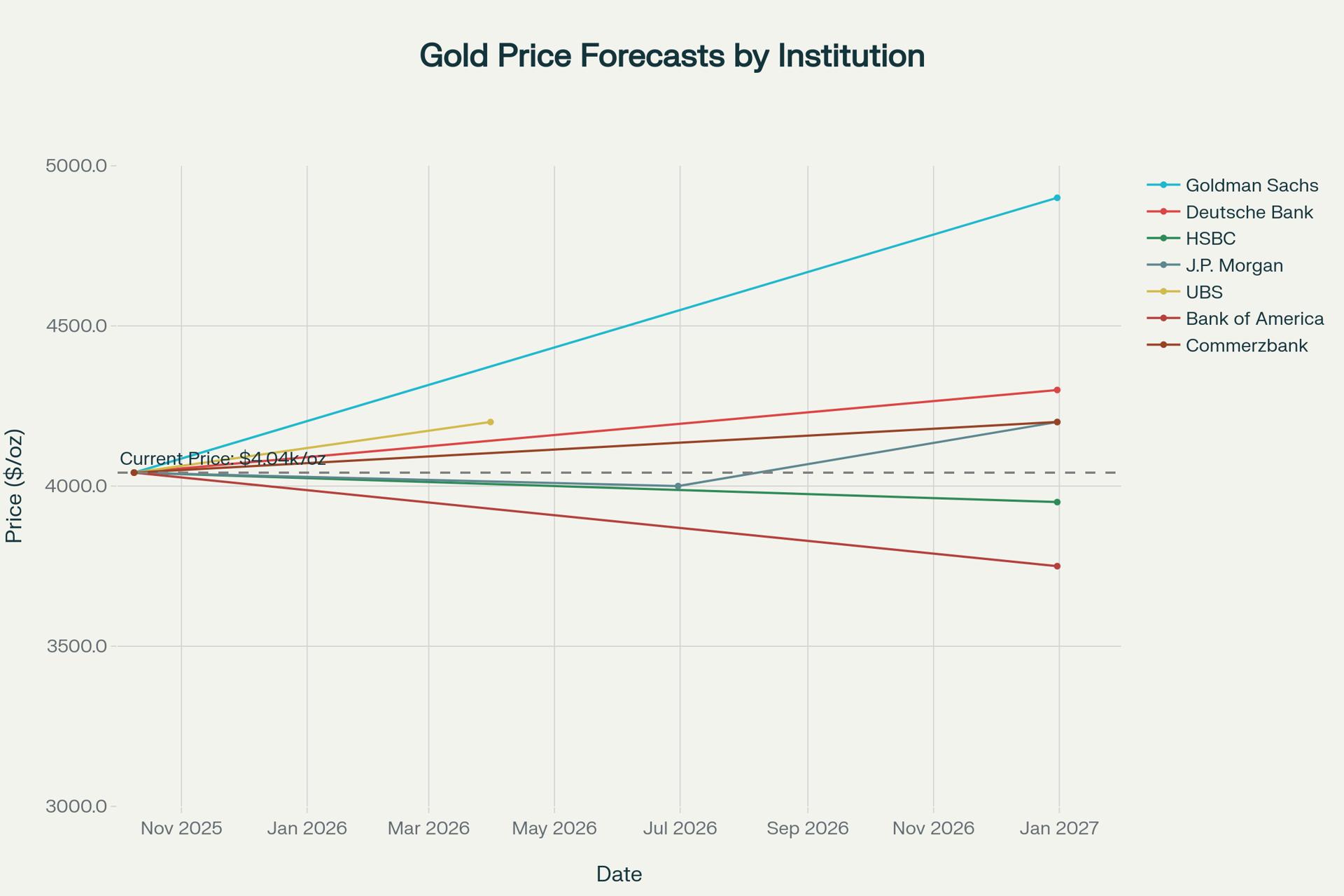

Goldman Sachs and Bank of America Gold Price Predictions

Despite the recent downturn, long-term forecasts for gold remain optimistic. Goldman Sachs has raised its December 2026 price target to $4,900 per ounce from $4,300, citing sustained ETF inflows and central bank demand. The firm suggests that if investors shift just 1% of the $57 trillion U.S. Treasury market into gold, prices could surge to $5,000.

Similarly, Bank of America projects gold reaching $5,000 per ounce by 2026, with an average price of $4,400. These projections are based on expectations of continued central bank purchases and a weaker US dollar.