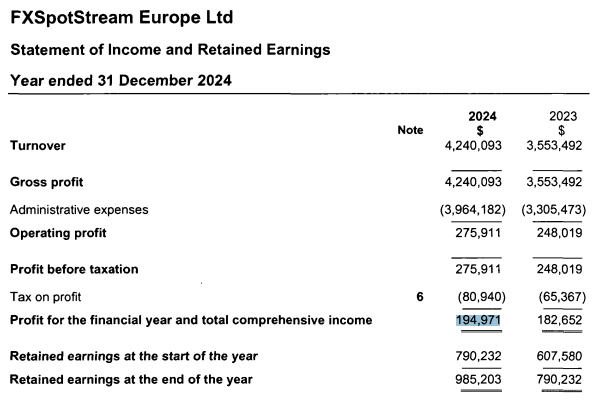

The 2024 turnover of the UK branch of FXSpotStream, a multibank FX aggregation services provider for spot foreign exchange trading, rose by over 19 per cent year-on-year to $4.2 million, according to the company’s latest filings with Companies House.

The Rising Revenue

Despite the higher profits, the company's administrative expenses also increased to $3.9 million, up from $3.3 million the previous year.

The filings of FXSpotStream Europe further showed that its profits before taxes for 2024 were $275,911, approximately 11 per cent higher than the previous year. After tax, the company netted $194,971.

The latest figures marked another year of revenue and profit growth for the UK-registered company.

It is important to note that the figures refer only to the UK unit, FXSpotStream Europe, and not the entire group.

You may also like: Why Did Forex Trading Volumes Crash in May 2025?

Trump’s Tariffs Pushed the Numbers

FXSpotStream is a bank-owned consortium founded in 2011. In addition to its services in the institutional spot forex market, the platform has expanded into the derivatives space. It also launched support for FX Algos and Allocations over its API, extending its service offering.

FXSpotStream Europe Ltd is the UK-registered support unit anchoring the group’s EMEA presence, while the core price-streaming and matching technology remains under FXSpotStream LLC.

Meanwhile, the trading volumes handled by FXSpotStream have been increasing steadily. The average daily volume (ADV), reported by the platform, peaked last April at over $122 billion—coinciding with market volatility driven by US President Donald Trump’s tariff policies. However, volumes corrected in the following months.

The ADV on FXSpotStream in May and June stood at $98.7 billion and $102.6 billion, respectively.