Monex Group, a Tokyo-based financial services company, released its 25th global retail investor survey this Thursday. The report showed high expectations for US stocks across the regions surveyed and noted that the number of US and Japanese retail traders investing in cryptocurrency reached its highest level since surveying began.

Before tackling the content of the report itself, it is worth delving briefly into some of its flaws. These are not fatal shortcomings, but they are worth keeping in mind when one considers the report’s results.

Through its biannual report, Monex aimed to track retail investor behavior across the globe, but the firm’s surveying efforts were limited in scope. The firm only surveyed investors in three areas - the USA, Hong Kong, and Japan.

The number of people surveyed within each jurisdiction also varied. Of the 1005 retail investors surveyed, 532 came from Japan, 353 from Hong Kong and 120 from the US. This disparity seems to have arisen as a result of shorter surveying times. Investors in Hong Kong and the US had from the 29th of May to the 1st of June to respond to survey questions. In Japan, they had from the 28th of May to the 4th of June.

That investors from other jurisdictions weren’t included has likely impacted survey data to some degree. For instance, in the cryptocurrency markets, as shall be discussed, there was a level of unanimity in investor behavior in some areas but not in others. Similarly, there were both similar and disparate views from respondents, across the three jurisdictions, regarding future stock performance in different markets.

The final point of note is age. Monex only provided data regarding the age of its Japanese survey participants, and almost 90 percent of them were older than 40. This may have just reflected the age demographics of the Japanese retail industry but it also likely impacted the survey results with regard to cryptocurrency.

A Bloomberg survey in January of this year found that 58 percent of bitcoin investors are between the ages of 18-34. If Monex’s survey was as skewed towards older investors in Hong Kong and the US as it was in Japan, it seems possible that the firm is under-reporting the extent of global cryptocurrency investment.

Crypto-boom

Regardless of the flaws of Monex’s surveying methodology, the results gathered with regard to the cryptocurrency industry are still noteworthy. The survey participants responses indicate that Japanese and US retail traders are investing more in cryptocurrency than ever before.

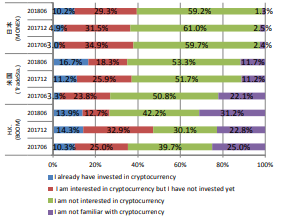

In the Japanese market, 10 percent of respondents said that they had already invested in cryptocurrency. This is more than double the 4.9 percent who said they had invested in December of last year and a drastic increase on the June 2017 survey in which 0 percent of Japanese respondents had invested in cryptocurrency.

The US market also saw significant growth. In December of last year, 11.2 percent of American respondents said they had invested in cryptocurrency. That figure increased to 16.7 percent in the survey released today. This means that there was a more than five-fold increase in the number of US traders investing in cryptocurrency from June of last year.

Respondents cryptocurrency stats (Monex)

Unlike the other two jurisdictions surveyed, Hong Kong’s respondents remained nearly unchanged with regard to the purchasing of Cryptocurrencies . In Monex’s last report, 14.3 percent of respondents from Hong Kong had already invested in cryptocurrency. In today’s report that number had shrunk slightly to 13.9 percent.

Hong Kong was also of note as it had the highest number of respondents stating that they were not familiar with cryptocurrency. In Japan, only 1.3 percent of respondents made this claim, and in the US the figure was 11.7 percent. Perhaps reflecting an older, or more modest, set of respondents, in Hong Kong, 31.2 percent of respondents stated that they were not familiar with cryptocurrency - an 8.4 percent increase on the last survey.

Monex did note that its cryptocurrency findings may have missed a key period of market activity. The last survey took place in early December of 2017 before the cryptocurrency boom had taken off. Today’s survey comes in the wake of that boom dying down. This could mean that investors entered and exited cryptocurrency positions in between the two surveying periods.

USA! USA! US Stocks!

A large proportion of retail investors, in all three surveyed jurisdictions, stated that US stocks are set to be the most successful in the next three months. That being said, the degree to which investors believed this to be the case differed substantially in each region.

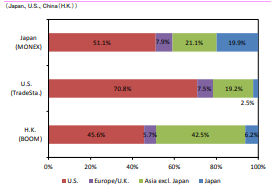

In the US, for instance, 70.8 percent of respondents stated that they see their own country’s stocks as being the most promising in the coming three months. In the other two jurisdictions surveyed, 51.1 percent of Japanese investors and 45.6 percent of Hong Kong investors thought the same.

Respondents stock performance estimates for the next three months (Monex)

There appear to be two major reasons for this enthusiasm. US stocks have recovered well from a global slump in February, a result of market corrections. At the same time, business conditions in the US are thought to be stronger than in other parts of the world.

This is not to say that retail investors think the rest of the world is on the verge of collapse. For example, Hong Kong investors were almost as enthusiastic about Asian stocks (excluding Japan) as they were about the American market. Monex’s report indicates that 42.5 percent of respondents from the Chinese territory thought these markets would perform best in the next three months. A not insubstantial 21.1 percent of Japanese investors and 19.9 percent of US investors thought the same.

All three jurisdictions reported a distinct lack of faith in European markets. Likely as a result of Brexit and turmoil in Italy, just 7.9 percent of Japanese investors thought European stocks would perform best in the next three months. The figures for the other jurisdictions surveyed were even lower, with only 7.5 percent of US investors and 5.7 percent of Hong Kong investors stating that European stocks would be the best performer in the next three months.

Perhaps reflecting a sense of national pride, 19.9 percent of the Japanese survey participants stated that Japan would be the best market in the next three months. For the other two groups surveyed, this figure was much lower with only 2.5 percent of investors from the Land of the Free and 6.2 percent from Hong Kong saying the same thing.

Currency Evaluations

Given their views regarding American stocks for the next three months, it is unsurprising that a large proportion of survey respondents stated that the US dollar would be the most likely currency to increase in value over the next three months.

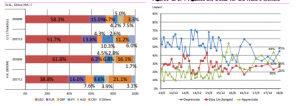

Hong Kong and USA respondents currency estimations (left) and (right) Japanese respondents Dollar/Yen predictions (monex)

In the US itself, 58.3 percent of respondents said the dollar would be most likely to increase in value over the next three months. In Hong Kong, this figure was even higher at 61.8 percent.

The Japanese were less sure, but 45 percent still stated that the US dollar would be rising against the Yen in the next three months. This was a 12 percent increase on Monex’s last survey.

America on the rise?

Despite all the brouhaha surrounding the country’s president, it appears investors still have faith in the great US of A. Monex’s report shows that retail investors still view the country as a strong and safe place to do business - something that cannot currently be said of Europe.

Although not as lauded by survey respondents as the US, retail investors still see positive signs in the Asian markets. This is particularly true of retail investors based in the continent itself.

Cryptocurrency is also on the rise and today’s report which, as noted, may under-report its level of use amongst retail investors, suggests that the industry may be starting to shed its shady, ‘wild west’ reputation and move into the mainstream.