FXCM has started migrating CFD trading accounts from the Tradu platform to its own systems. The move comes amid broader restructuring efforts, including recently announced layoffs.

Migration Notice

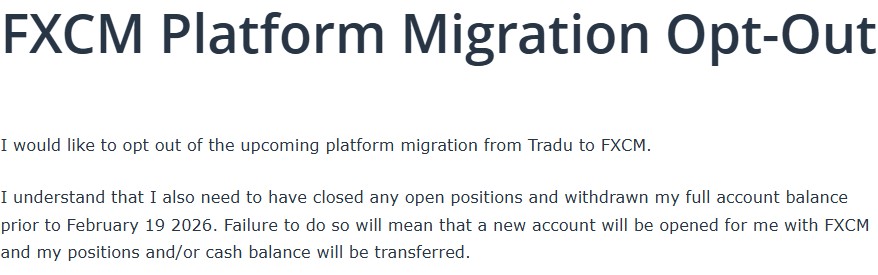

Traders who do not want their CFDs migrated must first close all open positions and withdraw any remaining funds, according to a communication sent to users. The migration will occur on March 20, after which traders will no longer be able to access their CFD trading accounts on Tradu.

“To provide you with a more powerful trading environment, we are consolidating our leveraged trading products under FXCM,” the communiqué mentioned.

“FXCM and Tradu already operate within the same company, and this gives you access to advanced tools and analytics built specifically for active traders.”

- Tradu Enables UK Traders to Place Spread Bets Directly on TradingView Charts

- Tradu’s European Retail Traders Get Secure Authentication via Salt Edge Partnership

- Tradu Names Philip Manning as Chairman of the UK Board

The move comes amid a period of restructuring and cost pressure at the group, which has already rebranded some European operations under the Stratos Markets name and announced job cuts.

Read more: Exclusive: Tradu, FXCM to Cut Over 100 Jobs; CEO Cites “Advances in Agentic AI”

“Coming into 2026, FXCM and Tradu have determined our strategic priorities for the company and how we best serve our clients in the new year. These prioritization decisions do have an impact on the make-up of the team,” commented CEO Brendan Callan.

“We, like a lot of firms, have made significant break throughs with the use of agentic AI tools which provide an opportunity to streamline the company and improve our customer experience.”

FXCM, Tradu Step Up Restructuring

The planned shift to FXCM follows earlier report that the firm is preparing to cut more than 100 jobs across multiple functions and locations, as profitability pressures persist despite an improved top line in the UK entity.

Public filings show FXCM UK’s client trading volumes fell 19% year-on-year to $243 billion and client cash balances dropped nearly 30%, even as turnover more than doubled and the unit still booked a loss of around $2 million.

Recently, Tradu enabled UK traders to place spreadbets directly from their TradingView charts following an integration with the platform that enables the analysis and execution within a single workflow powered by Tradu’s infrastructure.

Additionally, the platform earlier collaborated with open banking provider Salt Edge to enhance its security framework, ensure compliance with PSD2 regulations, and deliver a smoother, more secure experience for its European users.