The Volatility of May 2017 caused by the French elections and other political developments led to all major Electronic Communication Networks (ECNs) showing declines month-on-month (MoM) in terms of trading volumes. However, a different image emerges when viewing the figures on a year-on-year (YoY) basis, especially for one of the networks.

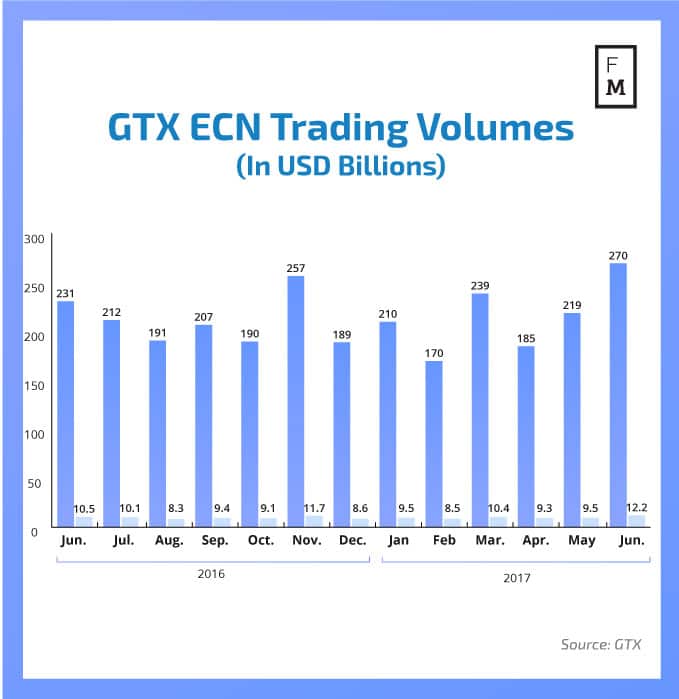

GTX:

GAIN Capital’s institutional unit GTX has just reported its latest monthly turnover for June 2017, which declined across both ECN + SEF and swap deals, in contrast to growth recorded in May. In terms of the total turnover of ECN + SEF and swap deals, GTX dropped 12 per cent from $306.5 billion to $270.1 billion. The sharpest decline was seen in swap deals, which declined by 46 per cent down compared to May 2017.

Accordingly, the average daily (ADV) trading volume was down 8 per cent MoM, totaling $12.2 billion in June 2017 compared to $13.3 billion in May 2017. However, YoY the trend is quite the opposite - compared to June 2016, total traded volumes were up 2 per cent, as was the average daily volume.

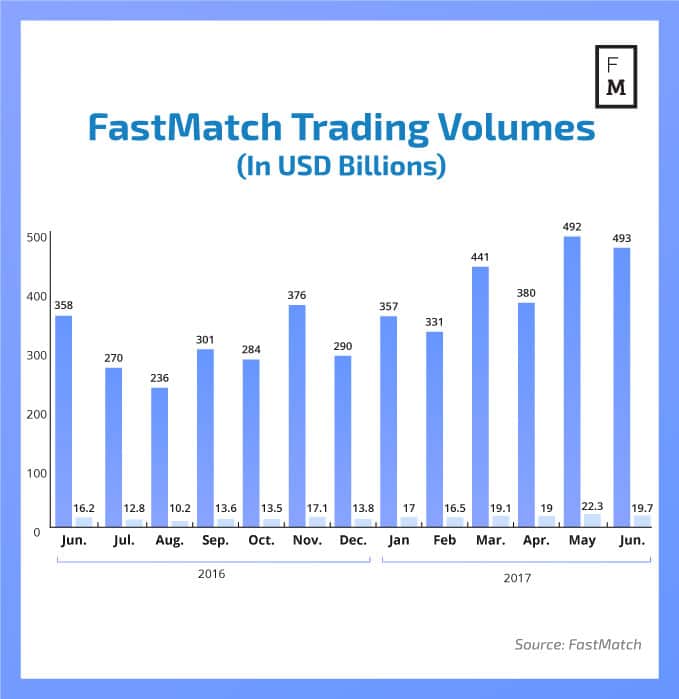

FastMatch:

Trading volumes at FastMatch in June 2017 followed the same trend as those of GTX. In terms of total traded volumes, it saw a decline of 16.6 per cent, from $518.4 billion in a volatile May 2017 to $433 billion in June. Compared to June 2016 however, volumes were up, with a staggering 21 per cent growth YoY. ADV during the previous month was 14 per cent lower than the month before, with $19.7 billion compared to $22.5 billion in May. ADV figures year on year were up 21 per cent.

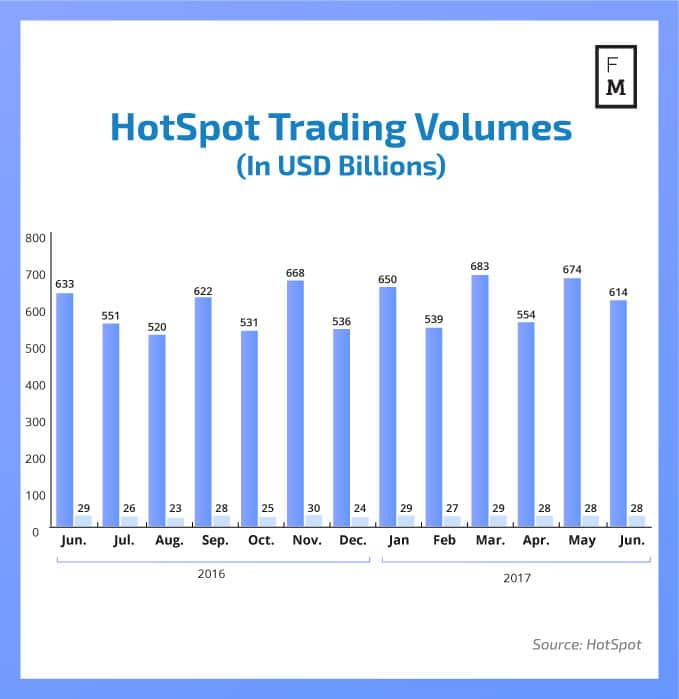

Hotspot:

Foreign Exchange electronic communications network Hotspot has been the most stable ECN in terms of change in traded volumes on a month on month perspective. The company reported a 3 per cent decline in June 2017 compared to May - $613.97 billion versus $647.3 billion respectively. Hotspot registered least growth on a year on year basis, with only 3 per cent growth in total volumes. As to its ADV, Hotspot reported a $27.9 average daily volume, which was flat MoM, and a decline of 3 per cent compared to June 2016.