Surveill, which has built a compliance-centric artificial intelligence (AI) system for the financial services industry, has raised about $1 million in a recently closed funding round, the company announced. The funding round was led by Simya VC, a subsidiary of 212 VC.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

Bootstrap to Securing Funds

“While we initially decided to bootstrap Surveill, we quickly realised that in order to provide best-in-class service and quality in regulatory and legal compliance agents, we needed more resources to execute against our vision,” Surveill’s Founder and Chief Technology Officer, Aydin Bonabi, wrote in a LinkedIn post.

Before founding Surveill, Bonabi worked in compliance for about two decades. One prominent financial services role included being FXCM’s Regulatory Counsel and interim Director of Legal and Compliance, APAC, for about four years.

“With this investment, we’re focused and determined to best serve our existing clients and to expand our services to leading financial firms in the US and across the world,” he added.

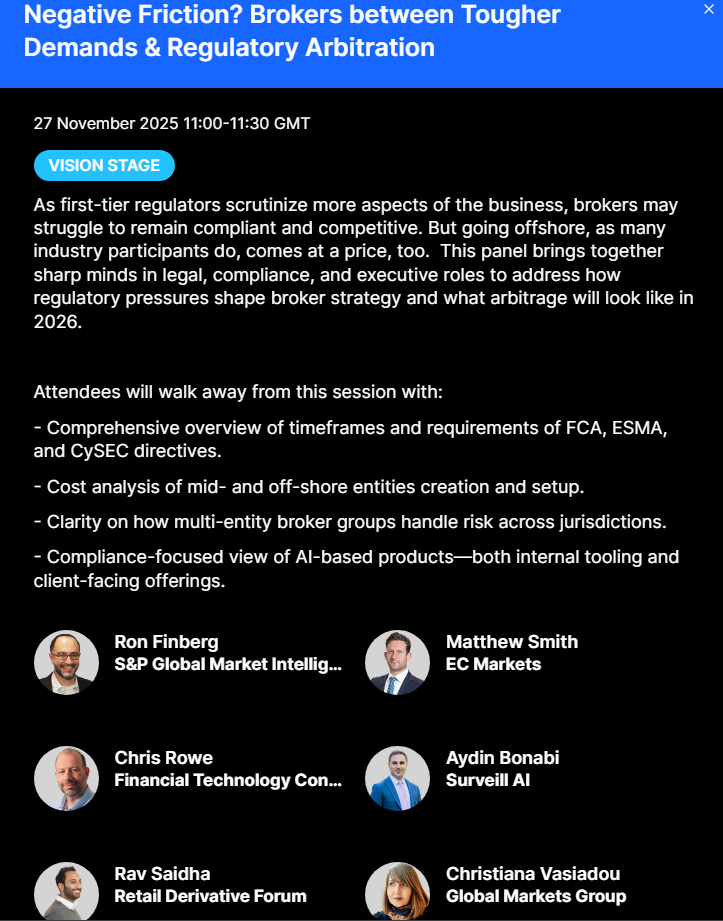

Bonabi will speak at the Finance Magnates London Summit next month in the panel “Negative Friction? Brokers between Tougher Demands & Regulatory Arbitration.”

Firms Building Niche AIs

Headquartered in the US, Surveill offers AI-powered solutions that help financial institutions enhance compliance oversight, reduce costs, and improve regulatory responsiveness.

The company claims its clients have reported up to 60 per cent time savings and as much as 60 per cent cost reduction, alongside improved risk visibility and regulatory oversight.

- Six RegTech Firms Combine as ComplyMAP, Covering Cyber Risk, GRC, and AI

- CFD Brokers Face Compliance Crunch as 2026 Deadline Looms—What You Should Do

- The Risk of Relaxed Regulations in Finance: How WhatsApp Chats Triggered Billion-Dollar Fines

Bonabi also stressed that Surveill’s AI model in its niche is “better than any existing models, including Gemini and ChatGPT,” and has a hallucination rate close to 0 per cent.

“This funding accelerates our data-driven approach to advancing platform intelligence and automation while delivering faster, deeper insights for our clients,” he added. “Compliance teams are under growing pressure to do more with less and often lack the unified data needed to make informed decisions. Surveill bridges that gap.”