Every serious progress requires changes. While institutional and retail Forex brokerages, startups, Fintech companies and a number of other financial entities know that fact very well, the traditional banks have maintained a very conservative attitude towards changes in recent years.

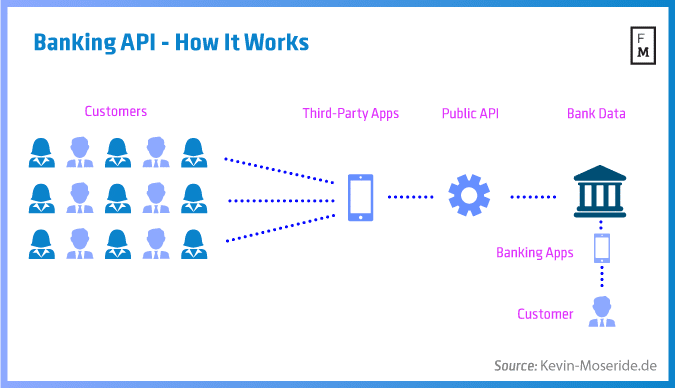

Banks at this point have access to the largest amount of financial data, but on the other hand they play the role of the most tightly closed institutions in the whole industry. Access to customers’ banking data is highly desirable for a number of organizations and software developers. And in most cases by the customer himself. This explains, in a simple way, why the fintech startups that lead cooperation with banks and which allow this type of access to customer information are evolving so rapidly.

This year should be a turning point in which the entire financial industry will undergo significant changes. All thanks to the expansion of data access outside the closed sector. This will be possible due to the banking API.

What is banking API?

In the simplest terms, banking API is a tool that allows access to the financial data of the user, with his consent. The whole process can be viewed as the 'Login with Facebook', but with respect to the reality and complexity of financial services.

Of course, the system in the case of banking API is different, due to the more advanced financial security measures. Nowadays, however, we do not need to go through the registration process on a particular website – the browser can pull the data from previous sessions. Once the client authenticates, an application gets read-only access to registration, account and transactional data.

While the topic seems to be very exiting for the average user, the market is still underdeveloped and premature due to the small number of companies operating in this new industry and the lack of an adequate legal framework. Having said that, banking APIs is available in many major financial centers and in larger countries.

Who can use banking API, and where?

The technology of data aggregation can help retail and institutional brokers, social lenders and fintech companies in a number of different ways. Firstly, it is just another way to optimize the registration of a trader and reduce the stress on the compliance department. Regulated forex brokers are required to complete KYC, and often dry brokers operate without branches, resulting in a time and energy consuming on-boarding process. A potential trader has to make a copy of his ID and utility bills, which can often be a show stopper. With banking API, a broker can identify a trader simply by requesting that he authenticate using an internet banking login.

After the trader’s authorization, the brokerage receives access to his account and transaction data which can be extremely important in the further lead assignation process. Information from other brokerages allows the evaluation of the experience and profitability of potential customers.

Want to learn more about the usage of banking API, its legal status and implementation in order to improve the functioning of financial services? A detailed article on this topic can be found inside our Industry Report for the first quarter of 2016.