The Amsterdam-based One Trading has received an extension to its license, enabling it to offer 24/7 perpetual futures on equities, in what the company described as the first in regulated finance.

The approval from the Dutch Authority for the Financial Markets (AFM) will enable investors trade equity derivatives with continuous price discovery outside exchange hours. One Trading plans to launch the platform by the end of the first quarter this year.

The AFM’s decision allows One Trading to run a fully regulated central limit order book operating 24 hours a day, seven days a week. The model eliminates the long-standing barriers of market opening and closing times, giving traders access to real-time pricing around the clock.

- European Retail Gains Regulated Access to Leveraged Crypto Trading

- This Dutch Exchange Debuts First EU-Regulated Crypto Perpetuals, Targets Retail Traders Next

- Banking Giant Bets Big on EU's First Regulated Crypto Futures Platform

Last year, One Trading expanded its crypto perpetual futures offering to retail traders in Germany, the Netherlands, and Austria. The expansion was based on the firm’s prior institutional launch, which introduced the first EU-regulated crypto perpetual futures under MiFID II guidelines.

Dutch Regulator Breaks New Ground

Commenting about the move, Joshua Barraclough, the Founder and CEO of One Trading, said: “This is the moment equity markets become truly global, continuous and always-on. For the first time in financial history, regulated equity derivatives can trade 24/7 with live price discovery, central-limit-order-book transparency and institutional-grade margining.”

“By combining MiFID II and MiCAR in a single trading venue, we have created a new category of regulated market infrastructure — one that unifies spot, custody, perpetual derivatives, clearing and settlement into a single always-on financial system.”

The platform will reportedly debut with US single-stock perpetual futures and equity index perpetual futures. These products have no expiry dates, offering continuous pricing and real-time settlement instead of traditional seasonal future expirations.

Additionally, users will gain access to cross-margining, portfolio margining, and integrated clearing and custody. Eligible retail and institutional investors will also be able to take both long and short positions.

Keep reading: This Dutch Exchange Debuts First EU-Regulated Crypto Perpetuals, Targets Retail Traders Next

Perpetual futures on equities are derivative contracts that let traders speculate on or hedge the price of a stock or equity index without owning it, and unlike standard futures they have no expiration date, so positions can be held indefinitely as long as margin requirements are met.

The price is kept close to the underlying equity’s spot price using a periodic “funding rate” mechanism, where longs and shorts pay each other, small fees depending on whether the contract trades above or below spot, and they are typically traded with leverage, which amplifies both potential gains and losses.

Always-On Market Model

One Trading’s structure unites multiple components that have historically operated separately. Spot trading, derivatives, and settlement will be integrated in one system, with shared collateral across asset classes. This design could streamline trading operations and improve capital use efficiency.

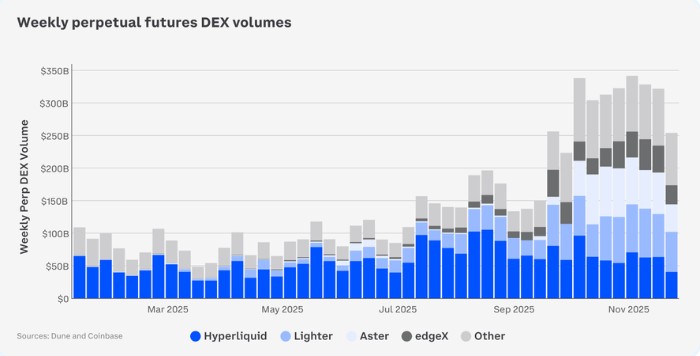

Interestingly, perpetual futures have become a core component of crypto trading and decentralized finance (DeFi), with decentralized exchanges processing around US$1.2 trillion in perpetual futures volume per month by the end of 2025, according to recent reports.

This came as the spot crypto markets saw comparatively slower activity. In an environment without a major altcoin rally, traders increasingly turned to perpetual futures to seek returns.

At the same time, perpetual futures became more integrated with DeFi infrastructure, including lending protocols, liquidity pools, and on-chain risk management systems.