FTMO has introduced an institutional-grade Know Your Business (KYB) framework for onboarding corporate clients, signaling a move towards infrastructure typically seen at licensed brokers.

Integrating iDenfy’s KYB solution enables FTMO to automate verification of corporate entities, ownership, and UBOs—common for brokers, but rare and notable for a prop firm.

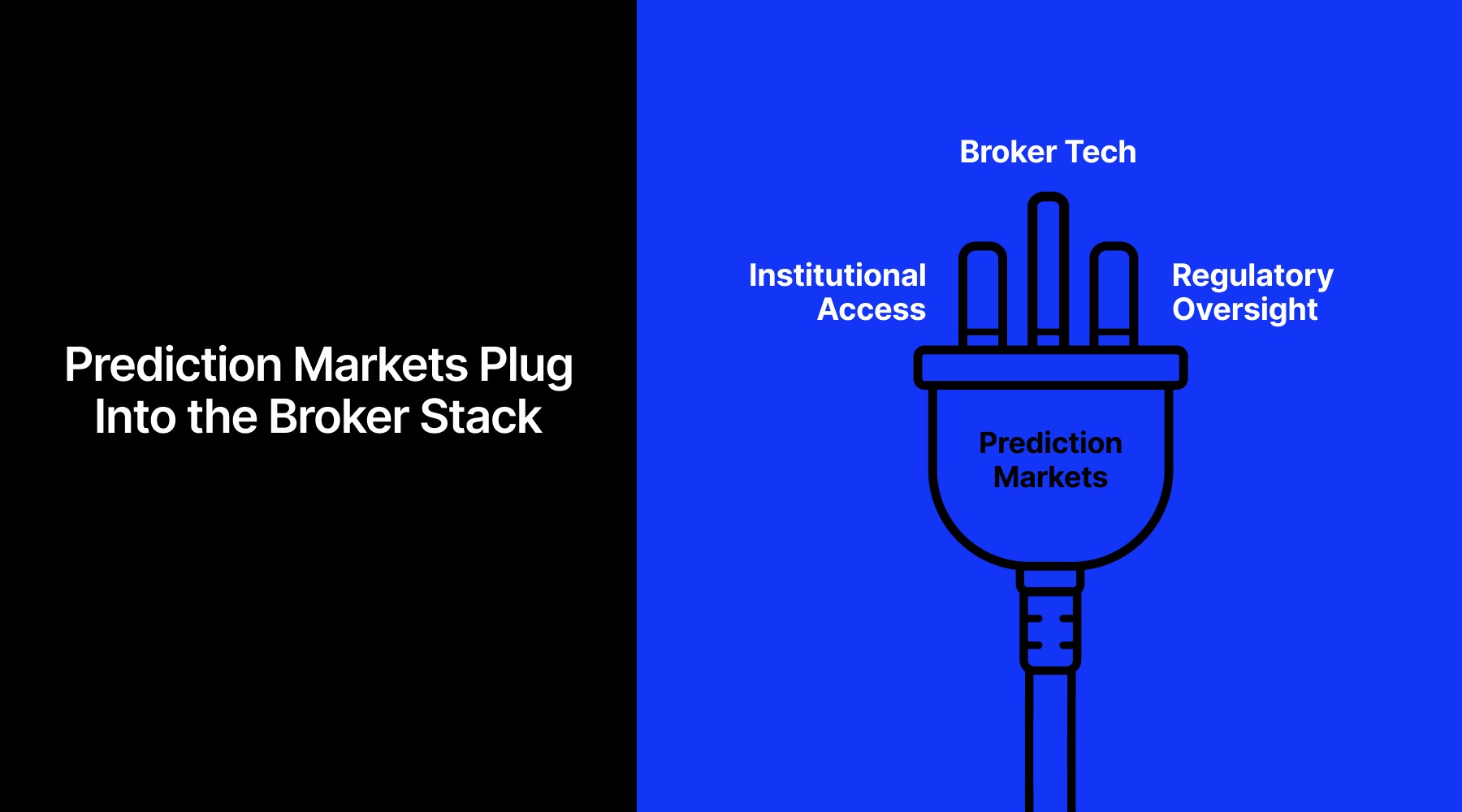

From Retail-Focused Prop Model to Broader Financial Infrastructure

FTMO has historically positioned itself as a trading education and simulation platform, catering primarily to individual traders. Introducing full KYB capabilities goes beyond the compliance needs of that core audience and suggests preparation for more complex counterparties, including corporate partners, affiliates, and B2B relationships.

This development is consistent with FTMO’s broader strategic direction, exemplified by its partnership with multi-asset broker OANDA. Gaining a regulated brokerage arm places greater emphasis on institutional-grade onboarding and ongoing compliance as foundational requirements.

For licensed brokers, KYB is a regulatory requirement. For a prop firm, adopting these standards is a strategic choice that signals FTMO’s intention to broaden its operational scope to include more diverse business models while future-proofing compliance.

- FTMO Building Global Trading Powerhouse – Completes Acquisition of OANDA from CVC

- Prop Firm FTMO Closes OANDA Acquisition Deal After Ten Months

- FTMO's Parent Netted Over $62 Million on $329M Revenue in 2024

Compliance as a Strategic Choice, Not a Regulatory Obligation

FTMO cites flexibility and auditability as key considerations in selecting the KYB solution. “The ability to customise our KYB flow to match internal procedures was a decisive factor,” said Pavel Dusek, COO of FTMO, pointing to the need for a scalable system capable of supporting future growth.

The iDenfy solution automates verification of corporate documentation across more than 180 company registries globally. Brokers handling international corporate accounts and cross-border partnerships typically use this functionality.

From the vendor’s perspective, the integration reflects a broader trend among fast-growing financial firms. “FTMO operates at scale in a dynamic environment,” said Domantas Ciulde, CEO of iDenfy. “Automated KYB allows firms to verify corporate clients efficiently while maintaining transparency.”