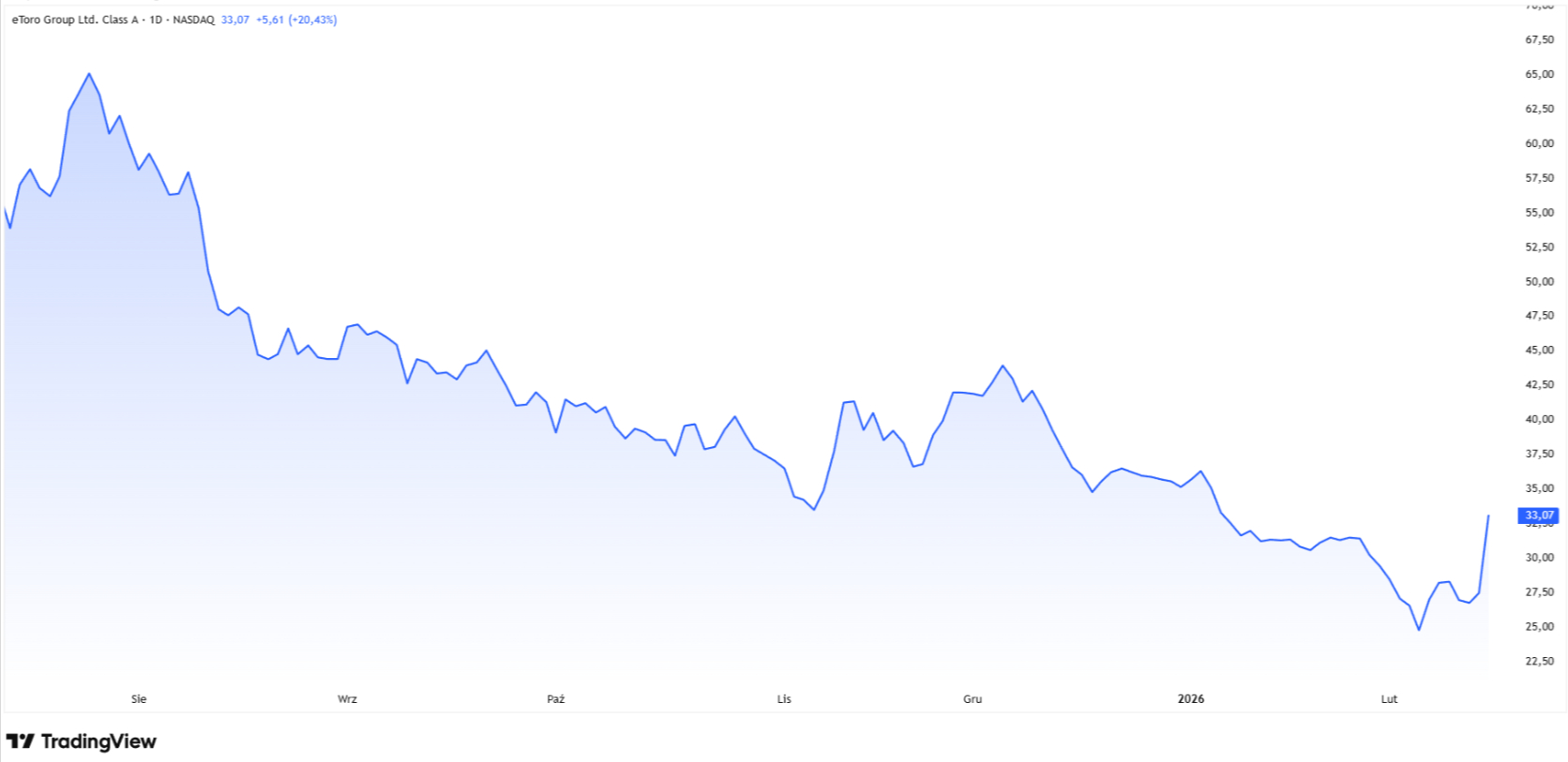

eToro Group (NASDAQ: ETOR) delivered what Wall Street wanted on Tuesday: a record full year, a buyback expansion, and a confident pitch about the future. The market rewarded it with a more than 20% surge in the stock, which closed at $33.07, the highest level in over a month.

Look at the headline numbers and the enthusiasm makes sense. Net contribution for the full year rose 10% to $868 million, net income climbed 12% to $216 million, and the company ended 2025 with $1.3 billion in cash on the balance sheet.

As FinanceMagnates.com reported when the results landed, full-year GAAP net income rose 12% to $216 million while the share buyback program was increased by $100 million. CEO Yoni Assia called it "a defining year" for the company, pointing to the May NASDAQ IPO, accelerating product launches, and expanding global reach as evidence of durable momentum.

But strip away the full-year framing and the picture that emerges is considerably more complicated. And the company's own data, including the supplemental KPI disclosures, tells much of that story.

eToro’s Assets Hit a Wall in the Second Half

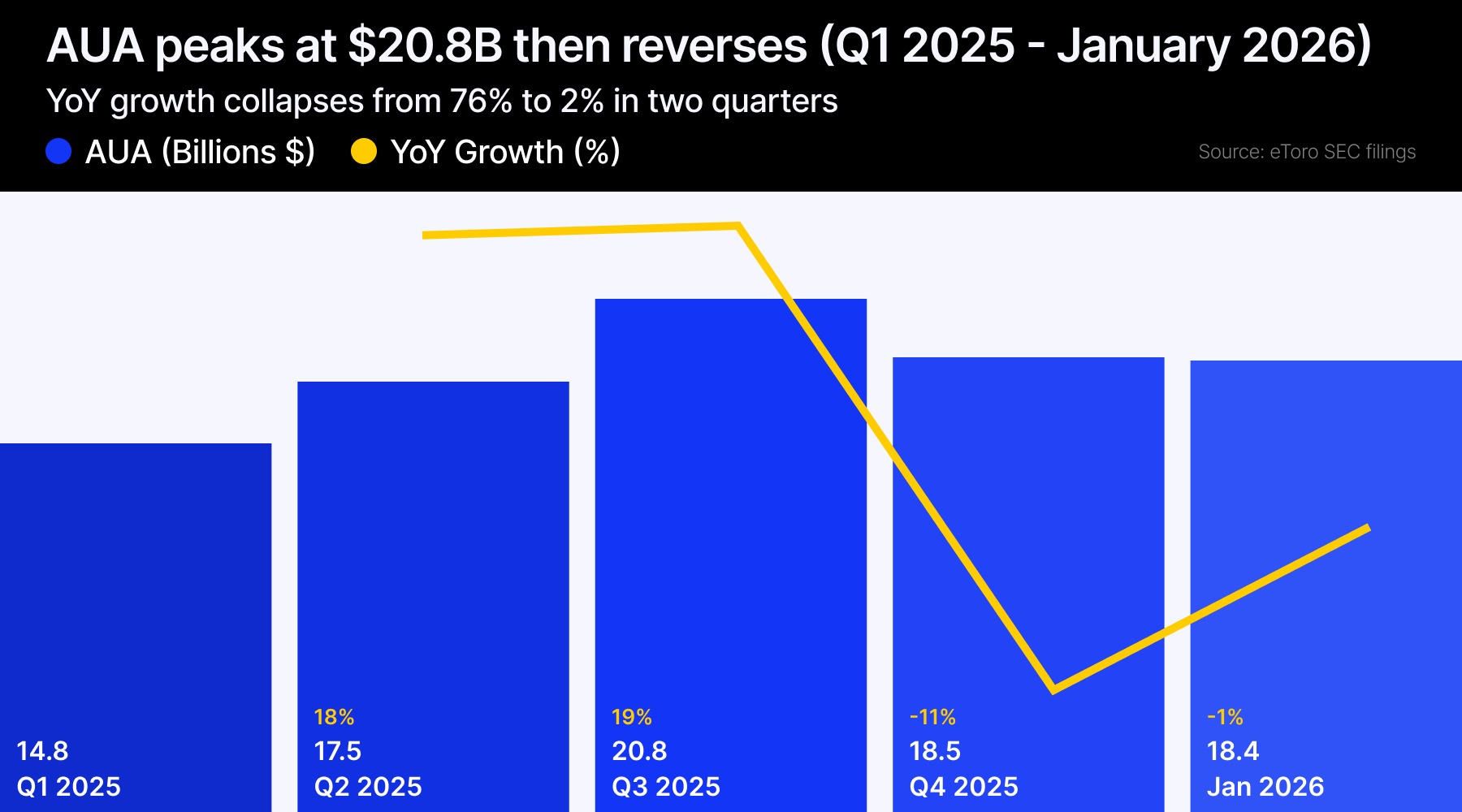

The single most striking data point in the entire earnings package is one eToro does not headline. Assets Under Administration (AUA) fell from $20.8 billion at the end of the third quarter to $18.5 billion at the close of Q4, a decline of $2.3 billion, or roughly 11%.

The company's press release frames that as "11% year-over-year growth," which is technically accurate. It does not mention that AUA was growing 76% year-over-year just one quarter earlier, a period when, as previously reported, eToro's Q3 net income rose 48% annually even as sequential momentum stalled.

- eToro Adds DKK Accounts in Denmark After Expanding Nasdaq Nordic Data

- eToro Launches Long-Term Thematic Portfolio Using Amundi ETFs for Retail Investors

- eToro Brings 24/5 Trading to Selected Smart Portfolios, Including BigTech and Magnificent-7

The AUA trajectory through 2025 was a clean ramp: $14.8 billion, $17.5 billion, $20.8 billion, and then a reversal. Q4 broke that trend decisively, and January has not reversed it. Monthly KPI data released alongside Tuesday's results showed AUA essentially flat at $18.4 billion, up just 2% year-over-year. In October 2025, the most recent comparable data point, AUA growth was running at 73% year-over-year.

That deceleration from 73% to 2% in a matter of months is the number analysts following this stock closely should be circling.

The Numbers Behind the Headlines

Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 | FY 2025 |

Net Contribution ($M) | $217 | $210 | $215 | $227 | $868 |

Net Income GAAP ($M) | $60 | $30 | $57 | $69 | $216 |

Adj. EBITDA ($M) | $80 | $72 | $78 | $87 | $317 |

AUA ($B) | $14.8 | $17.5 | $20.8 | $18.5 | $18.5 |

Funded Accounts (M) | 3.58 | 3.63 | 3.73 | 3.81 | 3.81 |

Source: eToro Group Ltd. SEC filings (Form 6-K), Q1-Q4 2025

Crypto Contribution Collapses, Q4 Spread Turns Negative

The AUA trend points directly at crypto. In Q4, net trading contribution from crypto fell 72% year-over-year to $26 million, and that number requires careful reading. Beneath the net figure, gross revenue from crypto assets in Q4 was $3.59 billion against a cost of $3.64 billion, meaning the base spread business generated a net loss of approximately $44 million before derivatives. A $73.8 million gain on crypto derivatives pulled the combined crypto line into positive territory for the quarter, but the underlying spot economics were underwater.

For the full year, eToro processed approximately $13 billion in crypto volume and generated a net spread of just $43 million, a margin of roughly 0.33%. The company made more from crypto derivatives in 2025 ($124 million) than from buying and selling crypto itself.

In 2024, those ratios were nearly reversed. This is part of a broader trend that has weighed on crypto-exposed platforms across the board: as FinanceMagnates.com reported in early February, both eToro and Robinhood shares faced extended losing streaks as the cryptocurrency downturn pressured revenue outlooks across firms that derive significant income from digital asset trading.

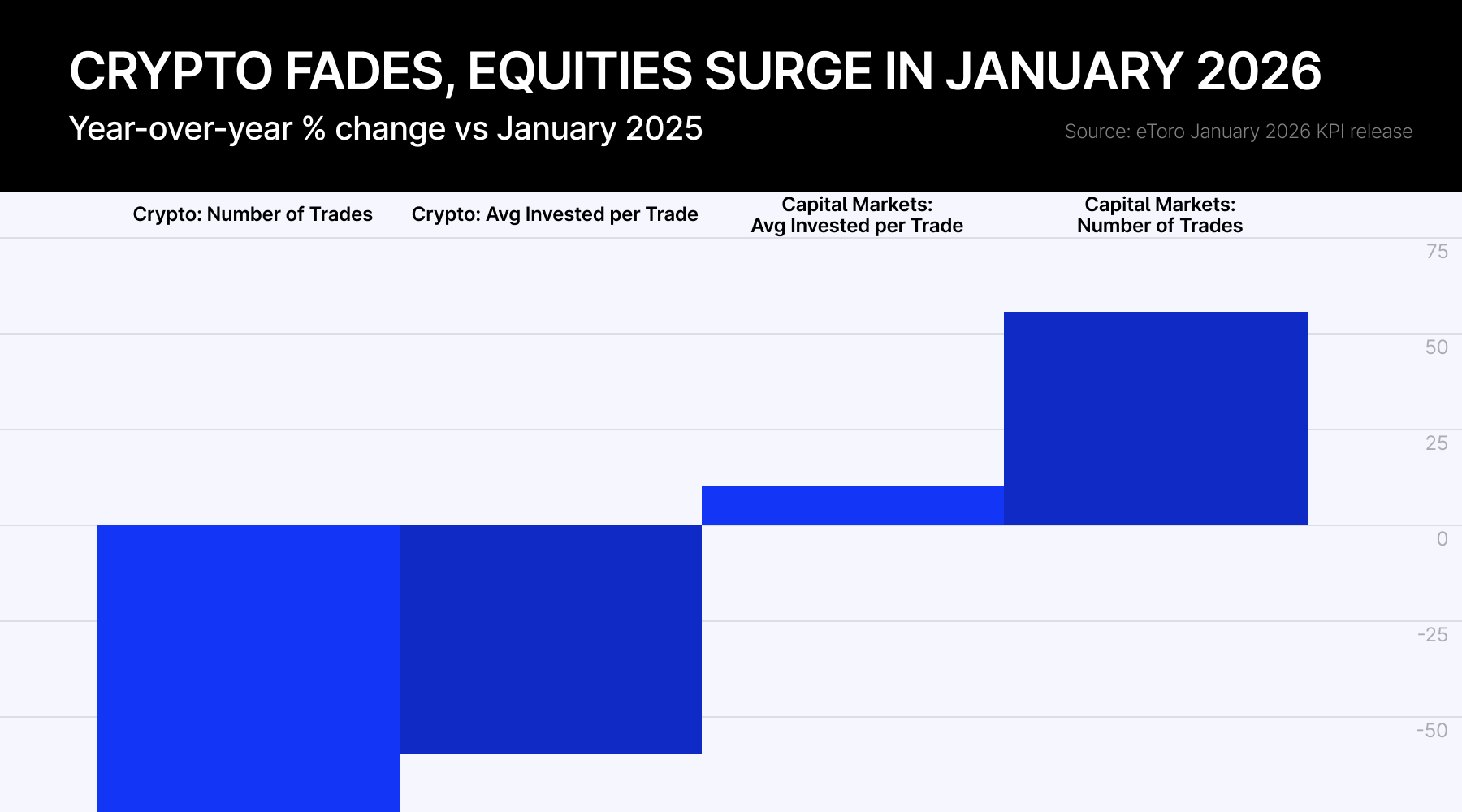

January's numbers confirm the pressure has not eased. Crypto trades on the platform totaled 4 million for the month, down 50% year-over-year. The average amount invested per crypto trade fell 34% to $182.

January 2026 KPIs: Two Very Different Stories

Segment | Metric | Jan 2026 Value | YoY Change |

Capital Markets | Total Trades | 74 million | +55% |

Capital Markets | Avg Invested/Trade | $252 | +8% |

Crypto | Total Trades | 4 million | -50% |

Crypto | Avg Invested/Trade | $182 | -34% |

Source: eToro January 2026 Monthly KPI Release

Equities and Gold Pick Up the Slack

Meanwhile, capital markets trades, equities, commodities, and currencies, surged to 74 million in January, up 55% year-over-year, with the average invested amount up 8%. The platform's non-crypto business is growing fast. Its crypto business is shrinking.

That divergence is not lost on management, and it shapes much of how Assia talks about the business.

"We've seen people write off crypto," he told investors on Tuesday's earnings call. "We've kept building." His broader argument is that eToro's multi-asset model is precisely what allows it to absorb these cycles, and the Q4 data gives him some evidence to work with.

Net trading contribution from equities, commodities, and currencies rose 43% year-over-year to $116 million in the fourth quarter, driven partly by a surge in commodities activity.

This is broadly consistent with a wider shift in retail investor behavior: a recent eToro study found that nearly 8 in 10 retail investors now invest monthly, with allocations to equities and cash declining as investors seek broader asset exposure.

On the call, Assia described something he called a convergence among the platform's users: crypto-native customers rotating into commodities as volatility shifted asset classes.

Marketing Ramp Signals a Growth Gap

During the earnings call, eToro also revealed its plans to boost sales and marketing spending, and CFO Meron Shani explicitly said it could go higher if ROI supports it.

"We plan to increase from 21%, scaling gradually to 25% of net contribution," Shani said on the call, adding the company expects this to drive "double-digit" funded account growth through the year.

That announcement comes after Q4 saw the lowest marketing spend of any quarter in 2025 at $47 million, 21% below the same period a year earlier, while funded account additions in Q4 were also the slowest of the year at just 80,000 net new accounts.

Simultaneously, Assia disclosed that eToro carried out a headcount reduction roughly a month ago, framing it as an AI-efficiency initiative. "AI means we can move 10 times faster," he said on the call. "We're building the eToro super app 100% with AI."

It seems the company is cutting internal costs while ramping external spend to re-accelerate user growth. It is a rational response to a slowing organic environment.

M&A Pipeline Opens Up

Responding to a direct question from UBS analyst Alex Cra, Assia confirmed for the first time that eToro has been in active discussions with acquisition targets since the IPO.

"We do expect to see several M&A deals in 2026," he said. "We have been in active discussions with several target companies over the last six months since the IPO."

He pointed to two areas of focus: the crypto space, both in the US and globally, and the brokerage and wealth management space. The CFO added that eToro has access to both its cash pile and a revolving credit facility to pursue "sizable deals."

Similar plans were already outlined last year in a Bloomberg interview with Ronen Assia, one of eToro's co-founders. The most recent acquisition dates back to 2024, when the company expanded into Australia by taking over the local investing app Spaceship for $55 million.

The Market Priced the Headline

None of this makes Tuesday's 20% share rally irrational. Full-year records, a strong balance sheet, buyback expansion, a resilient equities business, and an M&A pipeline are genuinely positive signals for a company less than a year into its public life.

Notably, the crypto exchange Gemini, which went public around the same time, simultaneously began pulling back and retreating to its core business, a move eToro has now capitalized on by taking over a portion of its customers.

The 2024 cohort already shows a 1.88x return on marketing investment; the 2020 cohort has returned 5.6x. These are the numbers of a business with real retention and long-term user value.

But the market priced the headline. The AUA trajectory, the January crypto data, the diluted EPS decline, and the marketing ramp required to sustain growth are the questions that the headline doesn't answer. For investors in ETOR at $33, those are the numbers worth watching in the quarters ahead.