At the end of last year, Forex Magnates connected with Dmitry Orlov, one of the pioneers of the PAMM accounts industry, to learn more about his opinion on the copy trading market and to gather some details about his new venture, Strategy Store. Strategy Store was created as a cross-broker combination of copy trading and PAMM product. Following a period of private live testing with clients from GKFX.ru, Strategy Store will be soon conducting its greater live launch.

As part of their buildup to the general launch, the firm held an open presentation in Moscow to executives of the FX and financial industry. According to comments provided by Strategy Store from attendees, two words that were used often to describe the product were flexible and innovative. Ilja Kitajevs, Senior Sales Executive, LMAX Exchange mentioned “I think Strategy Store has accurately identified the problems and pitfalls of both copy trading services and PAMM accounts, and their innovative approach allows solving them and satisfying all the parties in the network.” While Mikhail Berman, Business Development Director, Devexperts, stated “Strategy Store has good advantages for all participants. For trader: normalized strategy comparison, “fake strategy” is easy to identify; for investor: no order latency issues like in mirror trading services, all investors are equal, plus money management tools to control investment risks and “personalize” trading strategy; for broker: high trading volume and low number of orders plus special optimization for A-book to lower cost of IT and dealing desk.”

Although unable to send a representative, Forex Magnates followed up with some attendees on their opinions of the product. Commenters verified to us their favorable view of the product as they felt it fit a need in the industry and provided advancements over existing solutions.

Copy Trading and PAMMs

There are many existing copy trading products on the market. Overall though, however you describe them or how they are packaged to clients, they are based on users (investors) choosing a trade leader (trader) and allocating a portion of their account value to copying trades performed by the trader. Depending on the system, investors may be provided with some Risk Management features that include limits on the size of each trade, fixed or variable sized orders, ability to trade in reverse of the trader, and stop loss percentages. One of the product types that Strategy Store is aiming to improve are Percentage Allocation Management Modules, better known as PAMM accounts, along with the copy trading solutions.

With a PAMM, the investor is provided the ability to choose which traders to allocate funds to. However, once funds are allocated, it is the trader that ultimately elects the ratios of order sizes to be executed for each linked investor account. As a result, among negative views on PAMMs are that investors lose the ability to handle risk management of their account after choosing a trader. Due to risk management limitations, as well as its appearance of being a pooled structured product, PAMMs have gotten on the radar of the NFA, with the regulator proposing new rules to limit the use of certain features.

In order to provide additional control to investors, other copy trading systems such as ZuluTrade and Tradency, have taken a different approach from that of PAMMs. For these products, the trader operates their own account and has no control over individual investors. Upon placing a trade, the system will place a similar trade on behalf of investors based on their risk customizations. Depending on the system, the trader may know who is following, but has no control on the size of orders executed by the investor. Such copy trading systems have several advantages and disadvantages in addition to the risk management control provided to investors. Among advantages is the ability for traders to focus on their own account without managing ratios for multiple investors. In addition, these systems are often cross broker initiatives which make it easier to scale the amount of traders and investors to create a thriving user base. In terms of negatives, as orders are routed through the third party copy trading system, latency may occur if servers aren’t located near those of the broker, or an abundance of copiers creates a bottleneck of transmitting data. Thus, investors’ performance is often far different from that of the trader. Some products also compensate traders based on investor volumes, rather than performance, which may lead to high turnovers and aggressive commissions levied on investors.

Strategy Store

According to Strategy Store’s creators, the aim was to create a product that combined the advantages of copy trading and PAMM systems, while provideding a solution for their common problems such as latency and execution drawbacks, excessive commissions, and lack of the strategies rating transparency and investor risk management. The result is a product more in line with copy trading products and less of a PAMM system. At its core, Strategy Store is a central system that connects investors and signal provider traders. I specifically refer to them as signal providers and not traders as will be explained shortly.

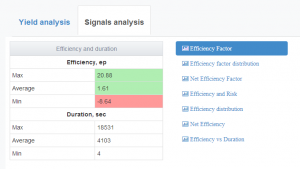

Once linking to and opening an account to an Strategy Store platform, investors choose their risk appetite of either conservative, moderate, or aggressive, along with choosing the complexity of interface and functionality according to their experience. They are then provided a list of strategies that fit their risk criteria. Investors can filter through the various strategies and elect to copy the trader. Upon doing so, investors enter the amount of capital to allocate to this trader as well as which currencies to trade. In addition, a maximum loss limit percentage per each deal can also be applied and set by the investor. By default the system includes loss limits based on investor risk appetite, but the value can be manually changed by the investor. Choosing a strategy, users are provided information such as past performance, maximum drawdowns, and trading efficiency.

Upon copying a trader the investor subscribes to a strategy, the system then begins to act like a trading signal system. Upon the trader opening a trade, it sends a signal to execute a similar position for the investor. Once a trade is opened, Strategy Store does not open a new trade from the same trader until the first one is closed, ensuring that the investors cannot lose more funds in one deal than they agreed to risk.. In this regard, Strategy Store is closer aligned to signal provider software than following a trader that may open multiple positions at different prices as they are following a currency pair. For trader signal providers, this means that some multi-order strategies, such as a Martingale system of opening many small positions won’t work, as only one position will be initiated by the investor followers, and other limitations will be applicable. However, what Strategy Store does provide, is the ability for investors to customize risk management guidelines based on each open position. (At a later stage, Strategy Store does plan on incorporating the functionality for the opening of multiple simultaneous positions, but with limitations that will still be ensuring compatibility with the investors’ risk parameters

Platform

Unlike other third party copy offerings that operate as plugins and integrate with existing platforms to send orders to the trading servers such as that of MetaTrader, Strategy Store operates as a standalone platform. Broker clients can either connect it to their Liquidity providers (LP) or internal trading servers, or partner with Strategy Store’s centralized LP (PoP)s. The platform has two business models for brokers; a white labeled offering or cross broker connection with a centralized shared base of strategies. With the white labeled model, brokers can customize which strategies users see as well as control whether trades are A or B booked. For end user investors, the cross broker offering, is similar to other services such as ZuluTrade or Myfxbook where all strategies from the shared base are available to be copied, but orders of the trader and all investors from all connected brokers are aggregated at the LP level and are executed at the same price. In addition, with this model, brokers are limited to partnering with Strategy Store’s partner LP in order to provide all investors with the same execution conditions. (Currently, Strategy Store is in discussions with numerous potential LPs, including LMAX, which is negotiating to be a founder LP)

In addition to strategies and liquidity, the other main difference between the two models is execution. In terms of latency, Daria Timoshchuk, COO and Co-Founder of Strategy Store, explained that users of Strategy Store, regardless of the mono-broker or cross-broker model, benefit from more efficient execution as the system aggregates copied orders into one large trade; thereby minimizing bottlenecks that can occur when sending hundreds or thousands of simultaneous orders.

Costs

Among the innovative features of Strategy Store is its cost structure. The platform is being made available to brokers for free, without turnover fees. On the investor side, commissions are charged per trade, with fees distributed between the broker, LP, and any additional agent involved with onboarding the customer. In addition to per trade commissions, investors are charged a performance fee for profitable trades which is paid to the trader. The performance fee is an adjustable rate which can be changed by the trader, and is included in the overall calculations of past performance. Therefore, traders that increase their performance fee, would see a reduction in their past profit yield. Timoshchuk added that as a result, “traders can compete not only in the quality of their trading, but also in their fees.”

In terms of Strategy Store, their compensation is based on receiving a portion of the performance fee. Timoshchuk explained that the firm had debated whether to base their revenue stream on customer trading volumes, but ultimately decided against it, in order to align their business model on the side of successful traders.

Review

Now down to my opinion after playing with the demo version of the product. There is little doubt that copy trading or however else one wants to call it is an important part of the retail forex industry. When it comes to Strategy Store, the first thing one realizes is that this isn’t a social type platform. The product more closely resembles that of Tradency than an eToro or ZuluTrade, and the focus is on managing strategies and not about evaluating individual trades. As a result, Strategy Store needs to be aimed towards customers who aren’t interested in their own trading, but prefer a discretionary account. However, unlike a mutual fund where investors choose a fund and close their eyes to the future, Strategy Store requires hands on management of traders. As such, for customers wanting to follow individual trades, they may not like how Strategy Store operates. But, parties interested in a managed account offering will find appeal with the control provided to them. Overall I found the product fairly easy to choose and customize risk management with. But, there was a bit of a learning curve needed to understand the terminology of several of the performance measures.

I believe that the product will be appealing to most brokers due to its no-upfront costs. However, firms may be hesitant to want to work with Strategy Store's LPs and find the product too cumbersome to administer if they are responsible for attracting trader leaders to the system.

Where I believe there is an opportunity is for the growing list of tight spread STP brokers that have been popping up lately. Attracting money managers with their pricing, a drawback is the limited size commission structures they can provide partners due to their smaller spreads. As such, providing partners the ability to onboard clients to an STP based Strategy Store, but with wider spreads and increased commission payouts due to the system's value add, could be a compelling marketing solution.

Another direction for the product which would seemingly make sense, and which Timoshchuk alluded to Forex Magnates could exist in the future, is the ability for Introducing Brokers to market the product directly, with clients onboarded by the LP. Such a solution would provide IBs with a copy trading product to promote, without the need of a retail broker intermediary. Overall, Strategy Store enters a competitive copy trading market, but has its own innovative features that may allow it to standout.