Futures prop trading platform FundingTicks is facing a massive backlash on social media after reportedly changing its trading rules retroactively last week. The changes include a minimum one-minute trade hold time for scalpers.

Retroactive Rule Change Created Chaos

Although rule changes are common in prop trading, many traders claim FundingTicks applied them retroactively to all accounts.

However, in a lengthy message defending his record, CEO Khaled insists he has “paid out more than US$220M while putting my traders always first and in heart.” He explained that “fundingticks started as a side project” that quickly “became a giant.”

Traders who bought challenges on the platform, agreed to the old trading rules, and passed them now have their challenges breached or profits reduced if they violated the current rules in the past. Earlier valid trades were also invalidated.

Read more: “Prop Trading Rules Aren’t to Trap but to Protect Capital”

The rule change includes a one-minute minimum trade hold period instead of no minimum period; a $200 minimum profit per day, up from $150; six profitable days, up from five; a new 80 per cent profit split compared with the previous rate of up to 90 per cent; and reduced and capped withdrawals.

However, FundingTicks highlighted an increased drawdown limit while promoting the new rules on social media.

FundingTicks was launched earlier this year by the same people behind the contracts for differences (CFDs) prop trading platform Funding Pips. Khaled claims to be the owner and CEO of both FundingPips and FundingTicks.

- Retail Trading & Prop Firms in 2025: Five Defining Trends - And One Prediction for 2026

- Prop Firms and Brokers Form a Perfect Synergy: One Offers Access, the Other Capital

- My Forex Funds Regains Control over Canadian Assets, Is Prop Trading Relaunch Imminent?

Angry Traders Moved to Social Media

“FundingTicks, you can’t change profit splits, trade holding times, and the number of profitable days required on existing accounts,” a social media user, Sahil, wrote on X. “You should have run polls and asked for public opinion. I believe you can make this right. The old rules were balanced.”

He also stated that the “one-minute scalping rule makes no sense.”

Another user, who goes by the name Babs on X, wrote: “This account was sitting at $3.2k in profit on Friday, and now it has been reduced to $751.62.”

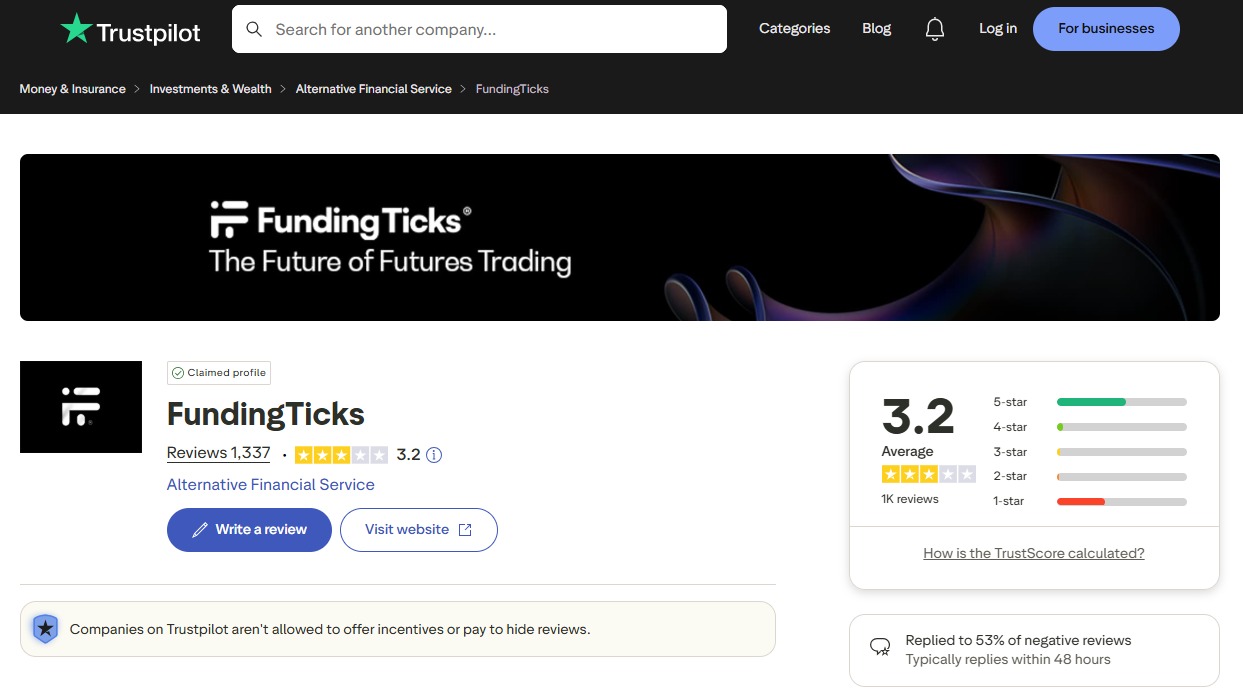

Traders’ anger is now reflected on FundingTicks’ Trustpilot page. With over 1,000 reviews, the platform’s current TrustScore is 3.2, down from 4.1 in October, according to archived pages.

Currently, 38 per cent of the ratings on FundingTicks’ Trustpilot page are one star, the lowest rating a user can give.

Trustpilot temporarily suspended the profile page of FundingPips last year but later restored it.

Read more: Trustpilot’s Reputation Casino – Are Brokers and Props Playing or Getting Played?

FinanceMagnates.com contacted FundingTicks for comment on the backlash but did not receive a response by the time of publication.