The summer period is usually a quiet one for the trading industry. This year, however, it was especially visible. June and July data from CPattern revealed by Finance Magnates Intelligence show a stable trend for deposit values.

It was unique, but on average retail FX investors deposited almost the same amount of money this vacation. In June the average deposit sent to trading accounts equaled $2,628.9, which was just fractionally lower in July, standing at $2,613.9.

As can be seen from the broader perspective of the whole year, we are above the bottom. In the case of deposits, this bottom was, so far, around the level of $2,000. From this level, a rebound in the size of deposits has taken place. Are we heading in this direction again? Or will one of the key industry metrics start growing already?

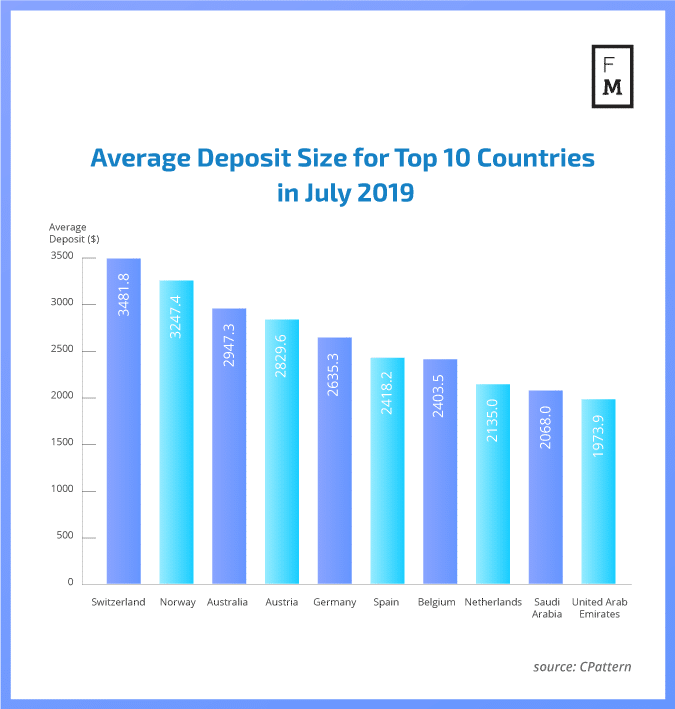

FX traders deposit more in Switzerland and Norway

Swiss traders sent the biggest deposits to accounts in July, with an average of $3,481.8. Not far behind were retail FX traders in Norway, funding their accounts on average with $3,247.4. Switzerland is definitely a place to look at considering the regulatory turmoil in the EU.

Traditionally we had Australia high in this ranking. The average deposit from “down under” came to $2,947.3 in July. The list of top ten countries according to deposits was closed by two Persian Gulf states – Saudi Arabia and the United Arab Emirates.

This is the latest publication from the FM Indices – a new cross-industry benchmark. In today’s business world, big-data analysis and access to objective information sources are crucial for success. Unfortunately, until now, it has been challenging and costly, if possible at all, to find any reliable benchmarks for operations in social media, Cryptocurrencies , Forex , and CFDs trading.

For this reason, the Finance Magnates Intelligence Department has launched a new project, creating a set of indices encompassing various aspects of the online trading industry. These indices will provide you with unique data points gathered by our analysts, that will serve as a valuable knowledge base for your decision making.