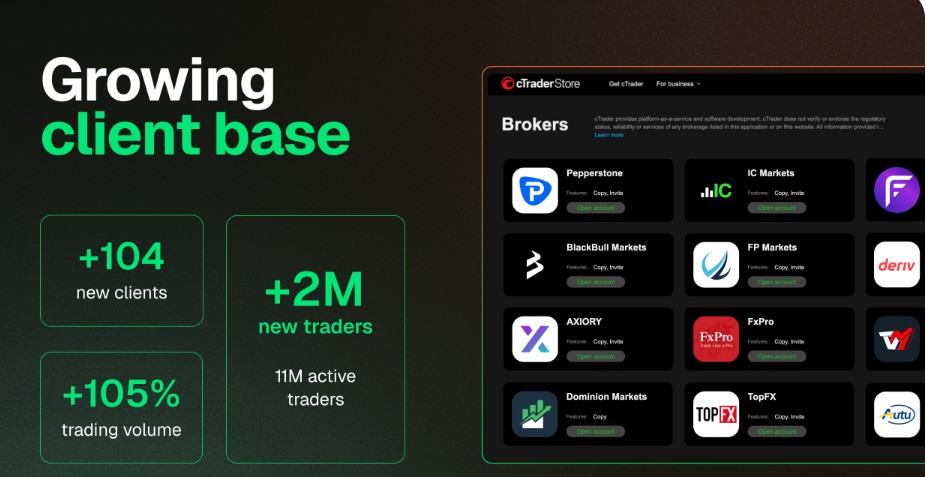

Spotware reported a 105% year-on-year surge in live USD trading volume on its cTrader platform in 2025, as the number of traders using the platform climbed above 11 million.

The financial technology provider also broadened its product stack beyond cTrader by rolling out a liquidity bridge, expanding its marketplace and embedding AI across core operations. It onboarded 104 new clients, strengthening its footprint among brokers and prop firms.

Volumes Double as Traders and Clients Increase

A key milestone in 2025 was the market rollout of cBridge, Spotware’s liquidity bridge solution for brokers. The product reportedly focuses on cost efficiency by eliminating volume-based fees and hidden charges, which can weigh on brokerage operating costs.

- Spotware Puts Prop Challenges Front and Center for “10,000 Daily Users”

- Spotware launches YouTube Channel

- Spotware Brings cTrader Platform to The UK Prop Firm OneFunded

“We clearly demonstrated to the industry that we have evolved beyond a single-product platform developer, expanding our product offering through the introduction of cBridge and the rapid growth of cTrader Store,” commented Ilia Iarovitcyn, the CEO of Spotware.

Related: cTrader Mobile 5.6 Updates Tools for Retail Traders as Market Set to Hit $133B by This Decade

“We implemented AI across our core operations, significantly expanding our capabilities and setting a stronger foundation for what comes next,” he added. “These milestones set a clear direction for 2026 – and we will take it further.”

Spotware also leaned on cTrader Store as a growth engine in 2025. The marketplace averaged about 700 installs per day and recorded a sixfold increase in purchases during the year, pointing to rising demand for plugins, indicators and automated strategies.

cTrader Leads, a related service, reportedly generated up to 10,000 daily visits, directing traders to brokers and prop firms at no additional cost.

Prop Challenges on cTrader

Towards the end of last year, Spotware introduced a dedicated section for prop firm challenges on the cTrader Store. The feature creates a structured hub where traders can browse, review, and compare different challenges and trading conditions offered by various firms.

In client support, Spotware implemented an AI-driven automation system connected to its internal knowledge base. The tool reportedly analyses incoming trader enquiries and generates responses automatically, resolving around 60% of requests within an average of three minutes.

According to the report, broker support response times improved by 33%, indicating that AI reduced handling times for institutional partners as well as retail traders.