Zeal Capital Market (UK) Limited, the FCA-regulated firm behind the ZFX broker brand, recorded impressive trading growth in the fiscal year ending 30 June 2025, yet finished in the red.

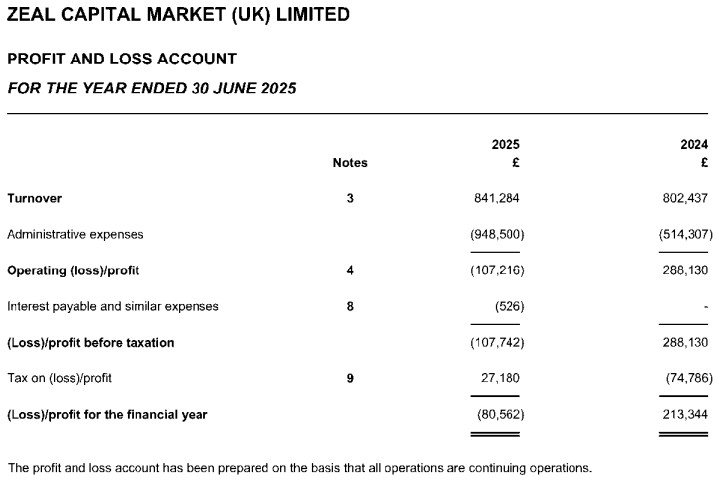

The company saw its trading volume surge by 43.5% to $28.8 billion, up from $20 billion the previous year. Revenue also edged up 4.8% to £841,284, reflecting steady client demand and strengthened trading activity.

“Adverse GBP/USD Exchange Rate Movements”

Despite the growth, the Zeal Capital Market UK posted a net loss of £80,526, a sharp turnaround from a £213,344 profit in 2024. Officials attributed the result to unfavorable GBP/USD exchange rate movements that reduced the value of capital and reserves held largely in dollars.

- ZFX to Showcase Innovation and Insight at iFX EXPO Asia 2025 in Hong Kong

- ZFX UK Pushes FY24 Profit Higher Despite Revenue Decline

“This result was primarily driven by adverse GBP/USD exchange rate movements, which affected capital and reserves held predominantly in USD, combined with higher costs related to trade execution and operations,” the company mentioned in its Companies House filing.

Balance Sheet Highlights

Zeal Capital Market ended the year with net assets of £2.42 million, slightly down from £2.5 million in 2024. Cash balances, however, jumped significantly to £1.45 million from £369,109.

You may also find interesting: CMC Markets Shares Surge Over 40% After Beating Income Guidance, Outpace CFD Competition

Finance Magnates earlier reported that Zeal Capital Market (UK) closed its fiscal year ending 30 June 2024 with revenue of £802,437, reflecting an 81% decline compared with the previous year. Despite the drop in revenue, the company recorded a net profit of £213,344, up 41% from £151,408 in the prior fiscal year.

The increase in profitability was supported by a reduction in administrative expenses, which fell to £514,307 from £681,321. This cost control helped lift the company’s pre-tax profit by 42%, reaching £288,130 for FY24.

“The company has established a highly diversified liquidity pool and prime brokerage relationships over the past few years,” the filing noted. “This has put the company in a highly competitive position to remain a matched principal broker offering CFD trading services exclusively to professional clients.”