This article was written by Aayush Jindal, currency analyst at Titan FX.

The euro has surged higher versus the British pound during the past couple of weeks, and when I look at the charts I think there are more upsides left going forward.

In this article, we shall try to figure out why the euro may keep rising versus the pound with the help of the EUR/GBP pair daily chart.

EUR/GBP Technical Analysis and Euro Strength Explained

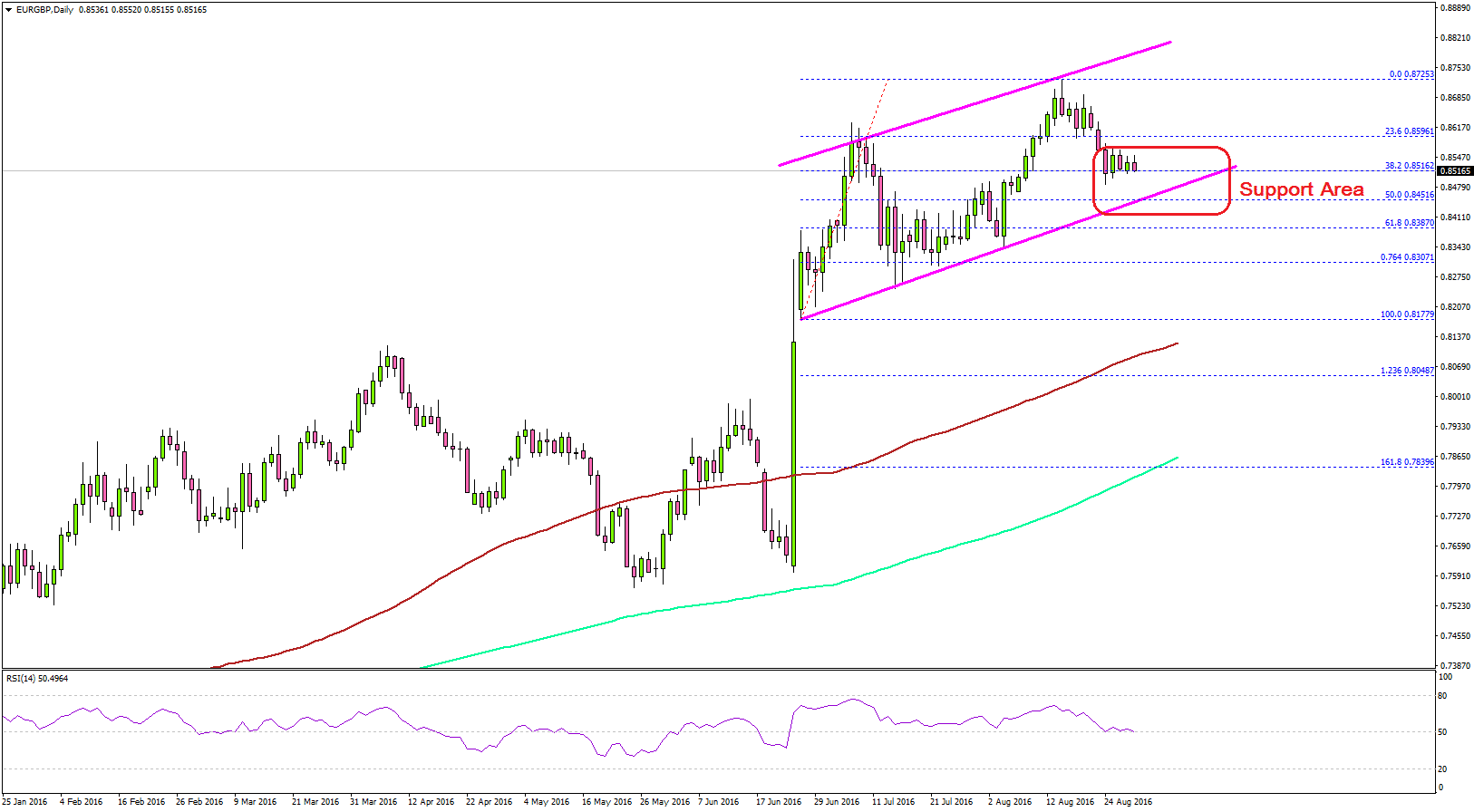

On 16th August the euro posted a new monthly high of 0.8725 versus the pound. The EUR/GBP pair has corrected since then, but the trend is still intact and in favor of the bulls. It has moved below the 23.6% Fib retracement level of the last leg from the 0.8177 low to 0.8725 high.

The main reason why I think the pair is in an uptrend is due to an ascending channel formed on the daily chart.

The highlighted pattern holds a lot of value for the euro bulls as it acted as a major support on many occasions earlier. So, it won’t be easy for sellers to break it and take the pair lower.

Moreover, the 50% Fib retracement level of the last leg from the 0.8177 low to 0.8725 high is also around the channel trend line area. So, we can say that there is a monster barrier formed on the downside at 0.8450.

If the pair corrects further lower from the current levels, then it may find buyers near the stated support level. Only a break below the channel trend line and a close might ignite a change in trend for the euro. If you are looking to buy EUR/GBP, then keep your stop tight below the channel support area.

The daily RSI is still above the 50 level, and approaching a support zone, which means there can be a bounce in EUR/GBP sooner or later.

Fundamentally, the UK recently saw a couple of economic releases like Consumer Credit by the Bank of England. The result was disappointing, and a couple of other similar outcomes may weigh on the GBP going forward.

In short, if you are planning to buy EUR/GBP, then keep a close watch on the highlighted support zone on the daily chart.