Webull entered the public markets this week, sending its stock price soaring nearly 372% just a day after its Nasdaq debut. The stock-trading app's explosive rise follows its merger with SK Growth Opportunities Corp., a special-purpose acquisition company, pushing Webull’s valuation to almost $30 billion in record time.

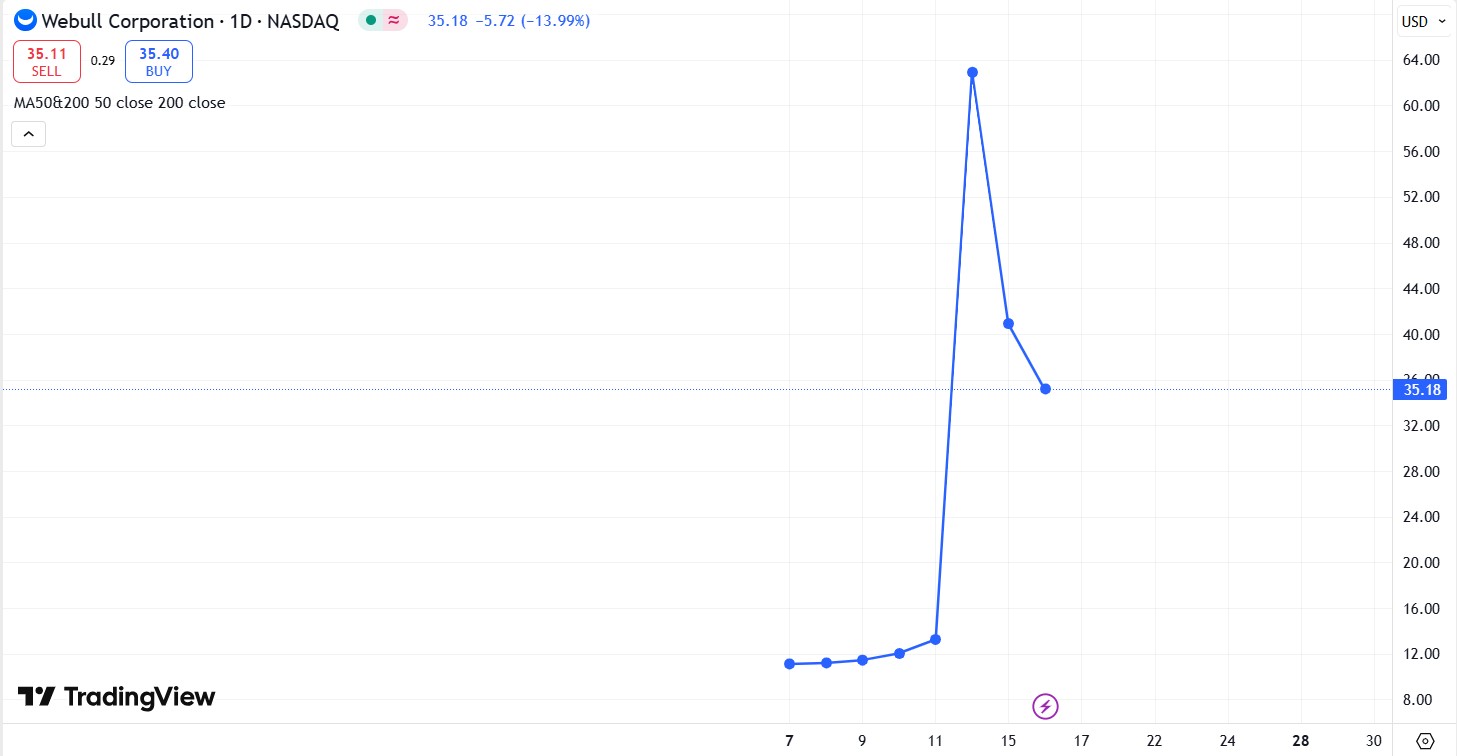

Stock Price Drops Over 76%

However, the price has since declined from its peak. According to TradingView data, BULL is changing hands for $35, a decline of 76% from its peak. With its shares now listed under the ticker “BULL,” Webull's market entry signals both investor appetite for digital brokerage platforms and renewed interest in select SPAC deals, even as the broader SPAC trend has cooled.

Webull first gained traction in the U.S. in 2020 when retail investors, many flush with stimulus checks, turned to the app for commission-free trading. It now operates in 15 regions globally, claiming over 23 million registered users and more than 50 million app downloads.

The company offers trading in stocks, ETFs, options, and cryptocurrencies , along with charting tools, watchlists, and a premium tier that costs $40 annually. Founded by former Alibaba and Xiaomi executive Wang Anquan, Webull now sits alongside Robinhood, Charles Schwab, and E-Trade in the increasingly crowded retail trading space.

Questions Around Global Operations

Webull’s path to Nasdaq came through its combination with SK Growth Opportunities Corp., whose shareholders approved the deal on March 30. As part of the transaction, SK Growth became a wholly owned subsidiary, and its securities were converted into Webull shares and warrants. Trading under the symbols “BULL,” “BULLW,” and “BULLZ,” Webull marked its market debut by ringing the opening bell at Nasdaq on April 11.

Despite the market enthusiasm, Webull faces scrutiny over its international ties. In November, the U.S. House Select Committee on the Chinese Communist Party contacted Denier regarding the company’s potential links to China, CNBC reported.

Still, with a multibillion-dollar valuation and fresh visibility, Webull appears well-positioned for the next chapter. As trading apps continue to reshape how individual investors engage with markets, Webull's meteoric rise could signal a broader shift in how fintech companies approach public listings in a post-SPAC-boom world.