For a very long time, Forex education including live seminars, was a very successful tool for client acquisition, building a connection with customers, and possibly acquiring introducing brokers. This was especially in areas where financial literacy was relatively lower than in most of the developed markets. The COVID-19 pandemic forced restrictions, such as social distancing and being confined to our quarters. How do these factors influence seminar-based sales strategies of the FX/CFD brokers, and what can they do now to succeed?

The COVID-19 pandemic has changed everything. Since we avoid meeting our clients directly, we conduct most of our business online. This has created a problem for sales departments among FX/CFD brokers. For many years, the education provided to potential clients during seminars was one of the most effective methods of onboarding.

While this is not the only method used by FX/CFD brokers, it was one of the more important and effective tools, especially in specific regions of the globe.

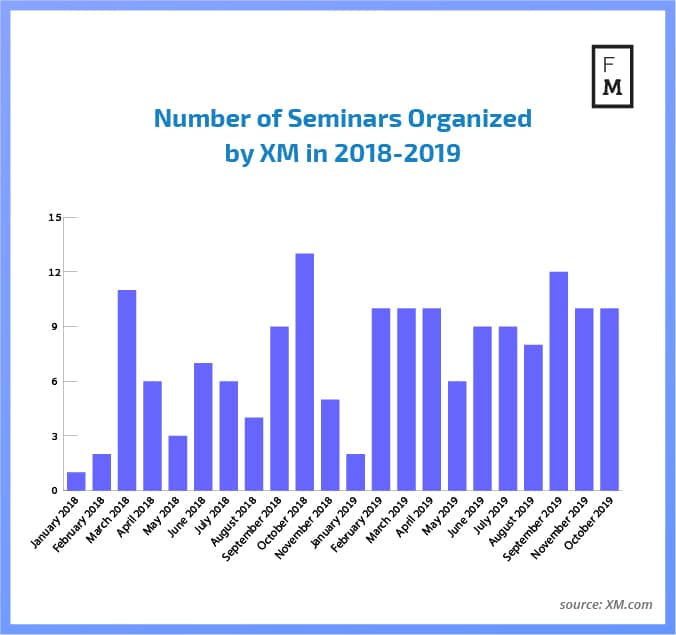

To understand how big and popular this method of contact was with customers, Finance Magnates Intelligence conducted research into the topic. Our findings suggest that forex education is the most popular in emerging markets. Additionally, it is most widely used by Russian and Asian brokers, but it is not limited to them. For example, in 2019, FBS hosted 74 educational seminars; a number of seminars were hosted in Asia. Another popular Hosting country for the seminars was Brazil.

In an interview with Finance Magnates, Nicholas Baumer, Chief Marketing Officer at Tickmill, reminds how important trading seminars are to the bigger picture: “The role of trading seminars in the industry has been multifold. Not only do seminars help to acquire new clients, but they also contribute to building connections and trust with both prospective and existing clients. Since the nature of the online brokerage business is almost completely online, and most operations including Marketing, Back Office, and Client Support operate digitally, the human touch is inevitably minimal. Seminars, therefore, provide a great opportunity for brokers to physically meet local traders in a certain region, listen to their feedback, exchange ideas, build up brand awareness with them and discuss their needs.”

If There Are No Seminars, What Is Left for Forex Education?

Because of the COVID-19 pandemic, the vast majority of the brokers have stopped organizing educational seminars. One of the brokers wrote on its website: “Due to Covid-19, our priority is the safety of you and our team, we have therefore suspended all our seminars until further notice.” But, if there are no face to face seminars, what can replace them?

To get the full article and the bigger-picture on forex education during the pandemic, get our latest Quarterly Intelligence Report.