The UK’s Financial Conduct Authority has issued a warning to Contracts for Difference providers, following a review that found some firms had not met the standards set under the Consumer Duty. The duty, introduced in July 2023, establishes higher expectations for consumer protection across financial services.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

Mark Francis, director of sell-side markets at the FCA, said: "The Consumer Duty raises the bar for consumer protection across financial services and CFD providers must meet those standards."

CFD Providers Criticized Over Fees, Transparency

The FCA noted that some firms had adopted good practices, such as simplifying fee structures and restricting access for investors unlikely to bear losses.

- South Korean Retail Investors Gain Access to US Stocks Through Webull and Meritz

- Former Trading 212 COO Launches Fractional Shares and Commission Free Trading to Retail Traders

- FCA and MAS Collaboration on AI Begins Amid Growing Broker Integration

However, the review identified areas requiring improvement. Firms were found to be failing to consider consumer complaints or satisfaction when assessing fair value. Some had made little or no changes to products or services in response to the Consumer Duty.

The review also highlighted issues with overnight funding charges. Some firms applied varying levels without clear justification, and disclosure of potentially significant costs was inadequate.

Certain providers charged overnight funding separately on matched long and short positions, resulting in ongoing charges with limited benefit to consumers.

CFD Providers Must Improve, FCA States

The FCA said it would engage directly with firms included in the review to drive improvements. It will also consider further work to address identified issues and take action against firms or individuals that fail to meet required standards.

Francis added: "CFDs are complex, risky products and it is vital that providers act to deliver good outcomes for customers, communicate clearly and provide fair value."

He further noted: "It is also important that consumers shop around and ensure they fully understand the investment and its costs."

Whistleblowing Highlights CFD Compliance Concerns FCA

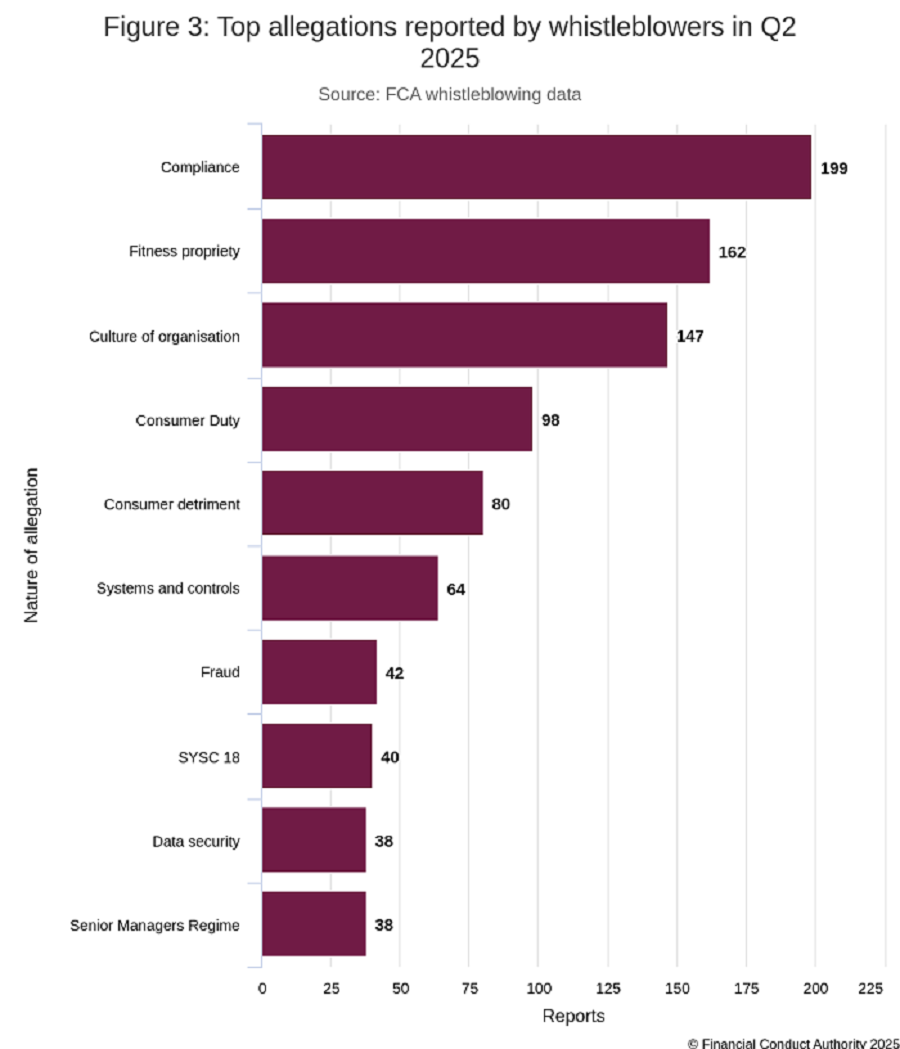

Meanwhile, the FCA reported 315 new whistleblowing cases in Q2 2025, containing 1,130 allegations. Among these, 98 allegations related to Consumer Duty, highlighting continuing concerns about compliance.

The authority closed 350 reports in the quarter, taking significant action in eight cases and harm-reducing steps in 147. The FCA emphasized protecting whistleblower identities and using reports to inform its wider regulatory work.