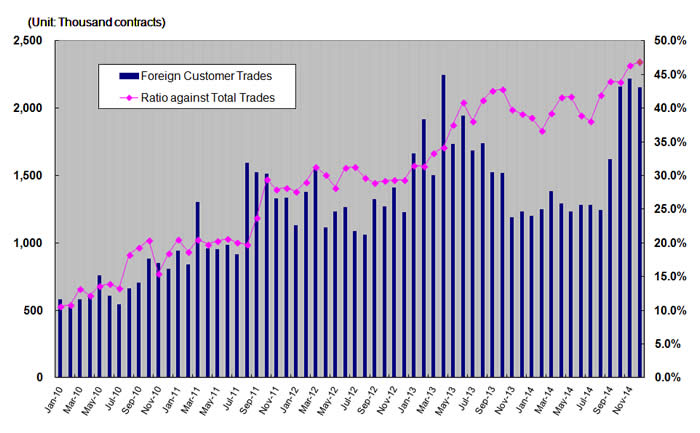

The Tokyo Commodity Exchange , the largest and most diverse commodity derivatives trading venue in Japan, has reported that the proportion of international investors transacting on the exchange has increased significantly with December 2014’s figures showing 46.8% of total volumes. The figure highlights the venue’s commitment on creating an open market place for global traders.

The total number of orders, both long and short, was positive for overseas participants, thus supporting the venue’s notion of internationalization. The firm commented about its extension plans in its midterm management plan issued in March 2014, stating: “Intensifying competition with other exchanges in Japan and overseas (is part of its objectives).”

The venue has seen cumulative growth in its overseas segment since launching the popular X_Trader platform in 2009, achieving a strong position with global traders. International markets have been on the agenda for the venue for a long time, as was reiterated by the current CEO Tadashi Ezaki, pictured, in his New Year message: “We will continue to promote our market to a diverse set of market participants, including retail investors, commercials and international participants. We will continue to improve the range of listed commodities to meet investor needs and carry on with educational activities to achieve this goal.”

Overseas Volumes

The latest news adds to recent reports that TOCOM received approval under the CFTC to operate in the US as a Foreign Board of Trade (FBOT). Reports state that the watchdog sanctioned the Japan origin venue, which permits TOCOM to provide its Members and market participants located in the US with direct access to its electronic order entry and trade matching system, a function that is expected to further enhance the overseas participation in the exchange.

The CFTC allows non-US trading venues to offers its solutions to US investors if the regulator can determine that the exchange’s regulatory procedures are in line with those of CFC authorized ones. A foreign board of trade registered with the CFTC must demonstrate that it meets regulatory requirements comparable to those required of US futures exchanges.

Furthermore, the CFTC must determine that the foreign board of trade’s regulatory authorities support and enforce regulatory objectives that are substantially equivalent to the CFTC’s objectives, in particular, with respect to market integrity, customer protection, Clearing and settlement and the enforcement of the rules of the foreign board of trade and its clearing organization.

Mr. Ezaki commented in a statement about the approval: “We are proud to receive FBOT registration, which confirms the soundness and reliability of our exchange and our market and will enhance confidence in TOCOM as the exchange of choice for trading commodities in Asia. As a result of our efforts to increase our global competitiveness, we have seen a significant increase in market participation from overseas, which has reached as much as 46% of total volume. We are poised to use the FBOT registration to further expand global participation from the U.S.”