The Polish FX/CFD market, which is one of the most developed retail markets in Europe with an established position and strong brokerage brands, has attracted the interest of several international brokers over the past few months, including among others AvaTrade, Plus500, OANDA and ATFX.

Poland: A Country, with Even Bigger Retail Trading Potential

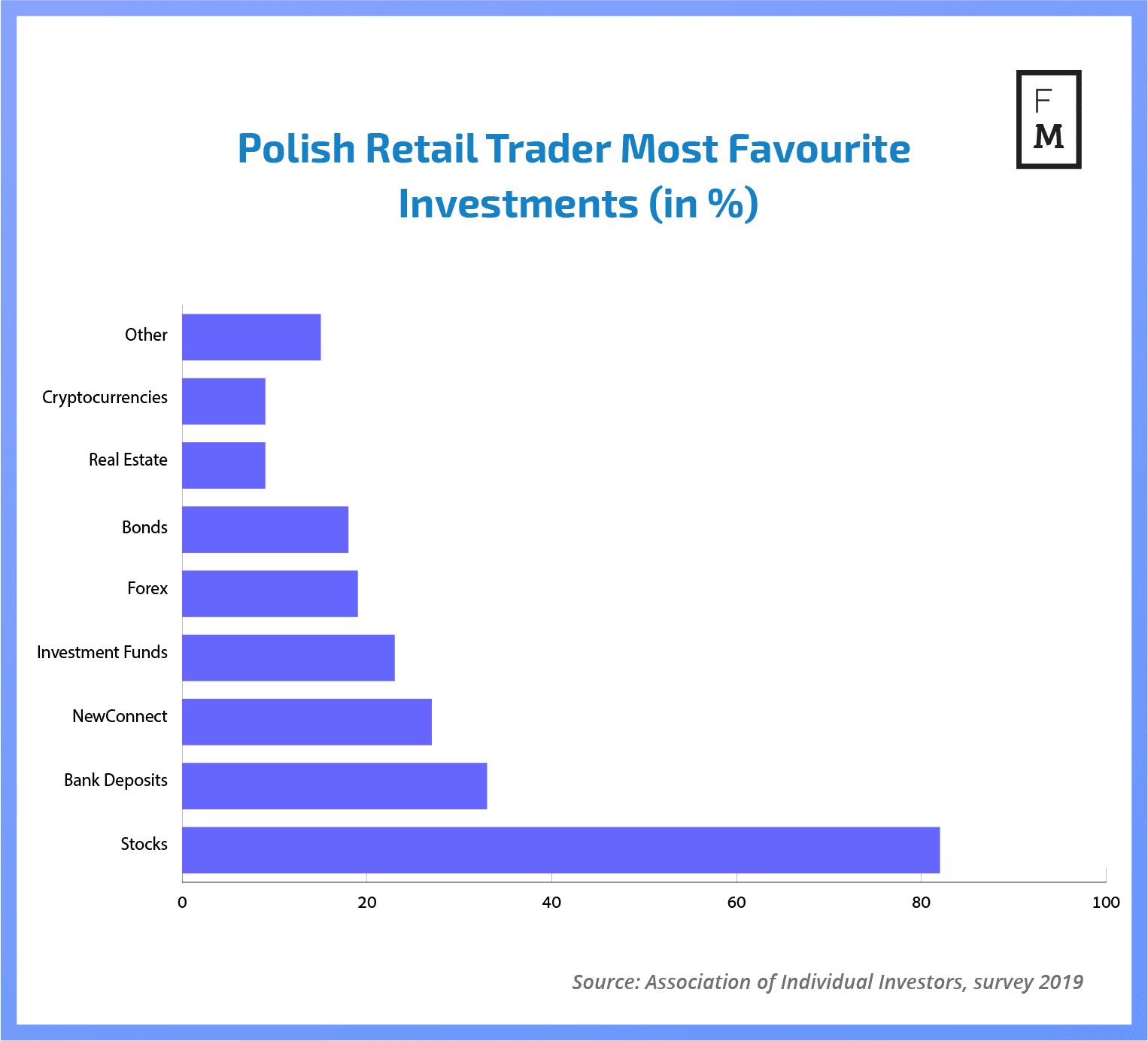

Poland is one of the 40 largest countries in the world in terms of population and, according to data from August 2020, has over 38 million citizens. However, the free market economy has only been developing in Poland for 30 years, previously under the domination of the communists. Thus, economic awareness is relatively low, as is the number of active retail investors. This year, the number of brokerage accounts maintained by Polish residents achieved a record of 1.3 million. While in comparison to other European nations this number might be modest, they are rising rapidly.

For years, Poland has been associated with a country that has been very proactive in regulating the derivatives market. First, in 2015, the local Polish Financial Services Authority (PFSA), to protect investors from exotic brokers' offers and very high Leverage , introduced its limitation to 100:1. Three years later, as the only EU28 country, it opposed the European Securities Markets Authority (ESMA) proposal to limit the leverage to a maximum of 30:1. Then it introduced its regulations, which led to the creation of an independent category of ‘experienced trader’. Retail customers who can confirm their market knowledge and experience can use more attractive trading conditions.

Polish FX/CFD Market Grows but XTB Is Confident of Its Dominant Position

In the Polish Forex market, apart from XTB and TMS Brokers, only a few local players stand out. These include bank brokers: mForex from mBank, BossaFX from BOŚ BANK and several foreign entities. The recent addition of OANDA, AvaTrade, ATFX and Plus500 may shake up the current environment, which was consolidating it strongly in recent years.

Finance Magnates asked the president of the largest Polish broker, XTB, for his opinion on the subject. Omar Arnaout pointed out that the Polish market is one of the most competitive markets in Central Europe, and it is comprised of both local and international companies. For XTB it is important to maintain the position of the market leader, and Mr. Arnaout is confident that his company has ‘the know-how and the experience to do so’.

“After the introduction of the product intervention in 2018, the industry has become very challenging, especially for small and medium-sized brokers, so I believe that generally, and regardless of whether we are talking about Poland or any other place in the world, only the biggest and most optimized companies will be able to grow. It is one of our key goals that we do not only want to be one of the biggest CFD and stock providers in Europe but also on a global scale. This is why we recently started our partnership with our new brand ambassador, Jose Mourinho - one of the world's most successful football managers,” Mr. Arnaout stated.

To get the full article and the bigger-picture on FX/CFD industry in Poland, get our latest Quarterly Intelligence Report.