The Commodity Futures Trading Commission (CFTC) has released its monthly composite of key figures and data for Futures Commission Merchants (FCMs), this time for the month ending on March 31, 2018.

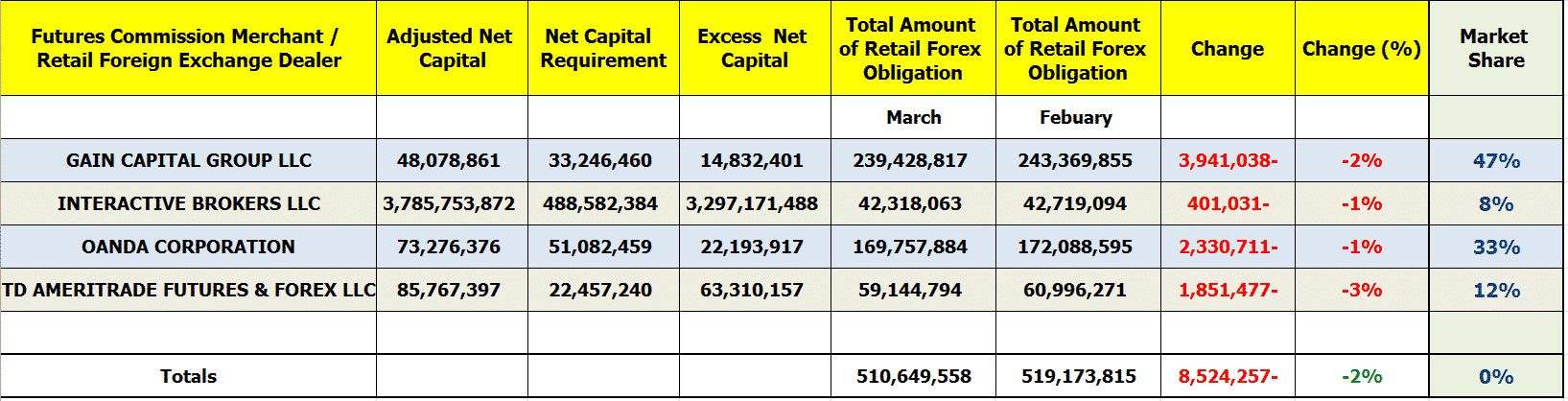

The statistics didn’t show notable changes in terms of retail FX funds held at registered brokerages operating in the United States – a drop of 2.0 percent month-over-month was seen in March 2018 with a result of $510.6 million, compared with $519.1 million reported in February.

According to the CFTC dataset, all the four reporting FCMs that hold Retail Forex Obligations registered lower figures in March – GAIN Capital, OANDA Corporation, and TD AMERITRADE. The largest loss was made by TD Ameritrade, a brokerage firm based in Omaha, Nebraska. The TD Bank's affiliate firm saw a drop of $1.8 million, or more than 3.0 percent month-over-month.

In addition, GAIN Capital reported a decrease over last month’s figure by nearly $4 million, to $239 million at the end of March 2018, compared with $243 million at the end of February, or a decrease by -2 percent MoM.

Interactive Brokers wasn’t an exception, though the broker-dealer saw a less substantial decline month-over-month across its Retail Forex Obligations. The largest U.S. electronic brokerage firm, as measured by DARTs, saw an overall drop to $42.7 million, shedding one percent compared to February’s metrics.

Finally, OANDA Corporation lost $2.33 million of clients’ deposits in March, coming in at $172 million, the data shows.

The report covers data for FCMs that are registered as Retail Foreign Exchange Dealers (RFEDs) and those also included as broker-dealers that hold retail forex obligations in the United States.

Looking at the market share of different brokers, distribution remained unchanged in March relative to the month prior. GAIN Capital remained the leader in terms of market share, commanding a 48.0 percent share. OANDA also solidified its stance as the second largest in the US with 33.0 percent market share – TD Ameritrade and Interactive Brokers retain a 12.0 and 8.0 percent share respectively.

The chart listed below outlines the full list of all FCMs that held Retail Forex Obligations in the month ending on March 31, 2018 – for purposes of comparison, the figures have been included against their February 2018 counterparts to illustrate disparities.