This article was written by Aayush Jindal, currency analyst at Titan FX.

The New Zealand dollar enjoyed back to back weekly gains against the US dollar, as the NZD/USD pair traded above a couple of crucial resistance levels including 0.6900 and 0.7200.

Let us try to find out the key factors driving the Kiwi higher and whether it could continue to move higher versus the US dollar.

Below are a few reasons why the NZD did well during the past few weeks:

- Gain in dairy prices prompted buying in the New Zealand dollar, as a rebound in dairy prices helps the currency to recover from the bearish sentiment.

- There was help from a weaker US dollar. The recent economic data in the US missed the forecast. One example the Institute for Supply Management (ISM) Manufacturing Index in August failing to post an expansion and coming in at 49.4. The US nonfarm payrolls released by the US Department of Labor came below the forecast of 180,000 with a reading of 151,000.

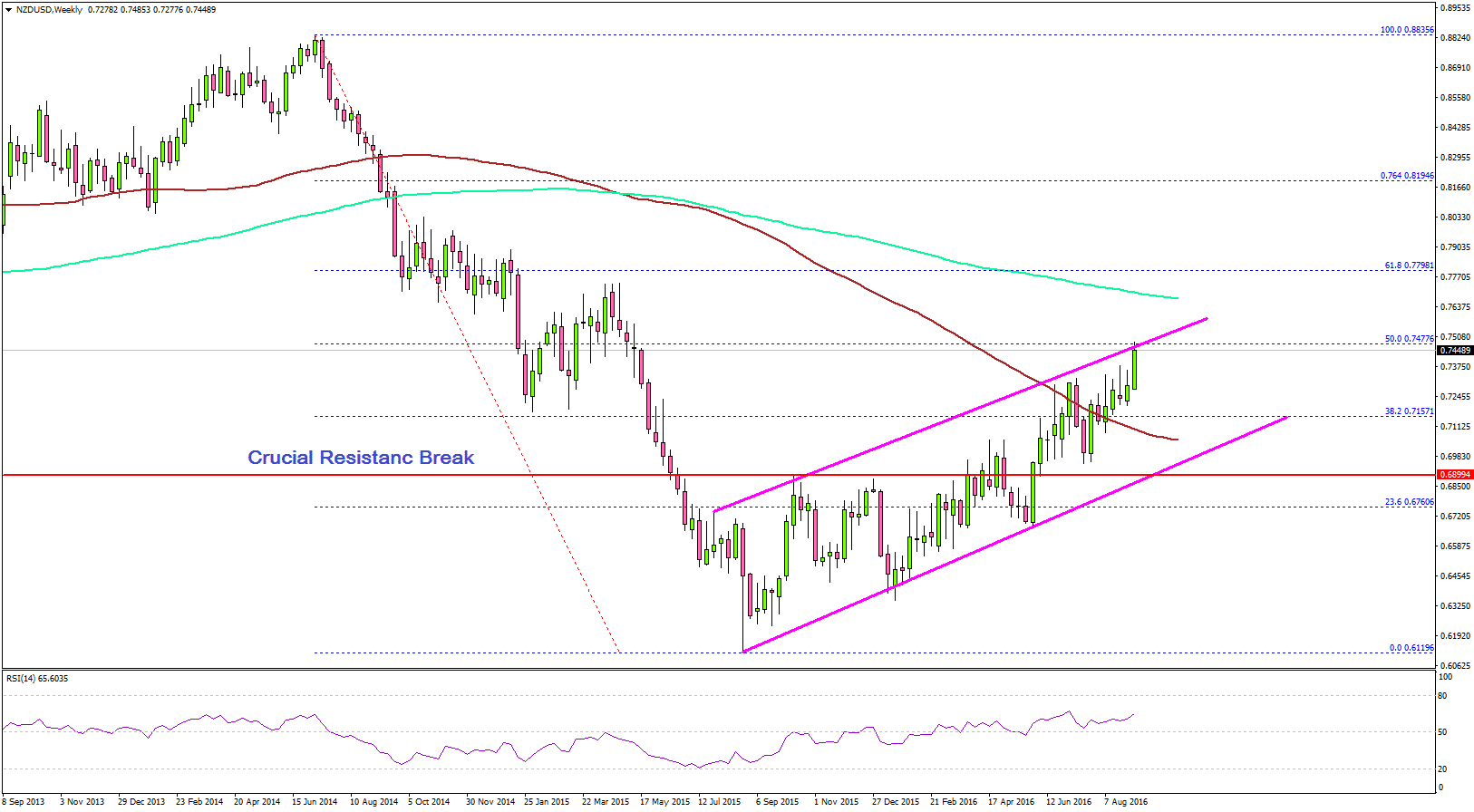

- Technically, there was a major break noted on the weekly chart of the NZD/USD, which triggered a rally in the pair.

Source – MetaTrader 4 (Titanfx)

NZD/USD Technical Analysis Highlighted Pair’s Strength

In August 2015, the New Zealand dollar traded as low as 0.6120 versus the US dollar, where somehow the buyers managed to protect any additional losses. Since then, the NZD/USD pair has been in recovery mode.

The pair has created an ascending channel pattern on the weekly chart, and has followed it over the past few months as market sentiment recovered slowly and steadily in favour of the Kiwi dollar.

There are a few important points to note regarding the recent upside drift. First, the pair managed to close above the 100-week simple moving average. Second, there was a close above a couple of crucial resistance levels including 0.6900 and 0.7200.

Lastly, the pair also broke the 38.2% Fib retracement level of the last drop from the 0.8835 high to 0.6120 low. So, there were enough reasons for the bulls to take the pair higher.

Can Kiwi Dollar Continue Higher?

I am pretty much sure that the current strength in the Kiwi dollar may not go down well with the Reserve Bank of New Zealand. So there is a high possibility that the central bank may opt to cut interest rates in the upcoming meeting since it is the best option currently available to tackle a strong currency.

In that case, the NZD/USD pair may definitely come under pressure. Technically, the pair is also heading towards a major technical resistance area in the form of the 50% Fib retracement level of the last drop from the 0.8835 high to 0.6120 low.

If the central bank fails to deliver in terms of easing, it could prompt further upsides in NZD/USD.