After more than 20 years in traditional finance, my perspective on blockchain has shifted from curiosity to operational assessment. What began as exposure to a new asset class evolved into a closer examination of whether blockchain infrastructure can meet the standards CFOs are accountable for every day.

From that vantage point, one pattern is clear. Fortune 500 CFOs are approaching blockchain thoughtfully. Many are observing how the space develops, tracking customer interest, and watching how peers engage. This measured posture reflects the discipline that defines modern finance leadership.

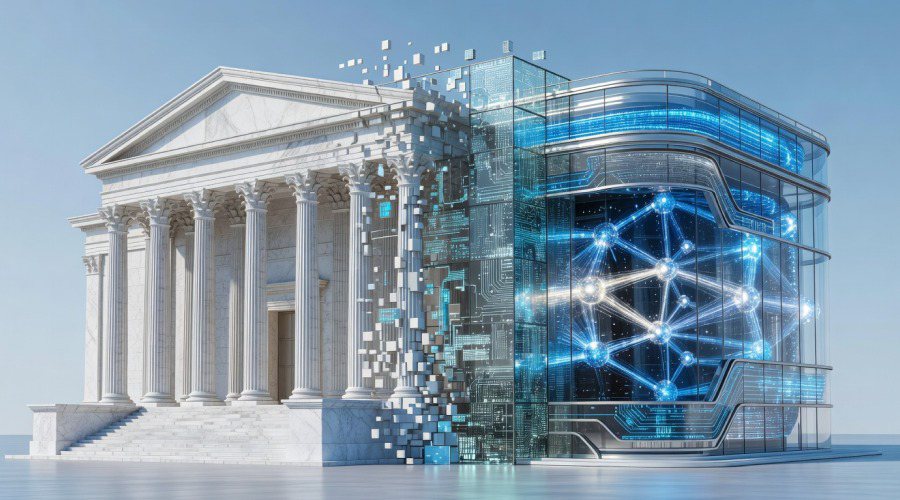

At the same time, the role of the CFO is expanding. Today’s finance leaders are not only stewards of capital and risk. They are architects of operating systems. Modern finance leadership now encompasses automation, AI-driven analytics, and an emerging understanding of digital assets and crypto-native infrastructure. Blockchain is becoming part of the broader financial environment, and CFOs have an opportunity to help shape how it integrates into enterprise operations.

The credibility checklist Fortune 500 CFOs expect

Enterprise engagement with blockchain begins with familiar criteria.

Operational assurance comes first. Certified validator infrastructure, including SOC 2–compliant environments, demonstrates that security controls, access management, and internal processes are designed to meet institutional standards. These signals of maturity help finance teams evaluate blockchain participation using the same benchmarks applied to other critical systems.

Clear custody pathways are equally foundational. CFOs look for transparency around where assets are held, how signing authority is governed, and how responsibilities are allocated between internal teams and external providers. Blockchain participation increasingly supports models that separate ownership, custody, and operations in ways that align naturally with corporate control frameworks.

Capital controls and accounting integration complete the foundation. Treasury teams need the ability to track balances, rewards, and exposures using reporting structures that support audit, disclosure, and internal review. When blockchain activity integrates cleanly into existing financial systems, it becomes part of standard operations.

Alongside infrastructure, know-how matters. Practical experience, both internally and through trusted partners, enables finance teams to evaluate blockchain systems based on how they perform in real-world conditions. Institutional confidence is built through exposure, repetition, and operational understanding.

How enterprise understanding continues to advance

Enterprise engagement with blockchain is shaped by context.

The ecosystem is dynamic, with new protocols, applications, and models emerging regularly. For CFOs and board-level executives, this creates an environment rich with learning opportunities. As more institutional-grade tools, educational resources, and implementation frameworks become available, blockchain participation is increasingly evaluated through an enterprise lens.

User experience and education are also evolving. Interfaces designed for finance leaders now emphasize clarity, reporting, and governance rather than technical novelty. This shift makes it easier for CFOs to assess blockchain activity in the same way they assess other financial systems.

Regulatory coordination continues to develop in parallel. As frameworks mature across jurisdictions, institutions are engaging from a position of growing operational understanding. CFOs are well positioned to contribute to these conversations, informed by hands-on experience rather than abstraction.

What works in enterprise environments today

Several participation models have already aligned well with Fortune 500 operating requirements.

Staking-as-a-Service delivered through white-labeled interfaces allows enterprises to participate in blockchain networks without building internal validator teams. These models provide oversight through familiar dashboards and reporting environments, keeping activity aligned with internal governance structures.

Modular reward structures add clarity. Protocol-defined rewards, visible on-chain and governed by explicit rules, allow finance teams to understand how returns are generated and under what conditions. This transparency supports treasury planning and internal review.

Dedicated validator partners often complete the model. Institutional-grade operators provide uptime commitments, performance metrics, and disciplined operating practices designed to meet enterprise standards. When validator operations are treated as infrastructure rather than experimentation, participation becomes repeatable, auditable, and scalable.

These approaches show how blockchain can be integrated using the same operational rigor applied to other enterprise systems.

A message to enterprise CFOs

For CFOs evaluating blockchain today, progress does not require sweeping change. It benefits from focus.

Beginning with one token, one network, and one validator relationship allows finance teams to gain practical exposure to on-chain operations, reward mechanics, and reporting flows in a controlled setting. This approach supports learning without unnecessary complexity.

Selecting experienced partners accelerates that learning. The right crypto partners translate blockchain mechanics into familiar concepts around controls, performance, and accountability. This collaboration strengthens internal understanding while preserving CFO ownership of decisions.

Most importantly, enterprise finance leaders have an opportunity to define their own path. CFOs have always built internal frameworks ahead of full market standardization. Blockchain follows the same pattern. Organizations that engage deliberately develop internal standards, refine governance, and build confidence through experience.

The focus is on preparing financial operations for an environment where settlement, coordination, and value transfer continue to become more digital and programmable.

The call to action is constructive and clear. CFOs can move from observation to informed participation by building internal understanding, partnering with institutional-grade infrastructure providers, and defining governance on their own terms. Those who take this approach will not simply adapt to the future of finance. They will help shape it.

About the Author

Betsabe Botaitis is Chief Financial Officer at P2P.org, where she oversees financial strategy, governance, and operational controls for institutional crypto infrastructure. She brings more than a decade of experience across finance, accounting, and risk management, with a focus on scaling global businesses in regulated environments. Her background spans traditional finance and digital assets, supporting organizations through periods of rapid growth and increasing regulatory complexity.