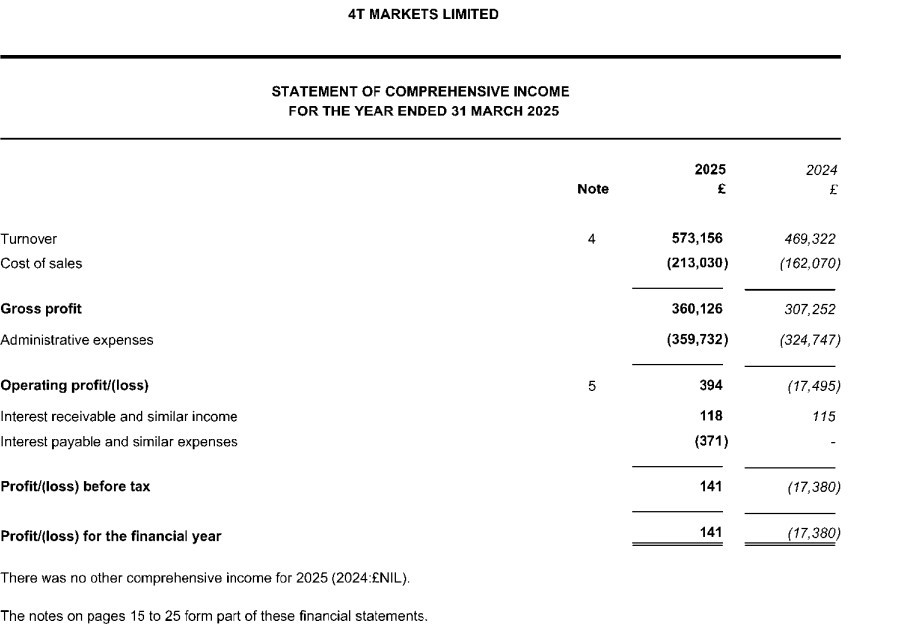

The UK division of 4T Markets Limited recorded a small profit of £141 for the financial year ending 31 March 2025. The figure marks a turnaround from the previous year’s £17,380 loss.

Revenue Growth with Thin Margins

4T Markets UK’s latest financial statements show turnover rising 22% to £573,156 in 2025, compared with £469,322 a year earlier. Gross profit jumped to £360,126 from £307,252.

However, administrative expenses – widened by 10% to £359,732 from £324,747 – kept net gains almost flat, underscoring the thin margins typical in today’s electronic FX brokerage space.

- 4T Markets UK Doubled Its FY24 Revenue, Narrowed Losses Significantly

- 4T Markets’ First Full-Year Financials (FY23): Revenue Crosses £235K

- Ex-SquaredFinancial CEO, Youssef Barakat Joins 4T

Besides that, the company’s operating profit reached £394, compared to a £17,495 operating loss the previous year, while interest income contributed an additional £118. The final profit after tax, though only £141, represented a positive turnaround from the prior year.

Read more: 4T Markets UK Doubled Its FY24 Revenue, Narrowed Losses Significantly

In the Companies House filing, the firm mentioned that it continues to target a seasoned clientele, including high-net-worth individuals, professional traders, and institutional investors familiar with the OTC foreign exchange market.

“The shareholders have funded 4T Markets with adequate capital to address not only the minimum regulatory capital necessary for the Firm to comply with the FCA's requirements but also its working capital requirements, and will continue to do so to ensure that it can sustain the business until it is profitable and can operate organically on its own resources,” the broker explained.

Management emphasized that the company’s culture remains anchored in client fairness and compliance with the Financial Conduct Authority’s Consumer Duty obligations.

4T Markets positions itself as an agency intermediary broker, allowing clients to access its electronic trading platform to execute OTC FX transactions. This model differentiates it from principal dealers by avoiding direct exposure to market risk.

Ownership and Governance

4T Markets Limited is wholly owned by 4T Global (Cyprus) Ltd, a holding company registered in Cyprus. In the statement, the company mentioned that it continues to navigate the UK’s evolving prudential framework following the adoption of the Investment Firm Prudential Regime (IFPR) in 2022.

As a former €125,000 matched principal license holder, the broker now operates under the MiFID Transitional Provisions (TP2) for Own Funds, as outlined in the FCA Handbook.

The IFPR raised the company’s permanent minimum capital requirement from £330,000 in late 2024 to £470,000 at the start of 2025, with a phased increase to £750,000 over five years.