The Italian financial services regulator Consob has once again taken action against fraudulent financial services by blocking five websites suspected of offering illegal financial services. This move happened barely a month after the regulator blocked six websites to protect investors from deceptive schemes.

Suspected Unlawful Operations

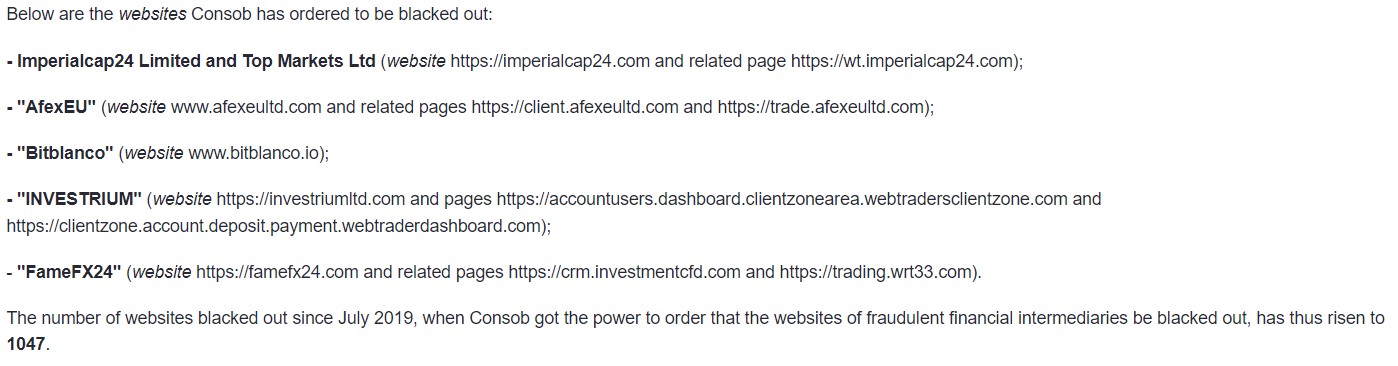

Consob's latest crackdown targets various websites operating without proper authorization to offer financial services. Among these platforms are Imperialcap24 Limited and Top Markets Ltd, AfexEU, Bitblanco, INVESTRIUM, and FameFX24.

The suspicious entities operate the website domains https://imperialcap24.com, https://wt.imperialcap24.com, www.afexeultd.com, https://investriumltd.com, https://investriumltd.com, and https://famefx24.com, respectively.

According to the watchdog, these websites were found to be violating regulations. Since acquiring the authority to order the blackout of fraudulent financial websites in July 2019, Consob has now blocked a total of 1,047 websites.

Ongoing Battle against Financial Fraud

Early this month, CONSOB restricted six websites operating without approval. This action targeted several websites, including Ether Limited, Aegion Group Ltd, Investment Analysts, Fidelitycfd, Mex-Fx, and Ultraford. According to the watchdog, these platforms were found to be offering financial services without proper authorization, posing significant risks to investors.

Since July 2019, Consob has restricted multiple websites involved in fraudulent financial activities. The agency has emphasized due diligence in making investment decisions, urging investors to verify the authorization of financial service providers and the publication of prospectuses for financial products.

Globally, financial regulators like Canada's Securities Administrators and Belgium's Financial Services and Markets Authority have cautioned against fraudulent online trading platforms. Similarly, the UK's Financial Conduct Authority has intensified efforts to combat financial scams by issuing over 2,000 warnings in 2023 alone.

Clone brokers pose a significant threat to investors by utilizing the credentials of legitimate brokers to deceive clients. Consob highlighted these deceptive tactics used by clone websites, which adopt names similar to licensed entities but lack legitimate authorization.