One of the biggest prop trading firms in Germany, Funded Unicorn, has closed its operations, shaking the prop trading community and raising deeper questions about the sustainability of certain risk models.

Unique A-Book Strategy

According to a blog by proptraders, unlike most prop trading firms that rely on challenge fees and operate largely on a simulated trading basis, Funded Unicorn used what’s known as an “A-book” model. The firm mirrored every trade made by its funded traders on the actual market.

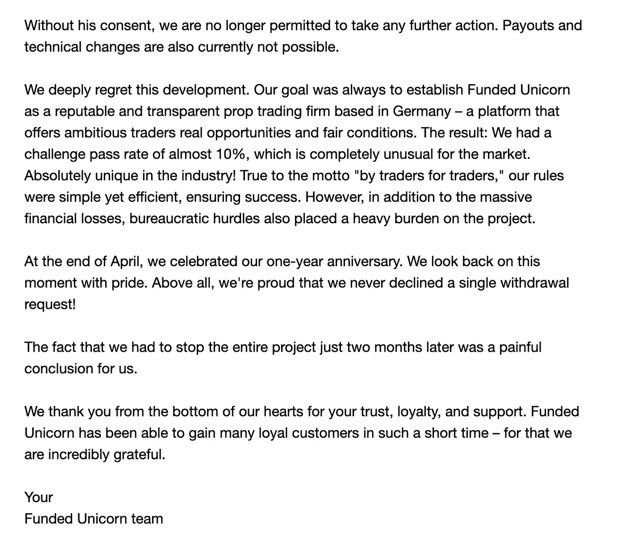

“We deeply regret this development. Our goal was always to establish Funded Unicorn as a reputable and transparent prop trading firm based in Germany – a platform that offers ambitious traders real opportunities and fair conditions,” the company wrote in a statement circulated to its users.

No Recovery Plans Yet

Funded Unicorn has yet to announce any recovery plans or future restructuring. In the message circulated to users, Funded Unicorn partly blamed what it described as bureaucratic hurdles for its business's closure. The company joins several other prop trading companies that have been forced to shut operations recently.

Towards the end of last year, Smart Prop Trader, a prop firm offering funded trading accounts, announced it would stop accepting new traders as it prepares to wind down operations by year-end.

And before that, Funded Engineer, another troubled prop trading firm, also announced a “permanent closure” of its operations last year and the decision to file for bankruptcy amid heightened volatility in the space. Around the same time, another prop trading firm, Karma Capital, unexpectedly closed its operations.

The turmoil in the prop trading space claimed many companies last year. According to estimates gathered by Finance Magnates Intelligence, between 80 and 100 proprietary trading firms may have disappeared from the market in 2024. What seemingly triggered the volatility was MetaQuotes' decision to step back from supporting prop firms.