Plus500 has stopped offering new CFD trading accounts to residents of Spain, tightening access to leveraged products in a market where regulators already restrict advertising and distribution to retail investors.

The decision comes as Spain continues to apply some of the toughest rules in Europe on how firms can market and sell CFDs to non-professional clients.

Plus500 Changes Onboarding for Spain

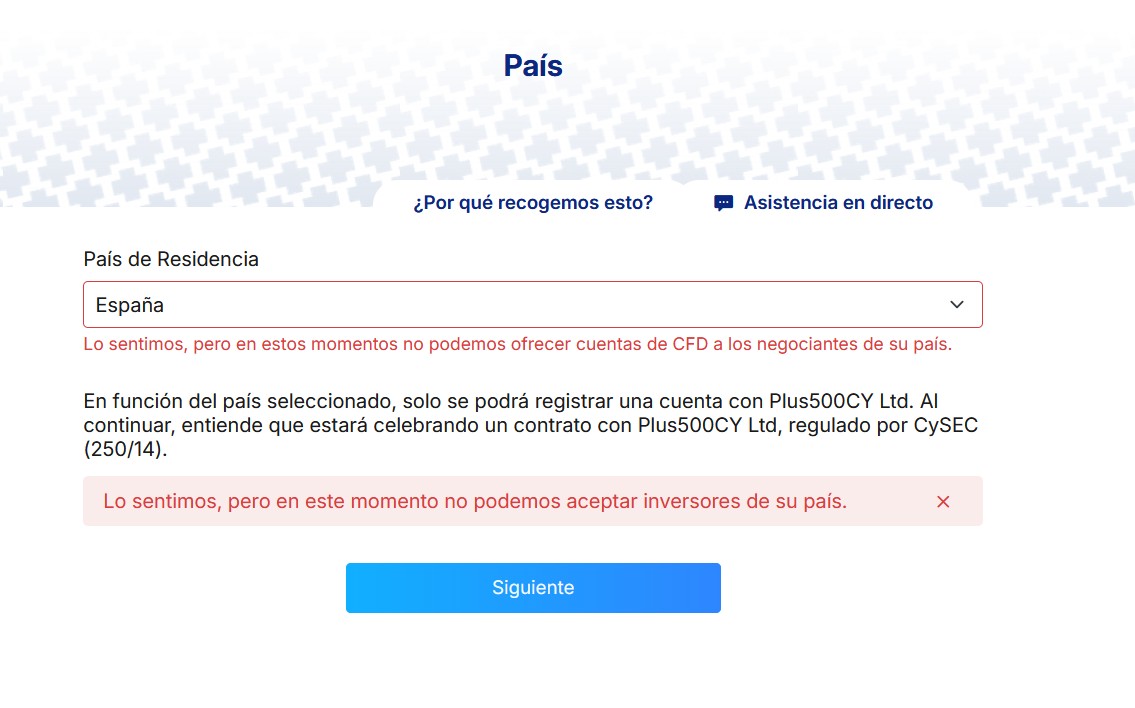

Plus500 now blocks new CFD account openings for users resident in Spain, according to information on the company’s registration page. Spain’s securities regulator, the Comisión Nacional del Mercado de Valores, rolled out a new set of rules for the CFD space in 2023.

- Plus500 Reports Half Its Revenue Now Comes From Customers Trading Over Five Years

- Plus500 Top Executives Got £20.5 Million in Shares under the “2026 Deferred Bonus Scheme”

- Plus500 Buys Now-Closed Indonesian Broker, Starts to Offer Services Locally

The measures prohibit the marketing of CFDs to retail clients in Spain and extend to banning introducing-broker and influencer-style promotion, as well as advertising through events or using celebrities to endorse the services.

Continue reading: Plus500 Reports Half Its Revenue Now Comes From Customers Trading Over Five Years

The framework aimed to curb the ways firms promote leveraged trading to the public rather than outlawing CFDs themselves. While the rules set formal limits on how providers reach retail investors, their practical impact depends on how firms interpret and apply them in day-to-day operations.

The tight regulations is behind the decline in the region's leveraged trading space. The space shrunk to a fraction of its 2021 peak, with the number of active FX and CFD traders dropping another 10% to around 35,000 as of early last year, according to a report by Investment Trends.

ESMA Rules and Spain’s Stricter Line

ESMA rules created a baseline for investor protection but allowed national regulators to adopt stricter measures where they saw additional risks.

Read more: Spain’s Expanded Restrictions on CFDs Set for July 20, Gets ESMA Backing

The measures apply to all firms authorized to provide investment services in Spain, regardless of where the firm is based or whether it operates through a branch or cross-border passporting.

ESMA summarized the effect by stating that marketing, distribution and sale of CFDs by means of advertising communications aimed at retail investors in Spain is prohibited.

For Spanish residents, Plus500 now focuses on non-leveraged equity trading through its Invest platform, which allows access to real stocks in Spain and other markets.