Trading activity in the world's largest derivatives exchanges saw mixed results in 2013, exchanges saw a slight uptake in overall trading volumes, after a bleak 2012, according to the World Federation of Exchanges (WFE) annual survey.

FX futures dropped 2.9% as traders were on the sidelines, in a year that was marked by harsh moves in emerging market currencies and the on-going tapering dilemma falling in the hands of the new Fed chairperson.

Exchanges saw 2.08 billion contracts exchange hands in 2013, a drop of 2.9% from figures reported a year earlier where exchanges saw 2.143 billion contracts trade. On the other hand, currency options fared well with an increase of 40.1%, with 403 million contracts traded, compared to 288 million in 2012.

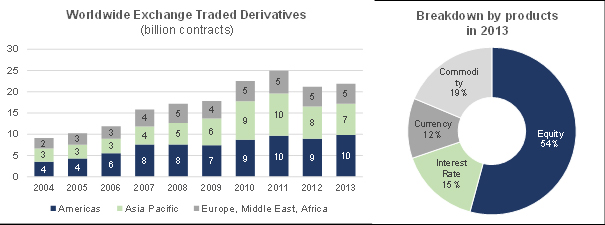

Across all asset classes, data complied by the WFE shows that exchange traded derivatives volumes increased by 3% to 22 billion. The report shows that the Americas region saw the highest amount of growth, this was followed by Europe, Africa and Middle East. On the other hand, Asia-Pacific performed poorly with a drop in numbers, a total of 7.3 billion contracts were traded in the region, a 2.7% drop from the 7.56 billion traded in 2012.

Exchange traded derivatives peaked in 2011, with the total number of contracts exceeding the 25 billion mark. Asia-Pacific was one of the best performing regions, with a number of exchanges setting up post 2008 recession, including the Singapore Mercantile Exchange and the United Stock Exchange (India). However, India's rupee suffered on the back of poor fundamental data and rising inflation in 2013, the currency weakened 20%. According to the WFE's report, 70% of Asia-Pacific's trading activity is from India.

"Government interventions coupled with a weak rupee severely impacted India's trading volumes, the currency is still trading above 60 to the greenback, which makes it difficult for traders to trade on the popular arbitrage; rupee - gold - dollar triangle," explained Asad Hussain, a Mumbai-based proprietary trader, to Forex Magnates.

India's capital markets regulator, the Securities Exchange Board of India (SEBI) intended to remove position limits on currency futures that were implemented in July 2013 to manage speculation in the currency.

"Markets are hitting a bull run in the run up to elections, we have seen the SENSEX hit a 12 month high, in addition trading volumes on all currency exchanges have spiked, and are expected to trade at record highs during the next 2 months," stated Chandan Singh, a technical analyst trainer from Delhi, in a comment to Forex Magnates.