eToro reported its first full-year results since becoming a publicly listed company, posting net contribution of $868 million, up 10% year over year. GAAP net income climbed 12% to $216 million amid growth in stocks, derivatives and savings products.

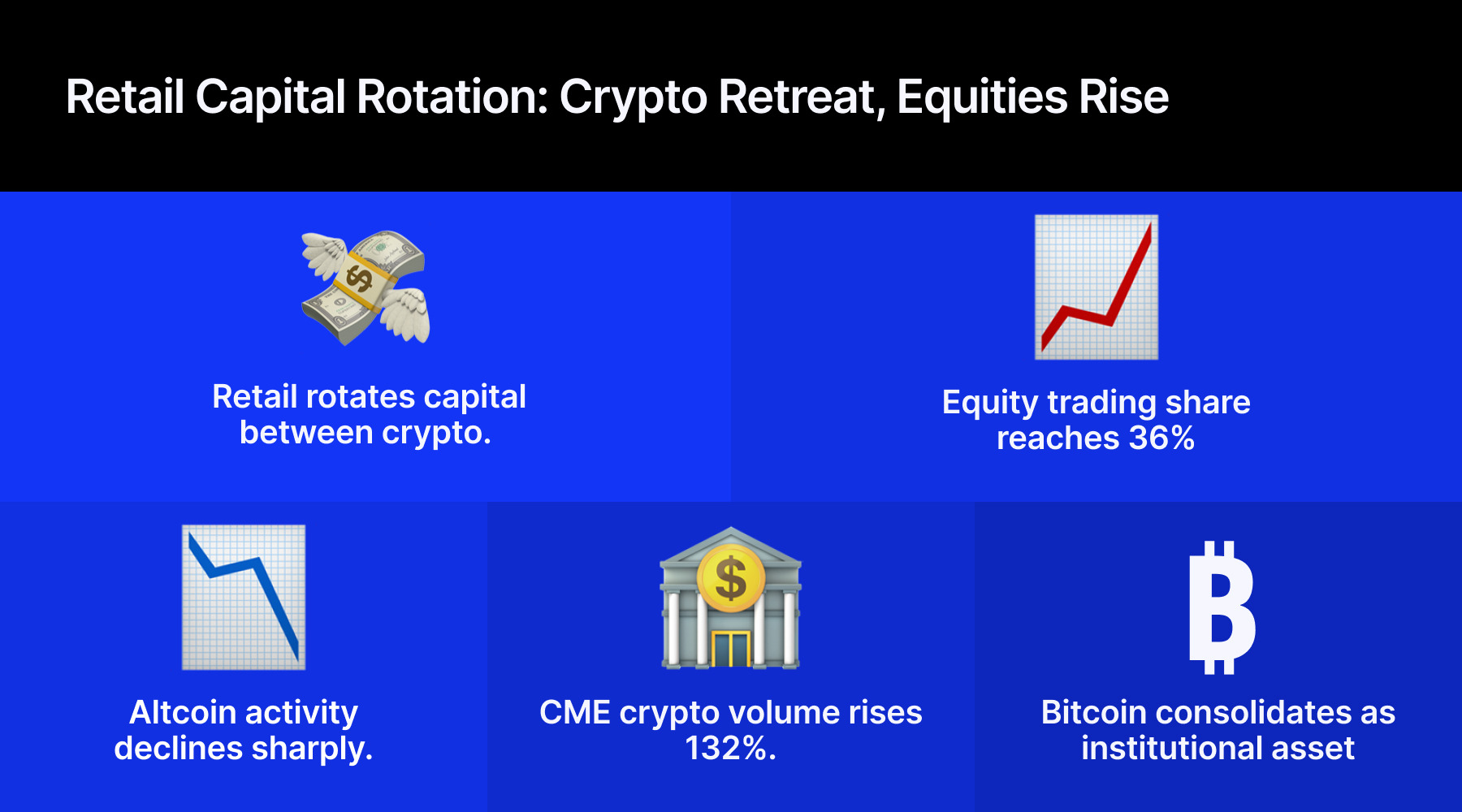

Adjusted EBITDA rose to $317 million, while crypto income declined from 2024 levels due to lower retail trading volumes and reduced market volatility. Following the announcement, shares jumped about 10% in early trading as investors welcomed the results and earnings growth despite the crypto slowdown.

Crypto, Stocks, ISA Expansion Drive Growth

Last year, eToro expanded access to 25 stock exchanges and grew its crypto offering to over 150 assets. The company also launched stock margin trading, expanded derivatives, and grew UK ISA and Australian savings products.

- Freetrade CEO Leaves After Nine Years This Summer Following IG Acquisition

- iFOREX Confirms "Advanced Stage" for London IPO Following Last Year’s Postponement

- “Singapore Private Banks Dominate Fund Flows” as Retail Investors Go Mobile

About the expansion, CEO Yoni Assia said, “We became a publicly traded company and significantly advanced the build-out of our global financial super-app.” He added that the company is expanding AI-powered tools and 24/7 access to select assets.

In the fourth quarter, net contribution fell 10% to $227 million, while GAAP net income rose 16% to $69 million. Funded accounts grew 9% to 3.81 million, and assets under administration reached $18.5 billion.

According to CFO Meron Shani, “(the) fourth quarter results reflect the strength and resilience of our multi-asset business model.”

Share Buyback Program Increased $100M

eToro also increased eToro Money accounts and transaction volumes as part of its neo-banking expansion. Partnerships were launched with BWT Alpine Formula 1 and Gemini Space Station Inc to expand brand reach and migrate customers onto the platform.

The company increased its share repurchase program by $100 million, bringing total remaining authorization to $150 million, including a planned accelerated buyback of $50 million.

Brokerage Workforce Reductions Follow Industry Trend

Alongside its expansion and buyback program, eToro is reducing approximately 7% of its global workforce. Assia said the move is intended to “ensure we are correctly sized to meet our business needs and support our long-term growth strategy.” The reduction could affect over 100 employees, though details on roles or locations have not been disclosed.

Workforce reductions are not uncommon in the brokerage sector. In recent years, other operators including IG Group, CMC Markets, and FXCM/Tradu have also reduced staff, sometimes citing technology or automation as factors.