The FINRA Investor Education Foundation released preliminary findings from its upcoming report, Investors in the United States: A Report of the National Financial Capability Study, scheduled for publication in December. The report examines the attitudes, behaviors, knowledge, and experiences of retail investors in the United States.

Guaranteed 25% Return Tempts Half

As part of the study, researchers asked investors whether they would consider a hypothetical investment promising a guaranteed, risk-free 25% annual return for five years.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

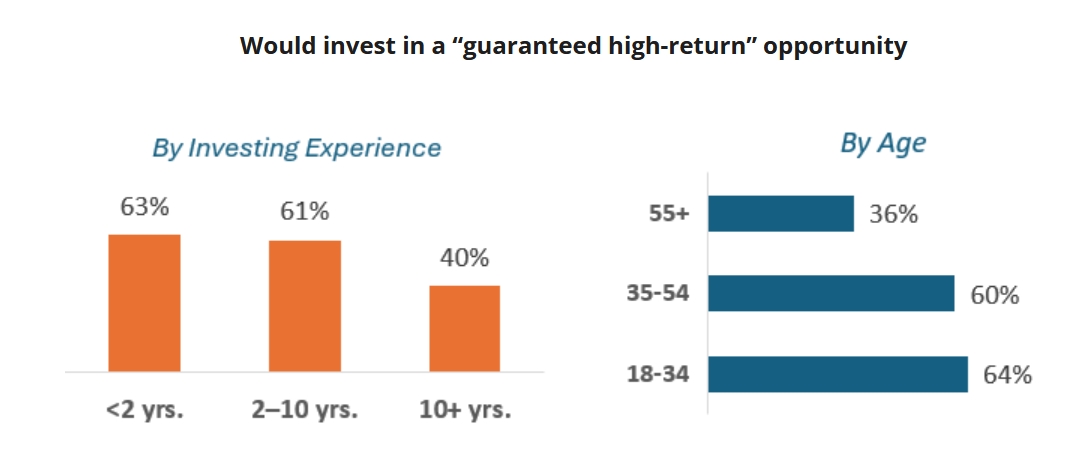

Despite the offer displaying clear warning signs of investment fraud, half of respondents indicated they would invest. Younger, less experienced, and less knowledgeable investors were more likely to choose to invest.

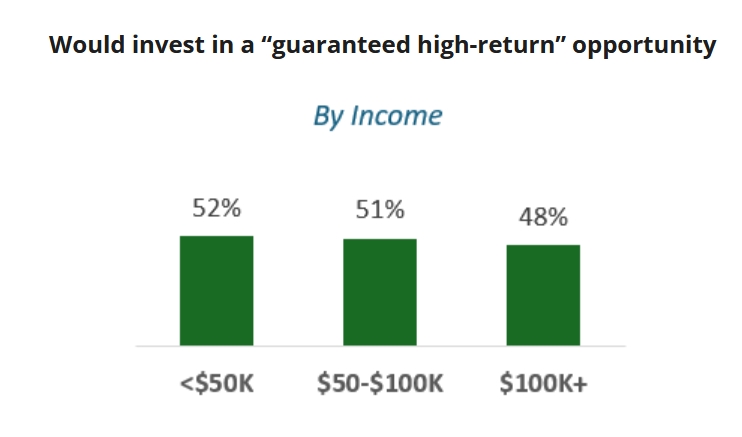

Income Shows Little Effect on Vulnerability

Investors engaged in higher-risk assets, such as cryptocurrencies and meme stocks, as well as those who follow financial advice from social media, were particularly open to the hypothetical offer. Income differences had little impact, with only a four-percentage-point gap between investors earning under $50,000 and those earning $100,000 or more.

Respondents who sometimes follow social media personalities for financial advice showed a 72% likelihood of investing, compared to 42% among those who do not.

- FINRA-Registered Broker-Dealer Equilibrium Capital to Be Acquired by GSR

- FINRA's Proposal to Scrap $25K Day Trading Minimum: Fair Markets or Riskier Bets?

- FINRA Advances Proposal to Replace $25K Minimum for Day Traders with Margin Standards

Crypto, Meme Stock Investors Risk Fraud

Investors with higher investing knowledge were less likely to invest than those with lower knowledge, with 36% of the former group indicating willingness compared to 49% of the latter.

Crypto investors were more receptive to the opportunity than non-crypto investors, with 65 percent compared to 44 percent, and investors who purchased meme stocks were even more likely to invest, with 77 percent compared to 45 percent.

Gerri Walsh, President of the FINRA Foundation, said the findings highlight that a significant number of investors may be vulnerable to fraud.

She emphasized: “Investors must learn to spot the red flags of investment fraud—including the promise of little to no risk with unusually high returns.”