The Financial Conduct Authority has prosecuted Daniel Pugh, who was found guilty of operating a Ponzi scheme and committing fraud. Pugh ran the scheme through a company called the Imperial Investment Fund. He raised over £1.3 million from 238 investors, most of whom were recruited via Facebook advertisements.

Fraudsters commonly use social media platforms such as Facebook, X, Telegram, WhatsApp, YouTube, TikTok, and Instagram Reels to target retail investors. A recent study by the German regulator BaFin confirms a growing reliance on these platforms for financial advice, increasing investors’ exposure to scams.

Risks and Trends in Retail Investment

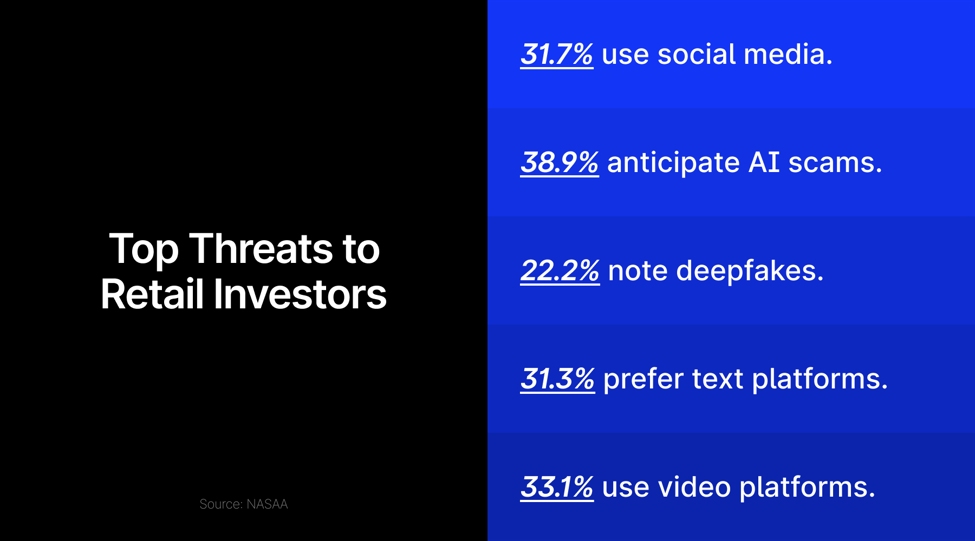

Social media allows retail investors quick access to financial information but also increases their risk of falling victim to fraudulent schemes. The North American Securities Administrators Association highlighted scams involving digital assets, cryptocurrency, and social media marketing in its annual list of threats. This list is based on a survey of securities regulators in the US and Canada, which identified common platforms used by fraudsters.

Younger Investors’ Reliance on Social Media

The BaFin study found that investors aged 18 to 45 increasingly turn to social media for financial advice, especially on cryptocurrencies . More than half of Millennials and Gen Z respondents consider social media a valid alternative to traditional financial guidance.

Regulators’ Response to Online Fraud

To address the rise in online fraud, regulators have started using social media to warn investors. The Cyprus Securities and Exchange Commission launched a campaign to combat scams falsely claiming affiliation with CySEC. The campaign advises investors not to share personal data and clarifies that CySEC does not send unsolicited emails or request money.

Details of the Ponzi Scheme and Conviction

Pugh’s scheme promised unusually high returns of 1.4% per day, 7% per week, or 350% per year. At trial, he was convicted of one count of conspiracy to defraud. He had earlier admitted to carrying out unauthorised regulated activity, breaching sections 19 and 21 of the Financial Services and Markets Act 2000.