There are many schemes and methods of work of foreign exchange (FX) brokers. Each of those schemes and methods have their pros and cons (both for the trader, and for the company), and the following synopsis will try to help the reader understand them.

Good and Bad Brokers

[gptAdvertisement]

I will start by stating that there are no ideal brokers, and there are no ideal schemes. There can be ideal schemes for a broker, which traders do not like, so they leave, making the scheme imperfect for the broker.

By extension, there can be an ideal scheme for a trader, which does not allow the broker to make profit and will eventually lead to bankruptcy, leaving the trader without the ideal company, and possibly without money, which makes the scheme imperfect for the trader as well. Let us look closely at the shift of the balance of interests.

Nowadays the FX market is a technological market. A lot depends on the technology (for a trader it is the quality of work, and for the broker - safety and efficiency). So, having set the boundaries I can say with full responsibility that good and bad brokers are divided according to either presence or absence of good technology and high-quality A-book. If a broker has good technology - it is a good broker, if not - it is a bad one.

To unlock the Asian market, register now to the iFX EXPO in Hong Kong.

You may ask where this conclusion comes from. Let us discuss it. The presence of technology allows a broker to choose any scheme of work, while the absence of technology significantly limits the broker’s choice to a few schemes to work with.

It is common knowledge that there are market makers among brokers (so called boiler rooms), and there are market brokers (which forward transactions to external contractors). There are specific terms for these: A-book and B-book.

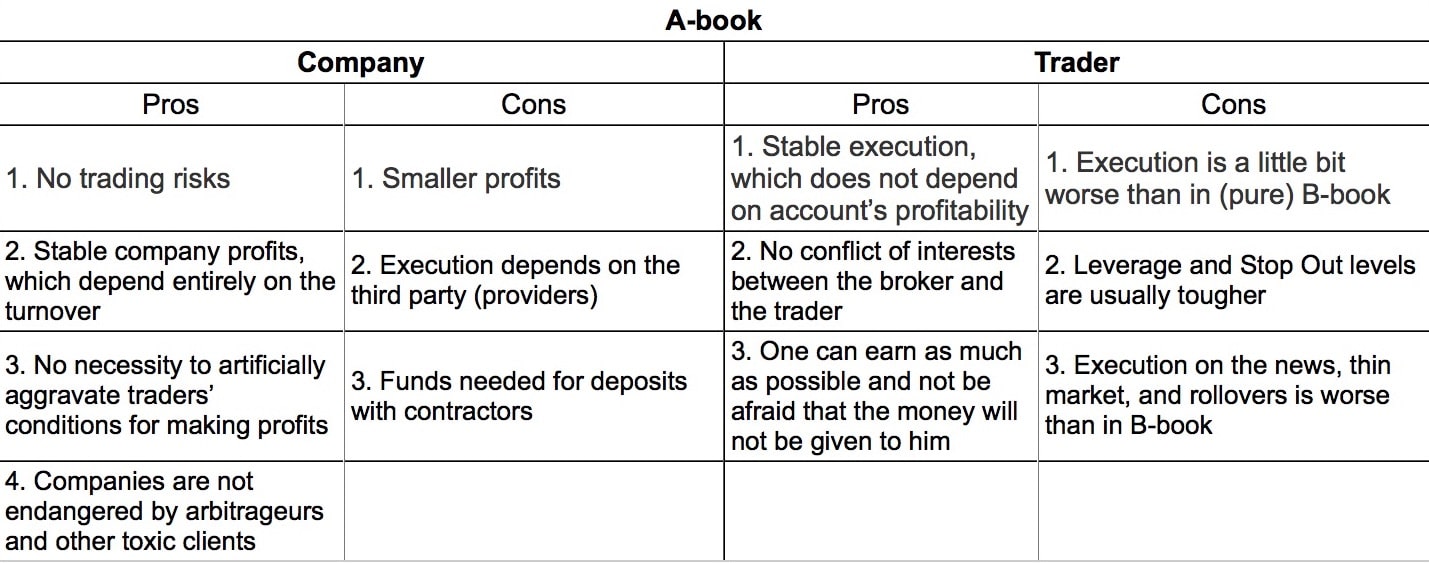

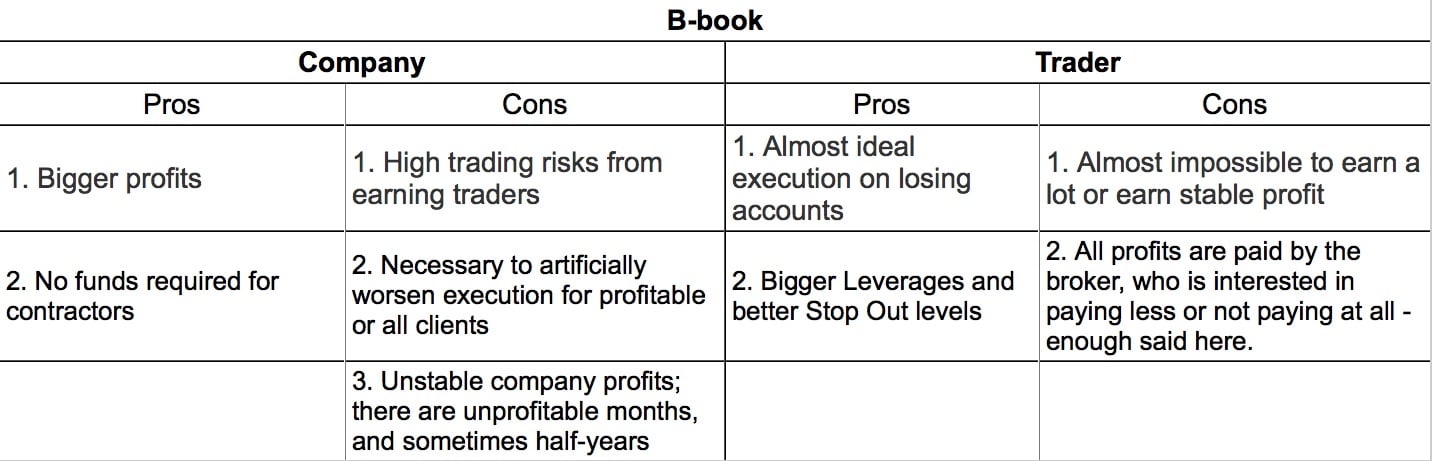

A-book are orders, which go to the market, and B-book are orders that remain in the company. In A-book companies earn money on the spread differences (markups) and commissions (between client commission and Liquidity provider commission), while in B-book companies earn on the financial result (everything that a trader had lost, the company gained, and vice versa).

Both schemes have pros and cons:

Bad Brokers

Bad brokers do not have an A-book, or have a very low-quality one. As a consequence, if there is an earning trader, the company may choose several ways to work with him:

The most loyal option. Start hedging the client. However, if a company does not have a high-quality A-book, then the client’s quality of execution decreases sharply, thus breaking his trading strategy. And if the trader had been developing his strategy for a long time for his broker, he also ends up with plenty of lost time.

A less loyal option. The company aggravates execution for the earning client (or for all clients) by introducing artificial lags or slippages, regular requotes or rejects. Order freeze levels (when orders cannot be placed or changed if the price level is close to that of the order, which is also a way of fighting against scalpers or just potentially profitable traders) also indicate that the company uses B-book. Modern dealing has greatly developed in recent years, and my personal belief is that the presence of freeze levels is outdated. Usually there are two types of companies which have chosen this method of artificial worsening of execution, the first type only does it to earning traders, while the others play safe and initially provide bad execution for all clients.

A disloyal option. There are several ways, for instance, besides poor execution (with artificially creates lags and slippages) the terms and conditions may include paragraphs about the abolition of transactions with duration below a certain length of time, or profitability below a certain amount of points. In contrast to freeze levels, I have always considered such items in terms and conditions to be a disgrace to the industry. One should not trade with such companies. Of course these paragraphs are applied solely to profitable accounts.

The most disloyal option. You will simply be robbed of your money. It can be done in several ways. For example, delete all transactions and say that they never existed, deny access to your personal TR and say that you never had one, or just write off all money, return initial deposit, declare you a fraud, and bid farewell. Unfortunately, there are companies like that, as well as companies which collect plenty of client deposits and then disappear. However, I do not want to get into this subject, as here we are talking about forex brokers, not fraudulent companies.

Of course, each of the above options results in a loss of clients for the company, and difficulties attracting new clients, as well as plenty of negativity.

Good Brokers

A good broker definitely has a high-quality A-book, without which it is impossible to provide good execution for all clients, which usually determines the success of a broker. If a broker does not have a quality execution for everyone, it has to either attract clients by using deceptive means, or spend very large sums on marketing.

Having a high-quality A-book, a company can also operate by using different schemes, nonetheless, it will not be critical for a trader, and he will not face risks that are present in Bad companies. Let us look closely at this category of brokers. I am sure that many of you think there is nothing to talk about, as everything is clear about Good companies. I must disagree.

A company with quality technology usually uses one of the following two schemes (roughly speaking):

The company is hedging all clients. This scheme has one significant disadvantage: company’s revenue is much smaller as the majority of traders are losing in the long run, and all the profit from their losses goes to Liquidity Providers , as well as half of the spread and commission taken from clients. As a result the company does not face trading risks, but small revenues prevent fast growth. This scheme is usually employed by conservative companies which favour stability over large revenues. The scheme’s advantage for a trader is that he always has (a more or less) high-quality execution and a company that is interested in him making profits. In contrast, a disadvantage is that execution depends on providers, which usually are not keen on allowing rapid movements in the case of illiquid markets, rollover etc.

The company is not hedging all clients. In this case a company uses B-book, and is hedging profitable traders. However, due to high-quality A-book, trader’s execution is not aggravated significantly, if at all. It is clear that the higher the quality of A-book, the less difference in execution is observed. This scheme brings more profit to the broker, allows fast growth, but carries some trading risks as well. The advantage of the scheme for a trader is that if he makes no profit, then his execution is better, meaning that his losses are smaller. The disadvantage is that if he makes money using a strategy that is very sensitive to the quality of execution, then the strategy can crush in a hedge. Most importantly, the broker will not worsen a trader’s conditions for making profits, in the worst case scenario the trader will be hedged, but it will not prevent him from earning a lot and reliably. It should also be pointed out that in the case of a balanced client base a company’s revenue equals spread plus commission. If there is insignificant imbalance of open positions, one can say that the broker is earning not on the loss, but on the spread. There are also companies which hedge this imbalance one way or another, thus reducing trading risks, however, these are extra subtleties, and there are plenty of them.

It is clear that a company with high-quality execution, which does not artificially aggravate conditions for its clients, has less negativity, it is not losing clients and it attracts new ones more easily. Clients are becoming more experienced every day, they measure average spreads with precision of up to two decimal places, the speed of execution with millisecond precision, and assess the quality of execution by slippage statistics on hundreds of transactions. Companies that do not understand it may also fail to notice how they one day lose the whole market one day.

To sum up the main idea, it is essential for any company to have good technology and high-quality A-book (not the type of A-book through which conditions for clients are aggravated, but rather an A-book that allows hedging without worsening the execution), and it is extremely important for the trader to not have his conditions artificially aggravated if he makes stable profits on his account.

This article was written by Dmitry Rannev, founding CEO of AMTS Solutions, a long-term partner of Admiral Markets - its key technology provider.