The Cyprus Securities and Exchange Commission (CySEC) has granted WeTrade, a Cyprus-based financial brokerage firm, a regulatory license. According to the company's announcement, the approval provides leeway to operate under EU passporting rights.

“WeTrade International CY Ltd, a proud part of WeTrade Group, is now licensed by the Cyprus Securities and Exchange Commission (CySEC),” the company mentioned on LinkedIn. “With Cyprus as our strategic hub, we’re ready to enhance our services across the EU and build even greater trust with our global trading community.”

Regulatory Green Light from Cyprus

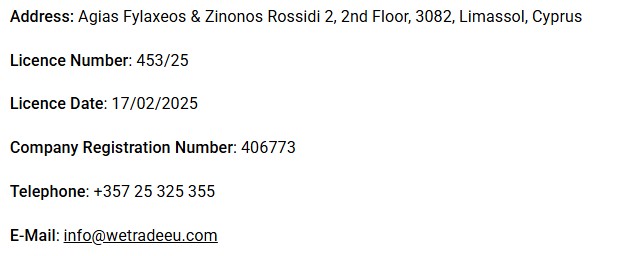

WeTrade International CY Ltd, part of the wider WeTrade Group, has secured a licence from the CySEC , effective under licence number 453/25. The CySEC licence reportedly gives WeTrade the authority to offer its trading services legally across the European Union.

According to the firm, the licence will also support the enhancement of its product offerings and client services. This includes improving its trading infrastructure and forging new partnerships within the EU market.

The Cypriot regulator confirmed the approval on its website, noting the company’s official address as Agias Fylaxeos & Zinonos Rossidi 2, 2nd Floor, 3082, Limassol, Cyprus. The license was issued today (Thursday), under #453/25.

CySEC Tightens Oversight

Even as the CySEC issues the new license to WeTrade, the watchdog has tightened its oversight on companies operating in the region. Recently, it issued a caution to the public about nine websites operating without proper license to provide investment services under Cypriot financial regulations.

Around the same time, the regulator announced that it reached a 200,000 settlement with Colmex Pro over possible violations related to authorization, client protection, and CFD regulations. The regulator cited violations across multiple areas, including CIF authorization requirements, organizational standards, conflict of interest management, and client information disclosures, FinanceMagnates.com reported.

Notably, last year, CySEC carried out over 850 inspections, imposed €2.76 million in penalties, and canceled several operating permits. With the implementation of the new EU regulations, the watchdog is intensifying its compliance monitoring to protect investors better and ensure financial market stability.