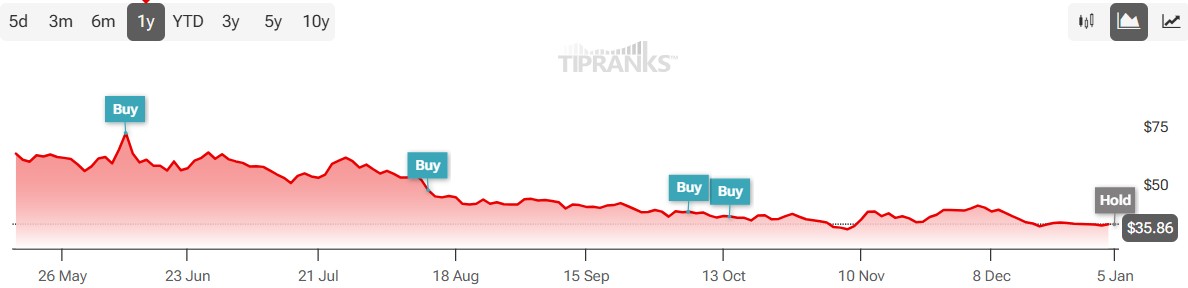

Goldman Sachs pulled back its optimism on eToro, downgrading the stock from Buy to Hold and trimming its price target to $39 from $48. The move highlighted deepening competitive pressure as rivals chip away at eToro’s once-clear edge in social trading.

Goldman’s analysts, led by James Yaro, said eToro’s growth trajectory lags behind its peers. The platform’s projected 7% annual top-line growth for 2025–2027 trails the peer average of 8%, while its 36% pre-tax margin looks thin next to the sector’s 54%.

According to InvestingPro, eToro’s gross profit margin sits at just 2.51%, a stark contrast to its relatively strong balance sheet and a “GOOD” financial health rating.

- One-Third of eToro Trades Now Happen in 24/5 Extended Market Hours

- Retail Investors Get Worldwide UAE Access with eToro as 56% Expect Market Rally

- UK Retail Investors Can Now Earn Passive Income as eToro Rolls Out Stock Lending

Social Trading Edge Faces Copycat Rivals

Despite steady growth in assets under administration – reaching $18.8 billion in November, up 9% year-over-year – and a 10% rise in funded accounts to 3.79 million, profitability remains under strain. The challenge lies not in growth but in maintaining efficiency as competition heats up.

eToro’s signature CopyTrader product once differentiated the platform, but U.S. peers now replicate similar features. Meanwhile, American trading platforms are expanding in Europe, historically eToro’s stronghold, Investing.com reported.

Goldman warned that these developments could lift customer acquisition costs, already about 50% above peers, and apply downward pressure on product pricing and returns.

Related: One-Third of eToro Trades Now Happen in 24/5 Extended Market Hours

As margins narrow, Goldman said eToro’s valuation of roughly 12.5x adjusted forward P/E appears fair but fails to justify a buy recommendation. The company trades at a P/E of 5.61, suggesting potential undervaluation on paper, yet lower-profit business lines and exposure to contracts for difference (CFDs) temper enthusiasm.

Coinbase Shines in Contrast

Goldman’s downgrade of eToro came alongside an upgrade of Coinbase (NASDAQ: COIN) to Buy, signaling the bank’s stronger conviction in crypto-aligned trading platforms heading into the new year.

They forecast Coinbase’s revenues to grow at a 12% CAGR through 2027, driven by lower acquisition costs and expanding subscription and service businesses, which now contribute around 40% of total revenue.

While Coinbase shares gained 4% in premarket trading, eToro dipped about 1.2% to $35.27, extending a six-month decline of over 43%. Analysts remain split on eToro.

While Compass Point, Susquehanna, and TD Cowen maintain bullish views with price targets as high as $66, Goldman’s caution underscores the uncertainty facing retail brokers navigating an evolving digital asset landscape.

With competition intensifying and costs rising, the once-favored social trading pioneer may need to reinvent its strategy to hold investor confidence into 2026.