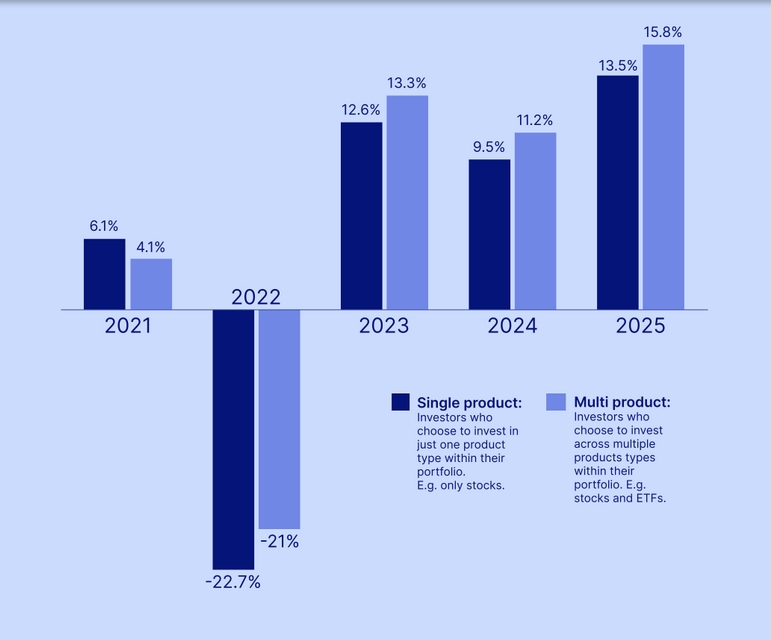

Saxo has released client data showing differences in performance between investors who traded a single product and those who traded multiple products. The data covers a five-year period from 2021 to 2025 and is based on aggregated results from Saxo’s client accounts. According to the firm, investors using more than one product were more likely to outperform on average.

Saxo Data Shows Diversified Trading Wins

Saxo said the findings underline the role of diversification. The firm said investors should “remember the importance of diversifying and spreading risk” and noted that clients trading multiple types of products were “likely to outperform investors trading only one.”

- Saxo and Etihad Deal to Bring Professional Portfolios to Retail Investors in UAE, GCC

- Following Finalto and Exinity, GivTrade Secures UAE SCA Category 5 Licence

- Spotware Brings cTrader to Vault Markets as TeamForce Supports Brokers’ Onboarding

The annual results show mixed outcomes in the early part of the period. In 2021, single-product investors recorded an average gain of 6.1 percent, compared with 4.1 percent for multi-product investors. In 2022, both groups faced losses amid a broader market downturn, with single-product investors losing 22.7 percent and multi-product investors 21 percent.

Performance recovered in 2023. Single-product investors earned an average return of 12.6 percent, while multi-product investors recorded 13.3 percent.

The gap widened in 2024, with returns of 9.5 percent for single-product investors and 11.2 percent for multi-product investors. In 2025, both groups posted stronger gains, led by multi-product investors at 15.8 percent versus 13.5 percent for single-product investors.

Retail Investors Shift Toward Multi-Asset Portfolios

Across the five-year period, multi-product investors outperformed in three of the five years and experienced smaller losses during the worst year.

Saxo linked the trend to changes in retail investor behaviour across Europe and Asia, where more investors are managing portfolios that combine equities , exchange-traded funds, options, foreign exchange, and, in some cases, digital assets.

Low interest rates encouraged investors to look beyond traditional savings products. At the same time, tighter European rules on leverage , transparency, and client protection reduced the role of lightly regulated offshore brokers and favoured firms operating under full regulatory oversight.