GAIN Capital's Chief Executive Officer (CEO), Glenn Stevens and his wingman Chief Financial Officer, Jason Emerson, couldn't dodge the plethora of questions about where GAIN Capital's savings are coming from in the near future during the earnings call yesterday. As shares of the company opened 10% lower on Tuesday trading, hitting a new 52-week low at $5.95, towards the end of the New York trading session, half of the lost ground was recovered and GAIN Capital's (NYSE:GCAP) stock closed lower by 5.11% on the day at $6.31.

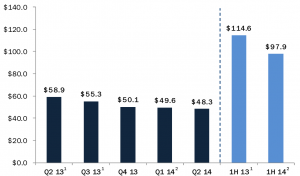

Cost optimization related to the Acquisition of GFT has remained a key question on the minds of investors in GAIN Capital's stock. The firm announced that total expenses, excluding referral fees and acquisition related items, totaled $48.3 million for the quarter, which was down from $49.6 million last quarter, and down 18% compared to the same time last year on a pro forma basis.

Mr. Emerson stated, "This savings results from our progress capturing synergies from the GFT transaction. For the year, total expenses excluding referral fees, acquisition related items were $97.9 million, down 15% from $114.6 million on a pro forma basis."

He went on to elaborate that the company is seeing the results of its integration plan, this all having an impact on reducing the cost base. In conclusion, he stated that the company is "on track to deliver annual run rate expense reductions of $40 million by the fourth quarter of this year."

Is the Market Buying These Cost Reductions?

GAIN Capital Fixed Operating Expenses, Source Q2 Earnings

At first glance of today's trading, the answer is no, however the end of the session rally could bring in some additional information as to the market perceptions of the ongoing cost optimization efforts at the company following the GFT acquisition. The question and answer session during yesterday's earnings call resonated with a key question - where are the savings numbers?

Ultimately, this is likely to be the piece of news which will be key to the performance of GAIN Capital's share price going forward. Nyamh Alexander from Keefe, Bruyette & Woods (KBW) bluntly stated, "You are saying that you are on track for the 40 (million dollars), but I am not seeing it in the numbers."

Mr. Stevens countered with the chart in the earnings report which outlined the cost savings for the first half of 2014, stating, “When you say you're not seeing the $40 million, I guess I would point to our year-over-year expenses basis and actually I would even take you back to the chart, where we actually continue to march every quarter over the year with our fixed operating expenses.”

He concluded his answer to the question stating, “In terms of the $40 million run rate for the GFT deal, that's something that we said that over a year's time, going forward, we will be at a $40 million recurring lower run rate. So at the end of Q4 of this year, there would be no surprise here. We don't need to Hail Mary on December 31st.”

Stating that there will be a $40 million lower run rate for the two companies (GFT and Forex .com), Mr. Stevens has put the question to rest in his mind. But will the market buy this? This is the $40 million dollar question for GAIN Capital this fiscal year.