While market volatility is cherished by day-traders as it provides a lot of potentially lucrative setups, they often lack a complete picture of all the factors that come into play when calculating total risk and trading cost.

Professional traders and leading analysts Alex Douedari and Frank Walbaum have been following the markets for more than a decade and have witnessed times of extreme volatility and even market crashes, gaining invaluable insight into how volatility can affect profitability and how choosing the right broker can help traders avoid common pitfalls that may wipe their accounts clean.

It’s Not Just About the Average Spread

Regulated forex brokers are obliged to disclose all applicable trading costs to their clients; some brokers offer far more competitive spreads; others offer smaller commissions and rollover charges while others still promise no markups or have hidden fees.

“When brokers talk about spread they differentiate between fixed, variable or average spread and while a great number of brokers nowadays offer very competitive spreads that can help reduce trading costs, it is important to remember that spreads like prices can fluctuate and tend to widen in times of great volatility,” underlines Alex.

Spread Widening & Unexpected Margin Calls

“Breaking news is a notorious time of market uncertainty; unexpected developments of a global scale can cause major shifts in the price of certain assets,” Frank notes.

Releases on the economic calendar occur throughout the day and depending on whether expectations are met or not, can cause significant volatility. Just like retail traders, large Liquidity providers do not know the outcome of news prior to their release and because of this, they look to offset some of their risks by widening spreads.

“For traders, spread widening can cause unexpected margin calls, which is why it is essential to carefully observe how a brokers’ spreads behave during times of high volatility, before actually opening any positions,” adds Alex.

Brokers that invest in partnering with more established Liquidity Providers like banks and other large institutional lenders can provide more competitive spreads that do not fluctuate wildly.

Essentially, lower spreads that do not widen too much in times of high volatility can help significantly reduce trading costs which translates to bigger profits and fewer losses.

Of course, a competitive quote is not the only thing that guarantees lower trading costs, other factors such as latency, execution speed and slippage should also be considered.

Latency, Execution Speed & Slippage

Latency is essentially the time it takes for an order to be executed. “In a matter of mere milliseconds, the price of an asset can change which means that if a broker does not provide optimal execution speeds traders can suffer slippage, which of course can be either negative or positive,” notes Frank.

Brokers with ultra-fast execution speeds can guarantee near-instant order placements which diminishes the possibility of negative slippage and reduces the risk of traders having to suffer greater trading costs.

Choosing the Right Broker

From a retail perspective, no matter how skilled a trader is in identifying market opportunities and anticipating trends, avoiding unnecessary costs such as wide spreads, unwarranted markups, hefty commissions and hidden fees is crucial to their success.

Finding a fair, regulated, and reputable broker that minimises trading costs and is fully transparent about their fees and charges can help traders optimise their performance.

“Thin spreads, minimal slippage, instant execution, no commissions and no markups are some of the things traders should be looking for when choosing a broker,” according to Alex.

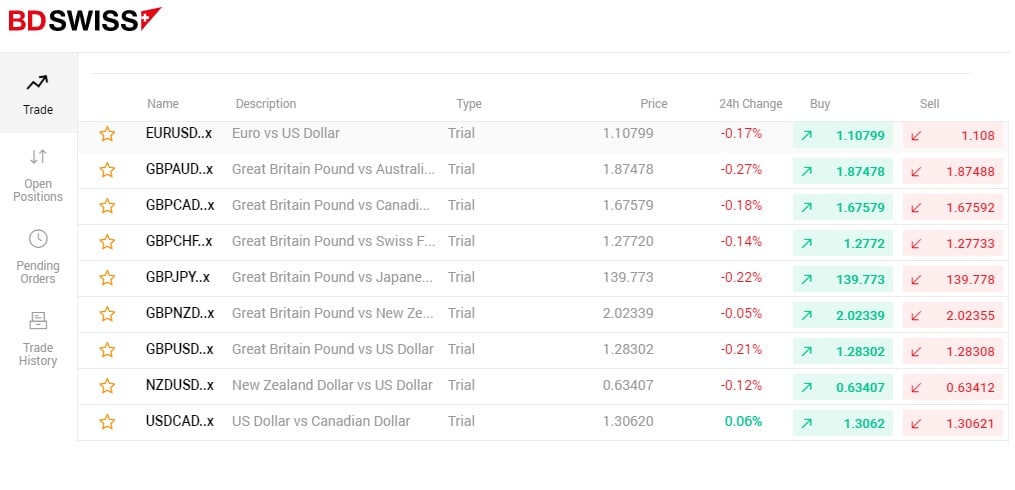

With more than 1 million clients worldwide, Forex and CFD financial institution BDSwiss offers its clients ultra-competitive trading conditions including deep institutional liquidity by top tier providers which can minimise spread widening during high volatility, as well as zero markups, zero commissions and a whopping 10 milliseconds median execution speed*. To learn more about BDSwiss product offering click here.

It is also worth noting that BDSwiss Affiliates & IBs besides the higher-conversion rate, have noticed significant increase the lifetime value of each client they refer and this allows them to look into other commission plans, rather just focusing on acquisition for a greater long-term partnership. To learn more about BDSwiss Partners Program visit our website.

*Note: Execution speed numbers are based on the median round trip latency measurements from receipt to response for all Market Order and Trade Close requests, executed on the month of September 2019. Data provided by BDSwiss BI Research Team.

Disclaimer: The above content was prepared by the BDSwiss Research Team. Any data and information contained herein should not be considered investment advice in any way. The above article was published for background and informational purposes only.

Risk warning: Trading in Forex/CFDs and Other Derivatives is highly speculative and carries a high level of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose.