“Big data” has been gaining a lot of attention in recent years. Regardless of what industry you’re in, chances are you’ve likely heard of the importance of this new trend when analyzing consumer habits and making more informed business decisions.

But what is it, why is it growing in popularity, and what difference will it make for the real estate industry? Let’s investigate further.

What is “Big Data”

Simply put, “big data” is nothing more than a vast volume of information, both structured and unstructured, that can be analyzed to give businesses insight. Those insights can be about nearly any concern a business or organization may have.

Some common applications of big data are analyzing consumer spending habits for retail, finding ways of reducing traffic congestion for governing bodies, creating effective marketing strategies, and tackling nearly any other concern a business or organization may have.

These vast amounts of information are too much for a single analyst to personally identify trends and behavioral patterns, but with today’s technology, enormous amounts of available consumer data can be transformed into valuable insights.

The Rise of Big Data

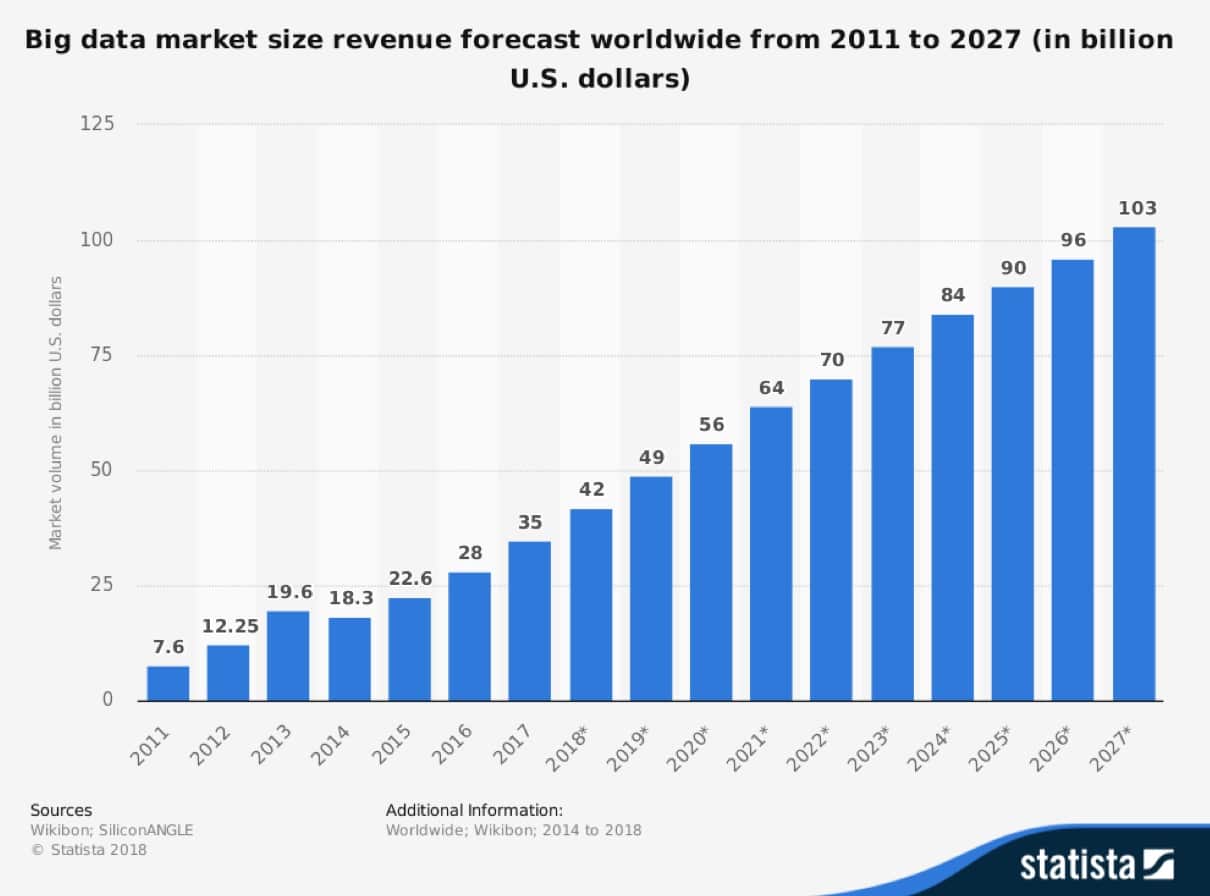

Because of the advantages big data offers businesses, the industry for curated information is continuing to grow rapidly across the globe. Market research firm Wikibon forecasts the growth of the worldwise big data market to continue with an 11.4% compound annual growth rate (CAGR) each year, resulting in big data revenue to grow to be a $103 billion industry by 2027. When comparing the $103 billion amount to just $7.6 billion in 2011, it’s not difficult to see that the information age continues to capture the attention of business.

Big data market size revenue forecast worldwide from 2011 to 2027, Statista

How Big Data Can Benefit the Real Estate Industry

One section of the economy uniquely positioned to benefit from the rise of big data is the global real estate industry. While other industries will undoubtedly continue to take advantage of big data and all that it has to offer, the world of real estate is one that’s truly data-driven.

Unlike other products available for consumers, pricing and valuation in the real estate industry is more difficult to quantify (though certainly not impossible). Because pricing and appraisals are affected by more than simply the cost of goods used to construct a property, big data plays a major role here.

Companies like Zillow, Trulia, and Redfin have already shown the real estate industry the power of big data by acting as important disruptors. Given the information these companies are able to compile and, in many cases, collect (things like the buying and selling trends in a specific area, amount of commercial vs residential development in a given area, traffic, demographic information, consumer survey results, etc.), they’re able to offer clear insights on pricing, home-value trends, and potential value of neighborhoods.

Buyers, sellers, realtors, financial institutions, and other parties all require access to data to make informed decisions about real property.

Todd Carpenter is the Managing Director of Data Analytics with the National Association of Realtors®and is one member of the real estate industry who’s been taking notice of the advantages big data can provide the future of real estate. As consumers continue to rely more on their mobile devices, Carpenter sees an ever-growing importance in utilizing big data that’s relevant to the industry. According to Carpenter:

“Realtors should educate themselves about big data and be knowledgeable of how it’s being collected through mobile devices. Buyers will increasingly use their smartphone during the search process -- often times before first talking to an agent. Realtors who adapt and embrace big data will add considerable value to their relationship with clients.”

Improving Access to Big Data

While the advantages of big data are becoming increasingly more evident to many in the real estate space, there are still barriers keeping the industry from truly leveraging big data. Of the current issues, one of the top concerns is the lack of standardization of data and ability to access data in a cost-effective manner.

With Forbes Real Estate Council, Stephen King has discussed some of the current issues revolving around data in the real estate industry, including the lack of standardization of real estate information and big data. King, who is also the founder of Imbrex, a Blockchain -based solution to the lack of standardization in the real estate industry, says that:

“The industry is poised to take its biggest weakness -- a lack of technology -- and turn it into its biggest strength. There are thousands of MLSs, agent/firm websites, CRM systems and startups all building tools to make the transaction process more cost-effective and efficient. However, these systems are not compatible with each other.”

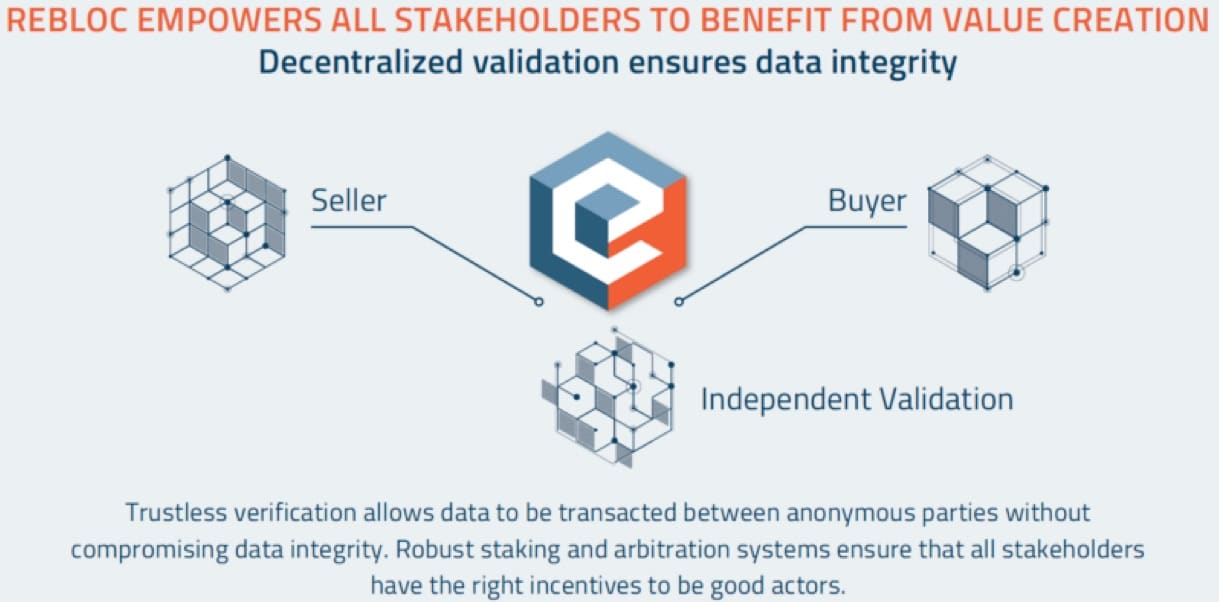

King isn’t the only one taking notice of the real estate industry’s pain points either. ReBloc is another blockchain-based startup that’s tackling the same problem in the space by working towards “democratizing real estate data” by allowing users to buy and sell valuable real estate data.

Joining others striving to solve bottlenecks in the real estate data industry, ReBloc is building a system for all parties involved in the real estate process (buyers, sellers, realtors, financial institutions, brokers, etc.) to benefit from not only using valuable data, but contributing and validating existing data for others.

The Takeaway

Big data has been growing rapidly as its own industry, but the implications of the information gathered and leveraged extend to nearly every sector of the global economy. As the trillion dollar real estate industry looks for answers and advantages in the growing field of big data, it must first develop an effective manner for organizing and accessing this valuable information.

Between all the parties involved in the process of building, buying, and selling real estate, it’s crucial that the industry accomplishes a way of allowing both individuals and large businesses to take advantage of the increasingly useful collection of big data.

Disclaimer: This is a contributed article and should not be taken as investment advice