CMC Markets is officially launching its institutional business less than half a year after going public, Finance Magnates has learned. The company is going to initially focus on an offering of CFDs which are one of the key strengths of the firm in the retail Online Trading space.

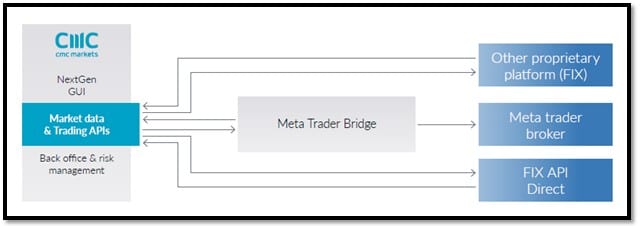

The company is looking to expand its business at a time when the importance of the balance sheet of counterparts to brokers, banks and funds has become one of the key selling points. CMC Markets will be delivering its institutional offering via a new API technology, which is designed to meet the needs of most industry participants.

The API connectivity will be bringing access to tier-one Liquidity and pricing of CFDs to banks, brokers, funds and trading desks. Aside from the API, CMC Markets has a suite of institutional products, which include a grey label solution for introducing brokers (IBs), and a white label market counterparty solution for banks and brokerages.

The company’s institutional team is active in about 20 markets worldwide and is headquartered in London. After the firm hired Richard Elston as Head of Institutional in July 2015, the strategic objective of the firm has become to extend the global footprint of the institutional business of CMC Markets.

A Tiered Rollout Starting with CFDs

Speaking to Finance Magnates, the Head of Institutional at CMC Markets, Richard Elston, explained that the firm has decided to start its official rollout with CFDs (contracts for difference) first and expand into FX and beyond later.

“While the API does carry FX, we are keen to promote the CFD side of the business at the moment. Given the fact that we have just gone through an IPO and our market cap is over £700 million, we believe that CMC Markets is in an advantageous position as a leading brokerage and a reliable counterpart in the market,” Elston said.

With a large list of clients globally, CMC Markets is actively taking advantage of becoming a publicly traded company. The capitalization of the brokerage can be a factor when financial institutions are choosing a reliable counterpart. Last week, the shares of the company closed on Friday with the valuation of the firm reaching £777 million ($1.12 billion).

CMC Markets’ sees its API as a growth opportunity for the firm both among its core institutional client base and for the hedge fund market. In addition to the API, CMC Markets has a suite of institutional products, including a Grey Label solution for introducing brokers, and a White Label market counterparty solution for larger banks and brokers.

How CMC Markets' technology works

The company’s initial focus is on API connectivity across the UK, Europe, Latin America and Asia. CMC Markets will also be working on consolidating markets for the Grey and White Label products mentioned above. With the scope of the company extending further, Elston plans to turn his attention to developing tailored propositions for asset managers and hedge funds.

Elaborating on the perks of the offering of CMC Markets, Elston said: “Another element of the offering is market data - we are delivering it with transparency and legal clarity. As a reliable partner we guarantee to protect the owners of intellectual property behind any derived market data we distribute it.”

The company has already started to deliver its institutional product to several clients, with about 9 already active. CMC Markets is the counterparty to all trades which in itself is important, since clients can rely on the fact that the firm is FCA regulated and solidly capitalized as its market cap suggests.

CMC’s Liquidity for CFDs at a Glance

Elston shared with Finance Magnates that the firm is going to deliver a broad range if CFDs to its institutional clients, however for the time being there will be no single stock contracts.

“We are offering a solution that includes a broad range of OTC instruments. The list includes indices, commodities, treasuries and where available they are both delivered as cash and as futures derived variants. We are providing the broadest range of CFD contracts available to our potential clients, with the offering including not only globally popular instruments, but also specific local contracts,” Elston explained.

Connectivity and the Post-SNB Industry Challenge

The company is offering a FIX API solution which is pretty standard with the product already being plumbed into the major MT4 bridges, the Head of Institutional at CMC Markets explained.

Asked about the main reasons to bring the product to the market now, Elston said: “We think there is a mid-market gap out there and while there are other players and peers that have entered into this space over the course of the last few years the mid-market gap has become more apparent in the wake of the SNB.”

“We think that our technology reputation and our financial strength will spark interest in the FX product that we are planning to launch later this year which is specifically designed to fill the mid-market gap. Our financial stability will be a great positive for CMC Markets as a counterparty,” he concluded.

Looking at the spreads, the offering of CMC Markets looks quite competitive with the Dow Jones index price being delivered at a spread of 1.4 points. Should the company manage to implement these tight rates all across the offering, its expansion into FX and single stock CFDs in the future could make CMC Markets one of the main competitors in the industry.