The retail trading industry remains dynamic in 2025. Brokers are not the only major players; prop firms are also key. Expansions, acquisitions, re-entries, exits and even layoffs shaped the year. Many floated big plans, but will they work?

What dominated 2025? What were the main points this year?

It is hard to point to a single set of events that defined the retail trading industry this year, as there were many. Here are five key recaps:

1. Prop Firms' the US and Brokers Bid

The early 2024 unofficial crackdown by MetaQuotes on prop trading firms forced many brands to exit the US market. This even pushed giants like FTMO to suspend operations there.

This year, many big brands re-entered the US, as they could not ignore the market’s size and the strong demand for retail trading services. The5ers, FundedNext and FTMO are among the major names returning. However, FTMO is the only one offering MetaTrader 5 to traders in the US, thanks to its partnership with OANDA.

Futures props are another area where CFD props see value, but mainly for the US market. Brands like TopStep, Apex and MyFundedFutures already lead the space, and others, such as FundedNext, have also entered. The5ers is expected to launch a futures prop platform as well.

- “Prop Space Still Struggles With Credibility”: Kathy Lien Explains Why the Trading Industry Needs Another Review Site

- From “Unrealistically Good” To “Cesspool Of Gamesmanship”: How 40 Minutes Changed Minds On Prop Trading

- Prop Firm Alpha Capital Pushes Mobile App Rollout As Yearly Payouts May Be One-Third Of 2024

For some time, brokers were the ones launching prop trading services. Now the trend has shifted, and props are becoming brokers.

The most notable move here is FTMO’s acquisition of OANDA, one of the most popular and well-regulated forex and CFD brokers. The Czech prop firm did not disclose the price of the deal, but it secured a USD 250 million credit line from a group of Czech banks led by UniCredit to fund the acquisition.

The founders of The5ers are also backing a move into the brokerage industry.

Many other prop firms have obtained offshore brokerage licences, though their main aim is to gain a MetaTrader licence rather than run full brokerage services. FundedNext may be one of the few that opened a brokerage brand under the Comoros registration, while also applying for licences in Mauritius and Dubai.

Find out what the CySEC Chair thinks about prop trading: "I understand there are potential risks related to prop trading and its possible impact on investors."

2. Brokers Entering Crypto

CFD brokers saw the value of crypto CFDs years ago, but now they want to move further. Some big brands have offered CFDs and physical crypto together for years, but it was London’s IG Group that became one of the first major CFD-focused firms to step into crypto at scale. It started by partnering with a third-party platform registered with the UK regulator to offer crypto to retail traders, and later bought a crypto exchange regulated in Australia and Singapore.

Pepperstone is another major CFD broker that has announced plans to launch a crypto exchange, joining a growing list of others.

The question is whether CFD brokers truly believe in crypto’s potential, or if it is simply a tool to convert crypto traders into brokerage clients.

For a while, crypto exchanges were the ones entering the CFD space, but moves by major CFD brokers show a clear shift.

3. The Super App Dream

What is a super app? In China, the best-known examples are Alipay and WeChat.

The Western world is still struggling to match them.

Among CFD brokers, CMC Markets has floated a plan to become a “financial super app”. It aims to roll out a multi-asset platform with both traditional finance (TradFi) and decentralised finance (DeFi) products, alongside SIPPs, ISAs, tokenised products and stablecoins. It also aims to include payments and banking products.

CMC is not alone. NAGA, Swissquote and XTB are also working on their own versions of a financial super app or have already launched early forms of it.

4. The 24/5 Trading Norm

For a long time, the forex market (excluding crypto) was the only market open around the clock on weekdays. Now stocks are catching up.

Rising demand for stock trading has pushed brokers to launch 24/5 trading services. Started by Robinhood, the offering has now been picked up by eToro, Trading 212, Interactive Brokers, Amana and others. These services cover both CFDs and physical share trading.

But will overnight trading truly help traders? Or will it simply lead to more trading fatigue?.

5. The AI Bridge

The use of AI-based solutions was also a notable trend in the brokerage industry this year, especially among tech providers. Although the early use was as simple as automating chatbots, brokers can now recommend stocks using AI.

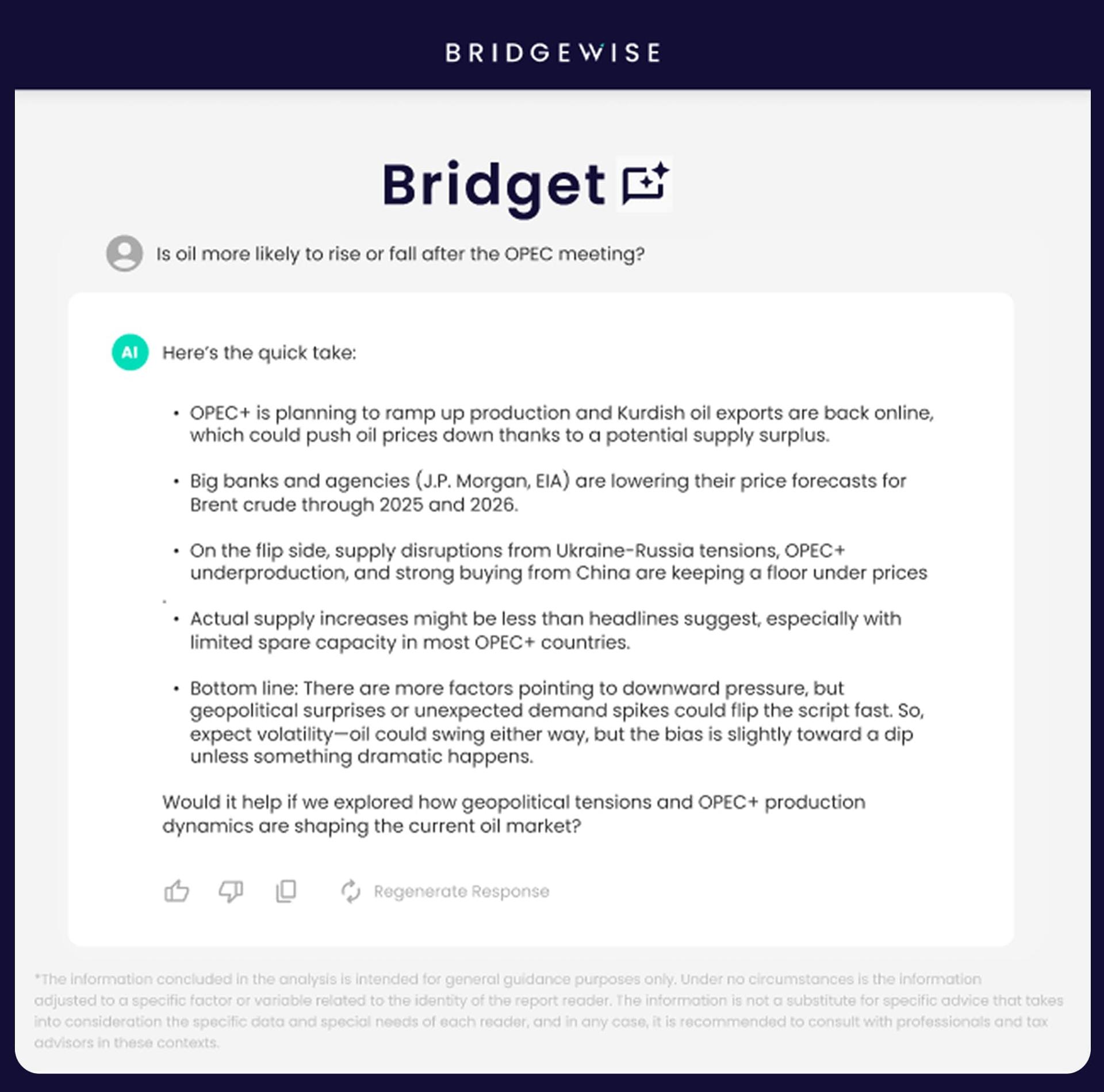

Bridgewise launched a white-label AI-based market analysis chat tool for CFD brokers, while Acuity added an AI-based research tool to the cTrader platform.

Another interesting use of AI this year came from Webull, which now allows order placement by voice and in natural language.

These updates show that AI is not just hype in trading and has strong potential to make the trading experience easier.

What’s to Expect in 2026? An Incoming Tech Demand

The retail trading industry is changing fast. Round-the-clock trading, tokenisation and super apps are all likely to grow next year.

While no one can predict events with full accuracy, one trend is the rise in the need for reliable technology for both brokers and prop firms. MetaQuotes’ crackdown has already forced prop firms to use more than one trading platform. Now, the recent decision by ProjectX, a trading platform close to TopStep, to stop services for “third-party” prop platforms has started the debate around tech providers again. Under these conditions, we might see another wave of tech providers targeting prop firms with simple, firm-specific solutions.

Another gap is the risk management of prop firms. Many experts are already offering risk management services to prop firms, an industry known for quick shut-downs, and next year, we might see more solutions focused on prop risk management.

What else can we expect in 2026?