eToro to slash 7% of workforce

The week saw several notable stories across the global trading and fintech landscape: eToro is cutting roughly 7 percent of its global workforce.

CEO Yoni Assia said the company is “ensuring we are correctly sized to meet our business needs and support our long-term growth strategy” as eToro continues to mature.

eToro reported 1,501 employees across more than 10 global offices and remote teams at the end of 2024, according to its IPO prospectus. Based on those figures, the planned reduction could affect over 100 employees.

AI drives broker layoff narratives

Interestingly, Artificial intelligence is already reshaping brokerage operations, with at least two firms—eToro and the owner of FXCM and Tradu—turning to workforce reductions.

- Market Wrap: Prop’s Rule Changes Spark Debate; Can Kraken–Deutsche Börse Pact Boost Crypto?

- Weekly Recap: FXCM, Tradu to Slash 100+ Jobs; 1/3 of eToro Trades Now in 24/5 Extended Market Hours

- Weekly Edition: The5ers Founders Move into CFDs; CNN and CNBC Turn to Kalshi Events Odds

Each reportedly laid off or is planning to lay off about 100 employees, citing the growing role of AI in their business processes as a contributing factor. While the adoption of AI is undeniably advancing across the industry, the term also serves as a useful narrative for companies.

It allows them to frame performance issues, redundancies, and cost-cutting measures within a single, forward-looking message that tends to resonate positively with investors.

Swissquote posts strong 2025 results

Beyond the headlines of layoffs and AI, some brokers are posting strong performances. Swissquote expects to wrap up 2025 with net revenue of at least CHF 720 million and a pre-tax profit approaching CHF 420 million. The previous year, the company posted a pre-tax profit of CHF 345 million on revenue of CHF 655 million.

The latest figures suggest another exceptional year for the Swiss online bank and trading platform. The anticipated revenue for 2025 has surpassed the company’s earlier guidance of CHF 700 million, while the pre-tax profit projection has risen well above the initial CHF 365 million forecast.

Capital.com enters Kenya

Also expanding geographically, Capital.com entered Africa after obtaining a new license from the regulator in Kenya. As a local Dealing Online Foreign Exchange Broker, it can now offer online forex and trading services to clients in the country.

The brokerage brand appointed Samwel Kiraka as Chief Executive Officer for its operations in Kenya. He will be responsible for establishing and overseeing local operations in line with Kenya’s Capital Markets Authority requirements.

Inside the B-book challenge

In retail trading, internalisation isn’t a flaw—it’s a strategy. Many retail brokers and prime-of-primes deliberately keep most client flow in-house. Far from being a stopgap or weakness, this B-book approach reflects a rational commercial decision. For a large share of firms, it simply works.

The real challenge emerges when that smooth internal balance breaks. Once hedging becomes necessary and risk must be offloaded into the market, brokers face a rapid shift in conditions.

Can the UK’s IPO market finally turn?

The UK financial markets saw little positive momentum last year. A series of policy reversals undermined confidence in the government’s fiscal management, while inconsistent economic indicators added to the subdued sentiment among investors and the public.

Data from the IPO market reflected the broader weakness. Investors who bought shares in each of the 20 companies that listed in the UK during the year would have ended 2025 more than 3% down by year-end, based on closing market prices.

Prop firms break even in 6 months in the US

In prop trading, the space remains heavily driven by marketing, raising key questions around startup budgets, break-even timelines, and the choice between saturated developed markets and fast-growing emerging regions.

The United States stands as a mature, competitive hub for prop firms, while Latin America continues to expand rapidly, yet the cost and speed of marketing returns vary significantly by region.

Globally, Google and Meta remain the dominant advertising channels, even as YouTube builds strong organic traction among traders. Some firms further diversify their outreach with campaigns on Reddit and native ad platforms such as Taboola and Outbrain.

Arizet debuts gamified prop trading platform

Still on props, Arizet Labs, known for its risk management and CRM solutions for proprietary trading firms, expanded itsofferings with the launch of a trading platform built specifically for the prop trading sector.

While gamification in live trading environments has drawn regulatory scrutiny in recent years, proprietary trading models largely operate in simulated environments. Because prop firms do not manage client funds for trading, the sector remains outside the scope of financial regulation.

Ripple and LMAX team up for institutional stablecoins

Stablecoins are quickly making their way into the capital markets trading industry. LMAX Group and Ripple entered a partnership to connect traditional financial markets with digital assets, combining technology integration with a financing arrangement.

As part of the deal, Ripple will provide $150 million in financing to back LMAX’s long-term cross-asset growth strategy, although no additional financial terms have been made public. LMAX Digital listed Ripple’s USD-backed stablecoin RLUSD on its institutional trading platform last year.

Interactive Brokers to support stablecoin deposits

Interactive Brokers is also eying stablecoins. The online trading platform introduced a new feature allowing eligible clients of its US subsidiary to fund their brokerage accounts using stablecoins. The company said the option offers near-instant processing and operates 24/7, including weekends and holidays, providing greater flexibility and faster access to funds.

The move builds on last year’s announcement, when Interactive Brokers revealed it was exploring stablecoin integration to enable around-the-clock funding and potential support for third-party stablecoins, depending on issuer reliability.

Stablecoins are reshaping settlement

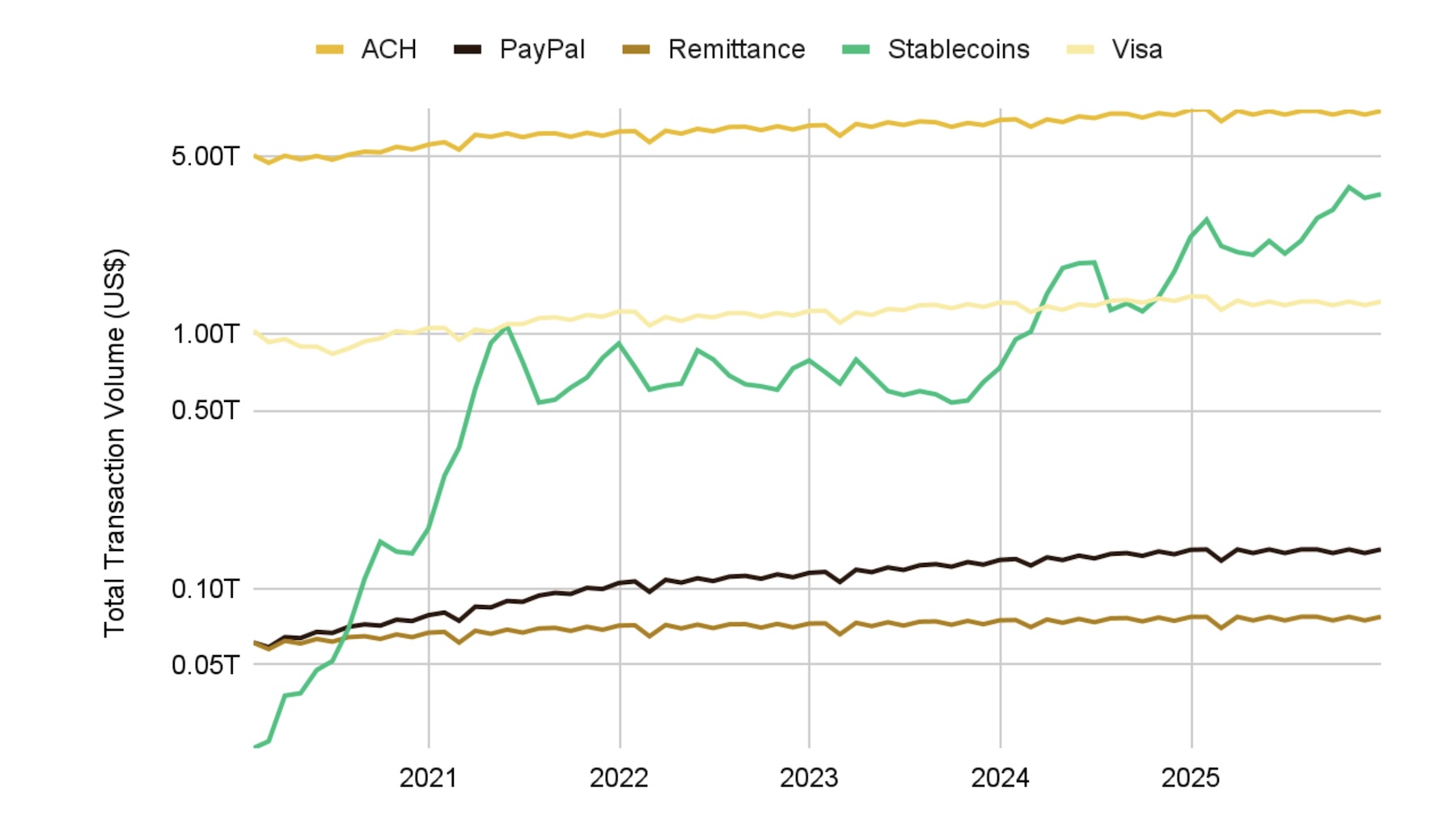

Overall, the stablecoin market has rapidly evolved from a niche crypto experiment into a core layer of global financial infrastructure, particularly within B2B payments and settlements.

In 2025, the sector’s growth underscored its newfound significance. Stablecoin market capitalization jumped nearly 50% to surpass $305 billion, while daily transaction volumes soared to $3.54 trillion.