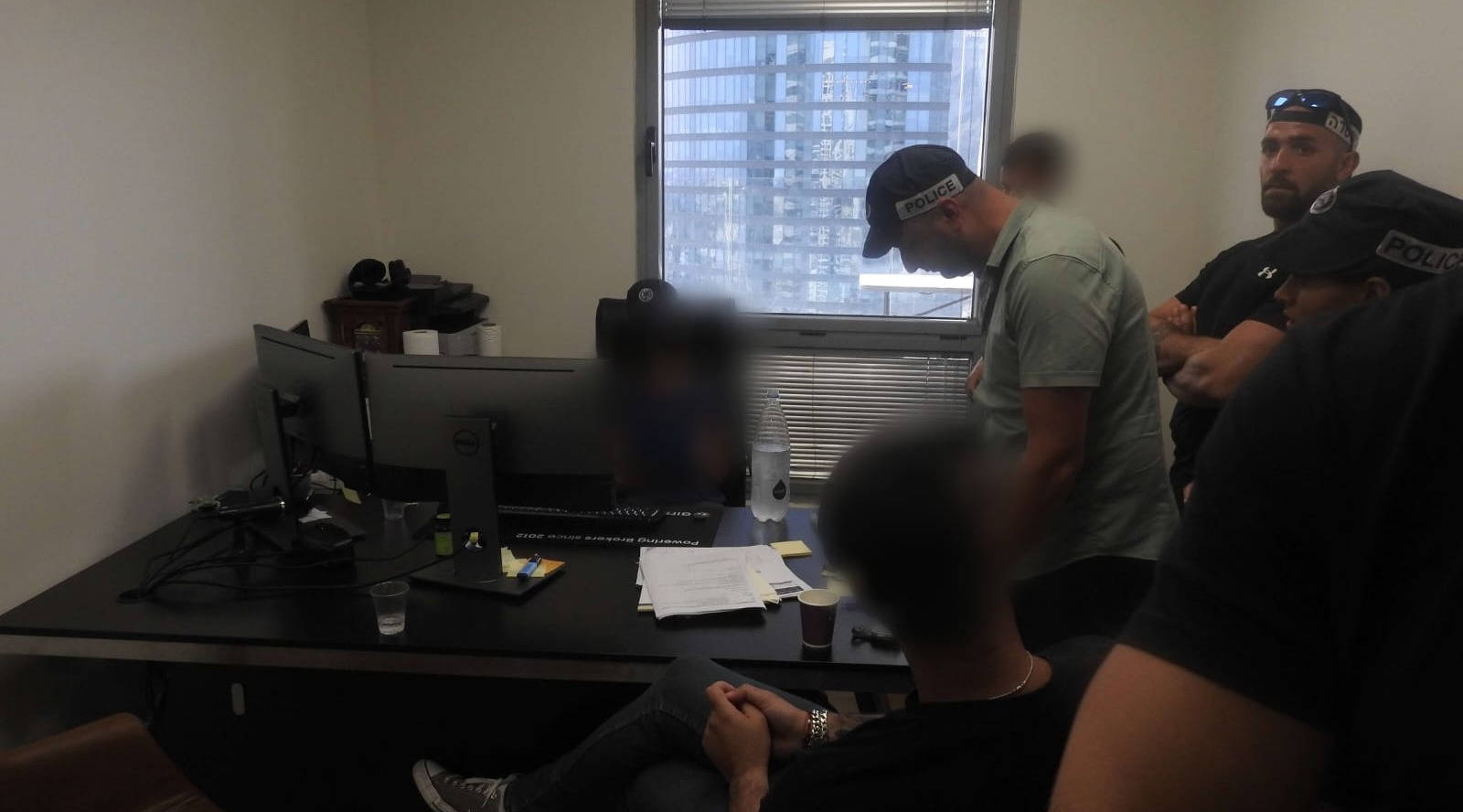

New details have emerged in the wide-scale crackdown in Israel against the providers of trading platforms for FX and crypto brands, in which four suspects have been arrested. Finance Magnates has learned that the raid, which included the confiscation of hardware and documents, took place in the Ramat Gan offices from which operated a fairly known industry brand: Airsoft Ltd.

In the summary of the remand custody hearings, viewed by Finance Magnates, the judge said that the "complex" investigation has just begun.

"This is a global and cross-country affair, in which suspects, under the Airsoft brand, have operated a platform that enabled defrauding investors," he said.

The 433 Lahav cyber unit and the Israel Tax Authority have signaled out two main suspects, who are suspected of anti-money laundering, fraudulent receiving under aggravated circumstances, conspiracy to commit a crime, and tax offenses.

Mastermind Fled

The scale of the scams was massive as it is suspected that the network provided infrastructure for fraudulent offenses to hundreds of forex offices globally and siphoned off tens of millions of euros, according to Israeli news outlet Posta.

The Massive Bust followed an investigation by German authorities against the fraudulent ring. Despite the arrests, Jeremy Katlan, also known as Roni Hajjaj, who is allegedly the head of the criminal network, managed to escape abroad. The latest arrests by Israeli authorities from the forex office in Ramat Gan include a family member of Katlan who is suspected to be managing the venue jointly. The CEO of that office was also arrested.

The suspects allegedly contacted victims globally through sales representatives who presented themselves as traders of forex , cryptocurrencies , and other financial instruments. They even operated fraudulent call centers in Bulgaria, Serbia, Ukraine, Georgia, Israel, and Kosovo.

Victims were lured in with promises of high returns. The fraudsters even presented falsified documents of the investment scams. However, in reality, the fraudsters never invested the collected proceeds from the investors. The fraudsters also transferred the victims' funds to bank accounts in Germany, the Czech Republic, and Hungary.

The German authorities were involved as they were the first to identify five groups that have been operating since 2018 and linked to the larger ring.