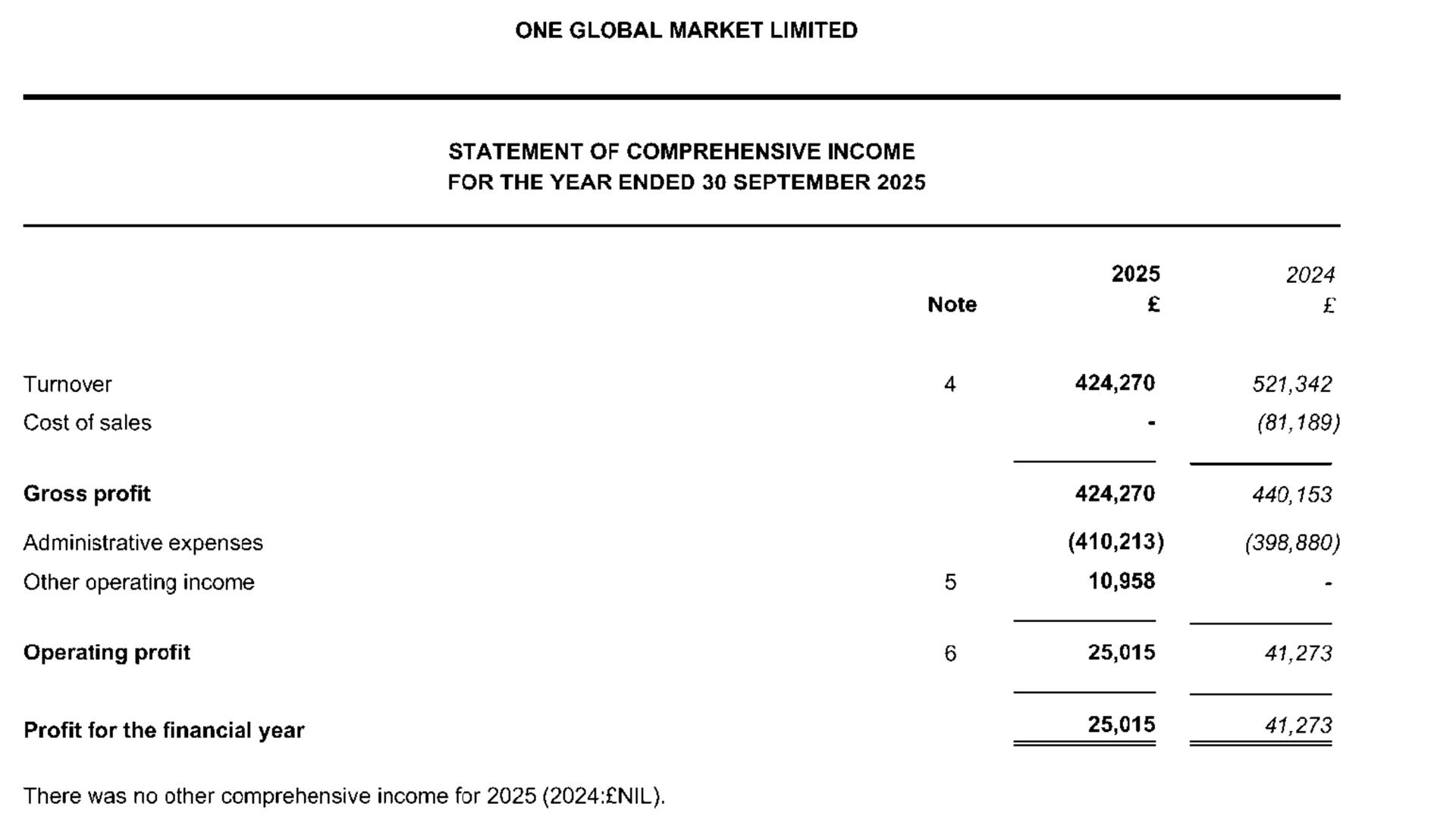

UK-based contracts for differences (CFDs) broker One Global Market (OGM) reported a modest recovery in its financial position for the year ended 30 September 2025.

According to the company’s latest Companies House filing, OGM generated £424,270 in turnover in FY25, down from £521,342 a year earlier. The decline reflects a year of reduced client activity, as the broker voluntarily paused trading operations during a 13-month platform migration aimed at strengthening its long-term infrastructure and regulatory footing.

Profitability Maintained Despite Lower Revenue

Despite the drop in revenue, OGM remained profitable. The company posted a pre-tax profit of £25,015 for FY25, compared with £41,273 in the prior year. Administrative expenses rose only marginally to £410,213, indicating tight cost control during a period of lower turnover.

The financials show that while headline earnings softened, the firm avoided a return to losses and preserved its operational base, including its experienced management team and client relationships, during the transition period.

Cash Flow Turns Sharply Positive

The most significant shift came on the cash-flow side. OGM generated £411,579 in net cash from operating activities in FY25, a sharp reversal from a £710,469 cash outflow in the previous year. As a result, cash and cash equivalents increased to £613,443 at year-end, up from £200,071 a year earlier.

The improvement was driven primarily by changes in working capital, including movements in amounts owed by group companies, rather than by higher trading income.

- “CFD Brokers Don’t Really Understand Risk Management”: ‘Rogue Trader’ Nick Leeson

- ThinkMarkets Launches Copy Trading App Ahead of Listing

- AximTrade Partners with Italian Motor Manufacturer’s F1 Racing Team

Restructuring Year Sets Stage for 2026

In its strategic report, OGM said it completed the platform migration while maintaining regulatory compliance and securing continued funding support from its group.

Client trading was paused from September 2024 through the end of FY25 to allow for a controlled transition, during which the firm retained all 41 client relationships.

Looking ahead, the broker said it is positioned to resume operations in 2026 with a focus on UK-based, sophisticated and professional clients, supported by upgraded infrastructure and capital backing.

OGM’s FY25 results reflect a stabilisation phase rather than a growth cycle. Revenue remained subdued, but profitability was preserved and liquidity strengthened following a year of deliberate operational pause.

For the broker, the coming year will test whether the infrastructure investments and strategic reset can translate into renewed client activity and sustainable revenue growth under tighter regulatory and market conditions.