Looking for leads to turn into clients and wondering how to focus your efforts for best results? The Finance Magnates Intelligence Department is here to help you decide where to invest your precious marketing resources with this month's Referrals Ranking.

Social

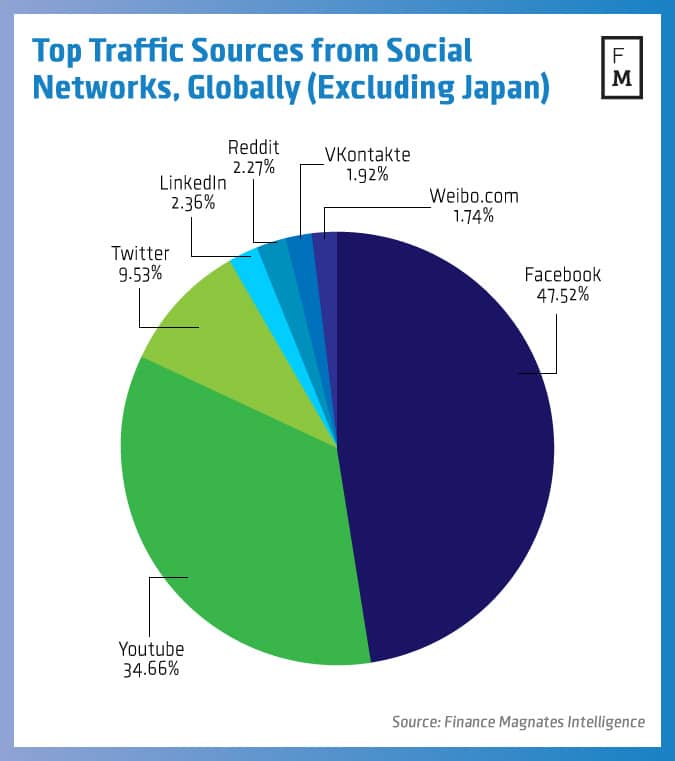

Today we reveal for the first time ever the top social sources for relevant traffic for brokers. Globally, excluding Japan, we see that the number one social referral source - dominating almost half of all traffic - is Facebook with over 47%. Following at a respectable second place is Google's video service Youtube with about 35% - keep on with those Ichimoku webinars.

Closing the international top three is Twitter with a little under 10%. Following these are the professional social network Linkedin, social forums site Reddit, the Russian social network VKontakte and the Chinese microblogging giant Weibo.com - all with around 2% each.

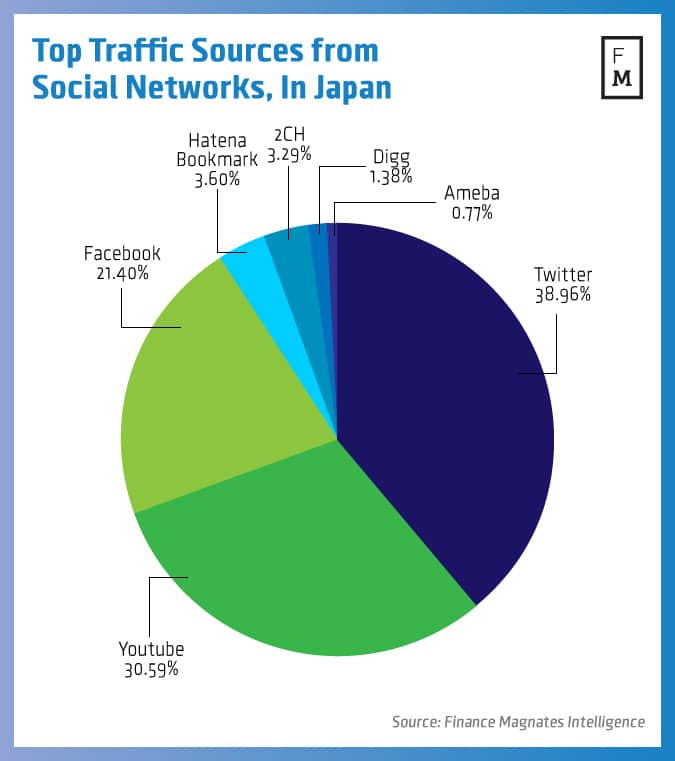

In the Japanese market the social referrals map flips on its head for the top three spots. Twitter controls about 39% of the market in first place, Youtube is again number 2 with 30% and Facebook is just over 21%. The remaining top seven sites are completely different from the international ones - Hatena Bookmark, 2CH, Digg (is this 2007?) and lastly micro-blogging platform Ameba - with market shares ranging from 0.6% to 3.6%.

Commercial

Looking at the top commercial sources for international referrals we see an upset this month, as news aggregator Investing.com has beaten the FX portal ForexFactory for first place. Number three is new entrent earnforex.com and number four is investopedia.com, moving up from its previous fifth place spot. Finally the fifth top commercial international traffic source is tradingview.com.

In the self contained Forex markret of Japan the top commercial traffic sources are pointi.jp, dietnavi.com, moneyforward.com, gendama.jp and zai.diamond.jp - pretty similar to the previous ranking except for new entrent moneyforward.com.

This data was created by closely examining the patterns of traffic on the websites of multiple brokers during August 2016

Working for you

This is the latest publication from the FM Traffic Indices – a new cross-industry benchmark, created with a methodological formula that matriculates data from three main sources: brokers’ trading volumes, brokers’ traffic data and insider information.

In today’s business world, big-data analysis and access to objective information sources are crucial to success. Unfortunately, until now it has been very hard and costly, if possible at all, to find any reliable benchmarks for operations in social, FX and CFDs trading.

For this reason, the Finance Magnates Intelligence Department has launched a new project, creating a set of monthly indices encompassing various aspects of the Online Trading industry. These indices will provide you with unique data points gathered by our analysts that will serve as a valuable knowledge base for your decision making.

Want know more? Get the brand new FM Intelligence Report: