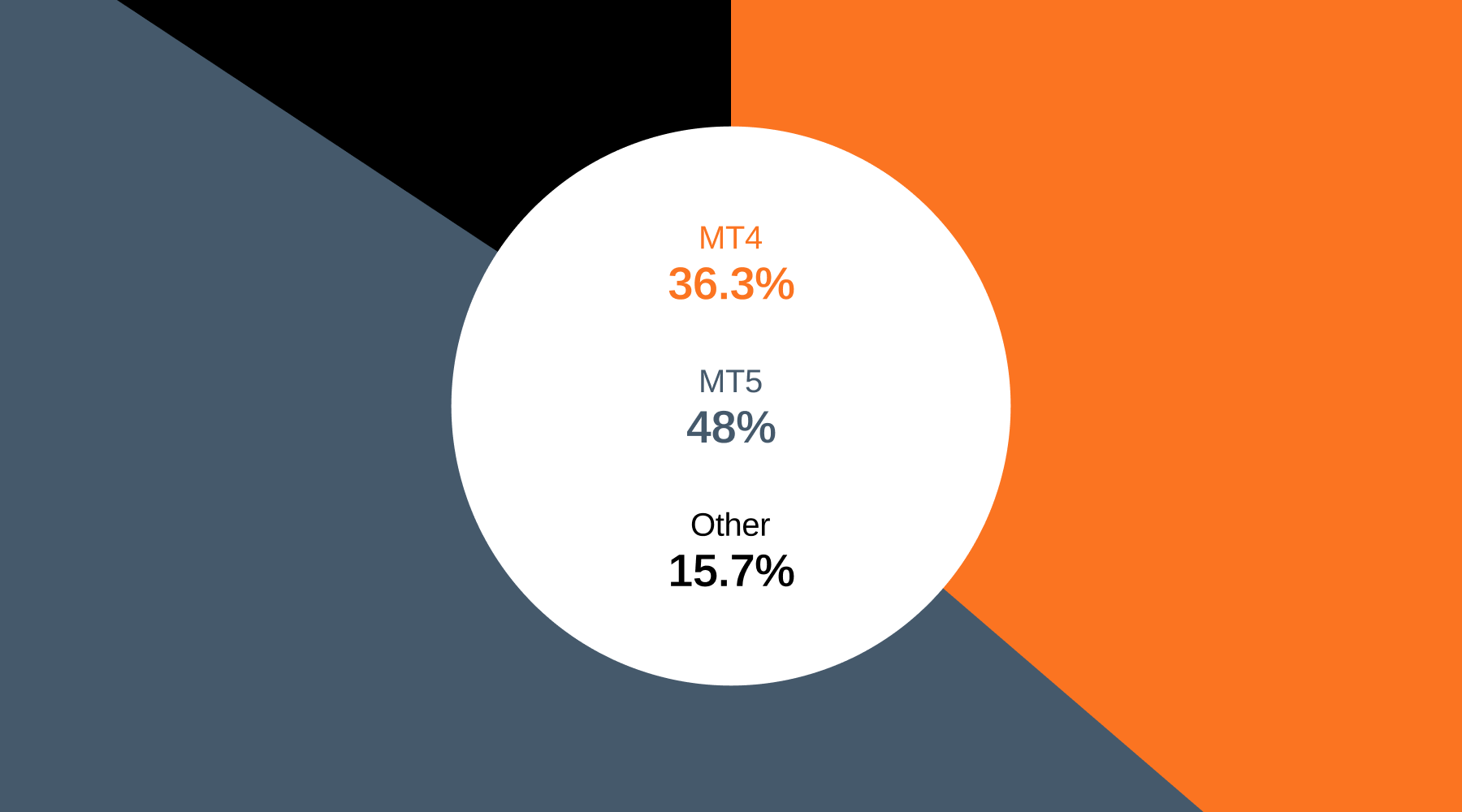

Competition between MetaTrader 4 (MT4) and MetaTrader 5 (MT5) is intensifying as MT5 widens its lead over its predecessor. Data from the latest Finance Magnates Intelligence Report shows MT5 accounted for 62% of retail CFD trading volumes on MetaQuotes platforms in Q3 2025, while MT4 slipped to 38%.

Launched in 2005, MT4 became the global standard for retail forex and CFD trading, praised for its simple interface and support for algorithmic strategies through Expert Advisors. It built a broad network of users, developers, and brokers that cemented its dominance for more than a decade. MT5, introduced in 2010 as its successor, expanded into multi-asset trading with equities, futures, and more advanced analytical tools.

For many years, MT4 remained the clear leader in retail CFDs. Even as MT5 gained traction, most brokers and traders stayed with MT4 because of its established community and familiar workflow. As recently as last year, Finance Magnates Intelligence data showed MT4 handling roughly two-thirds of all trading volumes, a clear sign of how deeply embedded it was in the market. Despite MT5’s technical edge, MT4’s loyal base kept it ahead until recently.

- Exclusive: MT5 Poised to Surpass MT4 in Volume Rankings by 2025

- Trigger Appy: How the MT4/MT5 App Store Ban Is Changing the Face of Mobile Trading

This year marked a turning point. Data from Q1 showed MT5 overtaking MT4 in trading volume for the first time in 15 years. The latest Q3 figures reinforce that shift, with MT5 now firmly in the lead at 62%. The numbers show how rapidly brokers and traders are migrating to the newer platform.

The Future of MT4

Still, MT4 is far from disappearing. Many major brokers continue to offer it as a core product because of its reliability, integrations, and client familiarity. While its dominance is fading, its large installed base will likely sustain activity for years. It may not drive future growth, but it remains too established to fade quickly.

Looking ahead, the pace of transition will be one to watch. Q3 data from Finance Magnates Intelligence also shows that 15.7% of retail CFD volumes are now executed on platforms other than MT4 or MT5. If that share continues to rise, MT4 could soon fall to third place – a shift that would mark a new phase in the competition for trading platforms.