The countdown has begun; nominations for the Finance Magnates Awards 2025 close in just one week. This is your final chance to be part of the celebration of the Visionaries of Tomorrow, the companies shaping the future of finance. If your brand has not yet secured its place, now is the time to join one of the industry’s most important recognitions.

Why the FM Awards Matter

The Finance Magnates Awards stand out because they combine community voting (50%) with an expert industry panel (50%), ensuring a fair and balanced process. Winning or even being nominated signals credibility, innovation, and market leadership. It’s an opportunity to stand alongside the brands that shape the future of finance.

Exposure Campaigns for Nominees

Every nominee gains visibility through Finance Magnates’ global media and communication campaigns, which run before, during, and after the awards. These include:

Pre-awards promotion across our platforms and social channels

Dedicated PR campaigns highlighting nominees in each category

Inclusion in voting campaigns, reaching traders, brokers, fintech leaders, and decision-makers worldwide

Post-awards recognition, including exclusive content, evergreen placements for winners, and global press coverage

Nominees are not just part of a voting process; they are positioned in front of the entire industry at every stage.

Confirmed Nominees

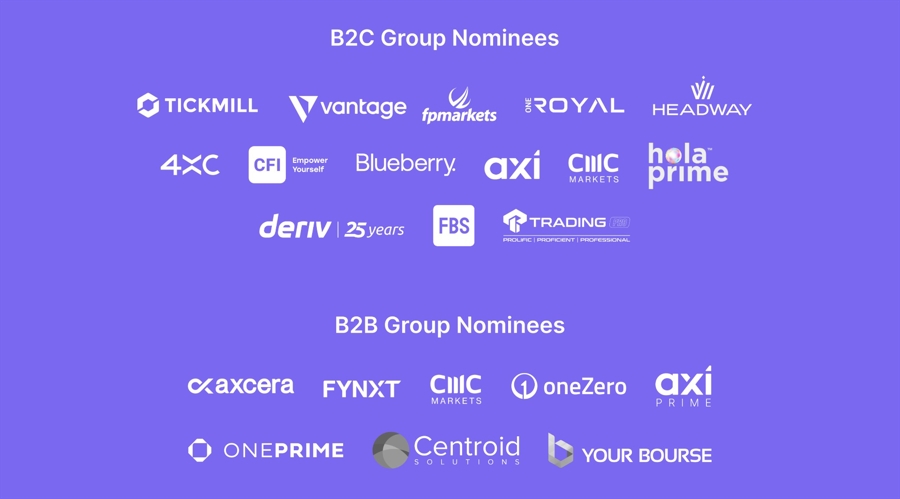

The list of nominees is expanding across all categories: Global, Regional, National (B2C), and Institutional Trading, Services for Brokers, and Tech for Brokers (B2B). Together, they represent a cross-section of the industry’s best.

These brands have taken the first step toward recognition, visibility, and industry validation:

Each brand is now officially part of the FM Awards 2025 voting process, which combines 50% community votes with 50% expert panel evaluation.

The Gala Dinner: Where Winners Are Celebrated

All winners will be announced at the FM Awards Gala Dinner in Cyprus on November 6, 2025. This black-tie event gathers top executives, fintech innovators, global brokerages, and media under one roof. More than just an awards night, the Gala is a premier networking event, giving nominees face-to-face access to industry leaders and new business opportunities.

One Week Left to be part of the FM Awards 2025

There are just seven days left to submit your nominations! Don’t let this opportunity pass to ensure your voice is heard and shine alongside your peers!

➡️ Submit your nomination today and make sure your brand is part of the official lineup before time runs out.

Disclaimer: Please note that submitting your details is the first step in the process; it doesn’t confirm your official nomination just yet. To become an official nominee and be included in the Awards process, a member of our team will reach out to you shortly with more details, including the available communication campaign packages. These packages are designed to give every nominee the exposure they deserve, before, during, and after the Awards, across our global network.