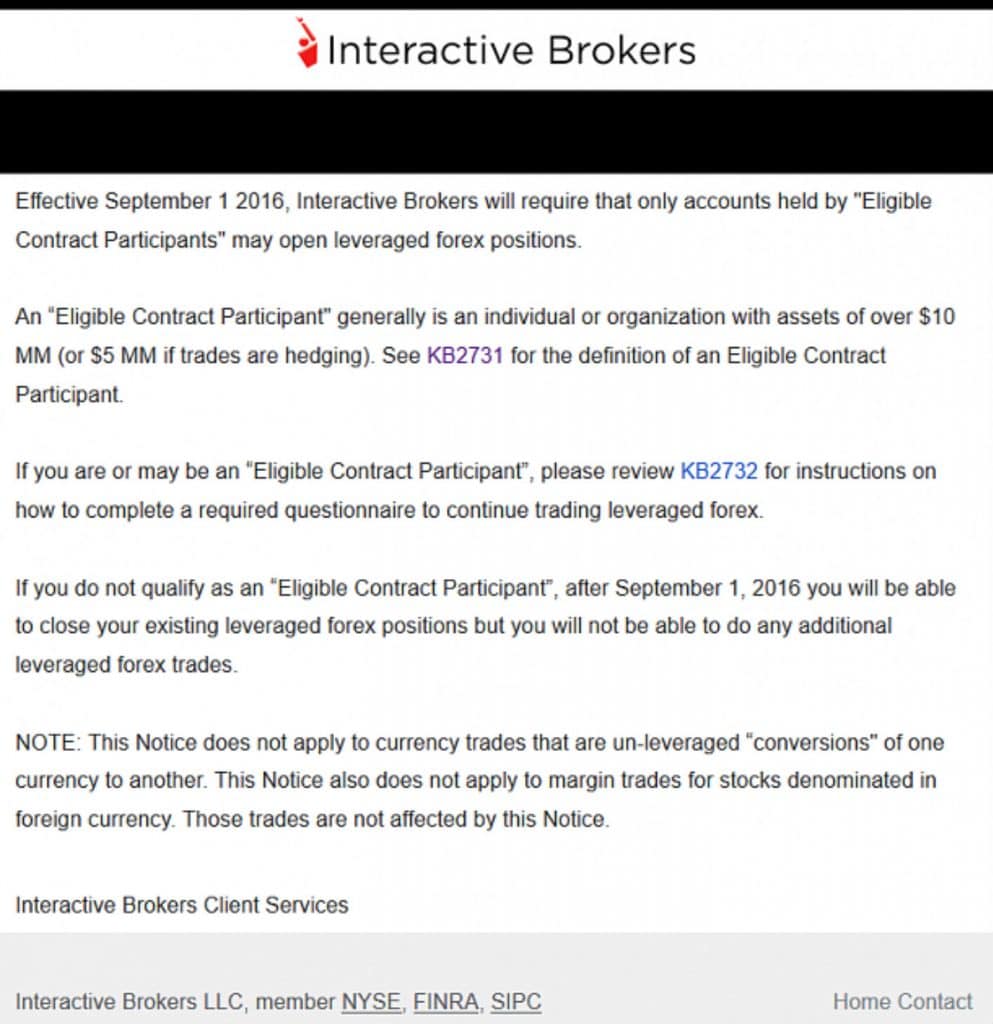

Finance Magnates has learned that US clients of Forex brokerage Interactive Brokers have been contacted by email informing them that effective 1 September, 2016, only accounts held by Eligible Contract Participants (ECPs) may open leveraged forex positions.

Eligible Contract Participants

ECPs are generally individuals or organisations with assets of over $10m or $5m if trades are hedging.

The email explained that clients who are ECPs are required to complete a questionnaire in order to continue trading leveraged forex.

Those who do not qualify as an ECP after 1 September 2016 will be able to close their existing forex positions but will not be able to carry out any additional forex trades.

History

In May 2016, the US. Securities and Exchange Commission (SEC) issued a statement reminding brokers and dealers not registered as Retail Foreign Exchange Dealers (RFEDs) that after the 31 July they would not be permitted to provide retail foreign exchange.

This was as a result of the aftermath of the financial crisis in 2008, after which the Dodd-Frank bill was introduced comprising new rules for retail foreign exchange brokers and clients in the US.

At the time it became clear that the only brokerages that will be able to provide retail foreign exchange services to clients would be the RFEDs registered as such with the National Futures Association (NFA).

Separation of Brokers Equities and FX Business

The new rules essentially made for the separation of brokers equities and FX business. As far as Interactive Brokers is concerned, with insufficient FX in the US, this effectively means it is folding its retail forex operation in the US.

While there is no official statement on the company’s website clarifying its position, a representative of Interactive Brokers is reported to have told a client that from September, they will only be able to trade spot FX 1:1.

Hence, clients who have, for example, a 5K account cannot buy/sell more than 5K units worth of any currency pair.

This makes trading FX with Interactive Brokers almost worthless as currency pairs tend to move in very small increments so it is therefore no longer possible to make decent profits unless a client has invested a huge account.

The news effectively means that Interactive Brokers is folding its retail forex business in the US as a result of the Dodd-Frank bill.